- BONK surged by 25.95 in the last seven days.

- The recent surge positioned BONK to reach $0.000025 level.

As cryptocurrency markets recover, altcoins are surging after a sustained decline. Bitcoin [BTC] traded at $62k at press time, a 2.11% increase in 24 hrs.

The surge has left altcoins reclaiming the market, with memecoins experiencing a considerable surge.

Inasmuch, popular memecoin Bonk [BONK], surged by 25.95% after coping with a hostile environment following two months of decline in trading volume and 6 months of dormant growth.

As of the time of writing, BONK was trading at $0.00002369 after a 6.74% rise in 24 hrs. At the same time, its trading volume surged by 50.90% to $177M.

According to CoinMarketCap, BONK’s market cap has increased by 6.4% to $1.61B in 24 hrs.

Prevailing market sentiment

BONK has recovered after being dormant for the last six months. The recent surge has brought back market optimism, with analysts predicting a bullish run.

For instance, crypto analyst Freedom By 40 shared his optimism on X (formerly Twitter), stating that,

“$BONK small time frame update. Going to be a good July imo for BONK”.

Another analyst, @father_gra22943, predicted an upcoming bull run, saying,

“$bonk is set and ready for a run-up.”

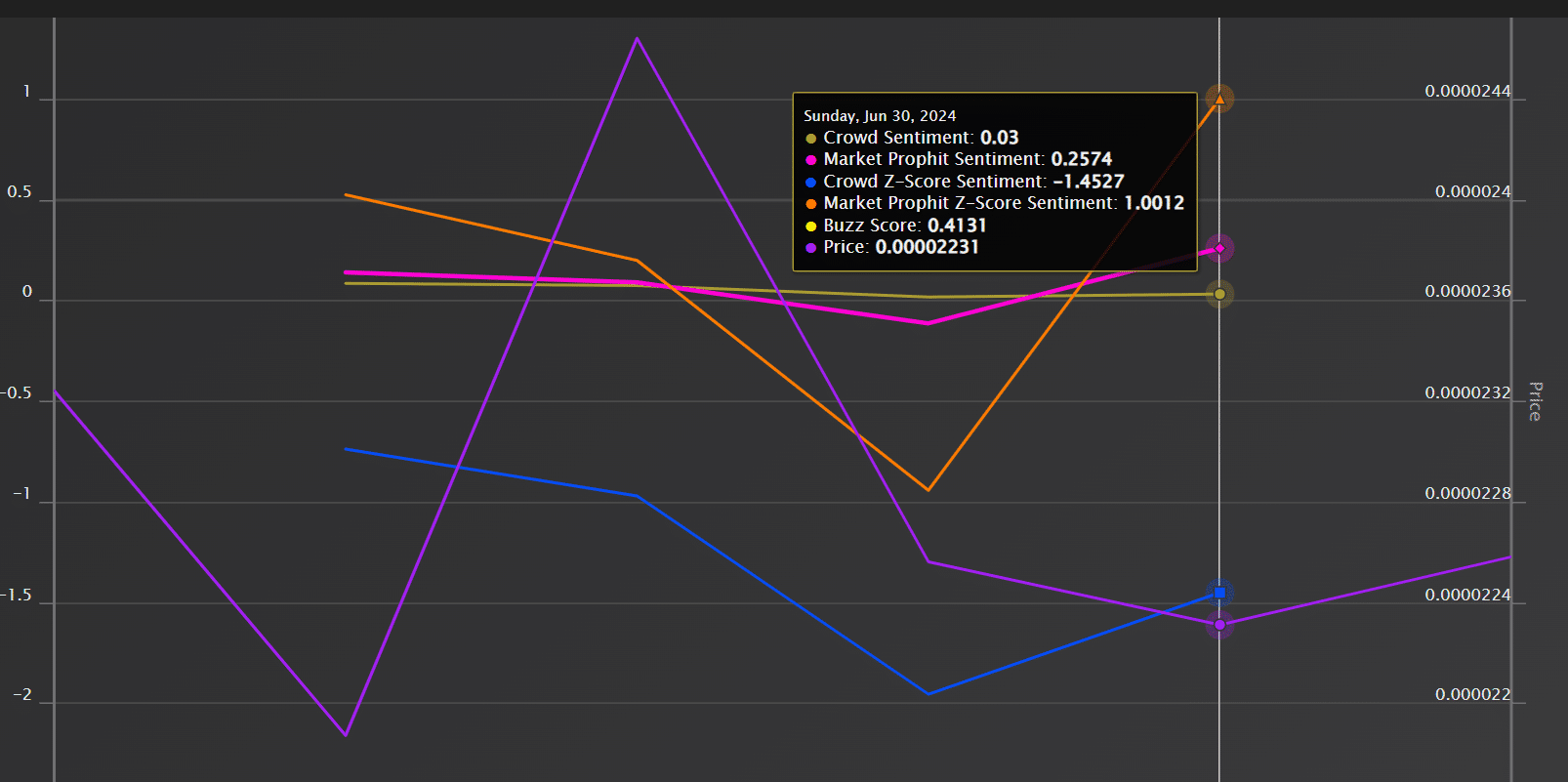

Source: Market Prophit

These speculations showed the current market sentiment. Equally, AMBCrypto’s market sentiment analysis from Market Prophit indicated that the market was overall positive at press time.

According to Prophit, the crowd sentiment was positive at 0. 03, the buzz score was above zero at 0.04, and the Prophit sentiment was at 0.25.

What BONK fundamentals indicate

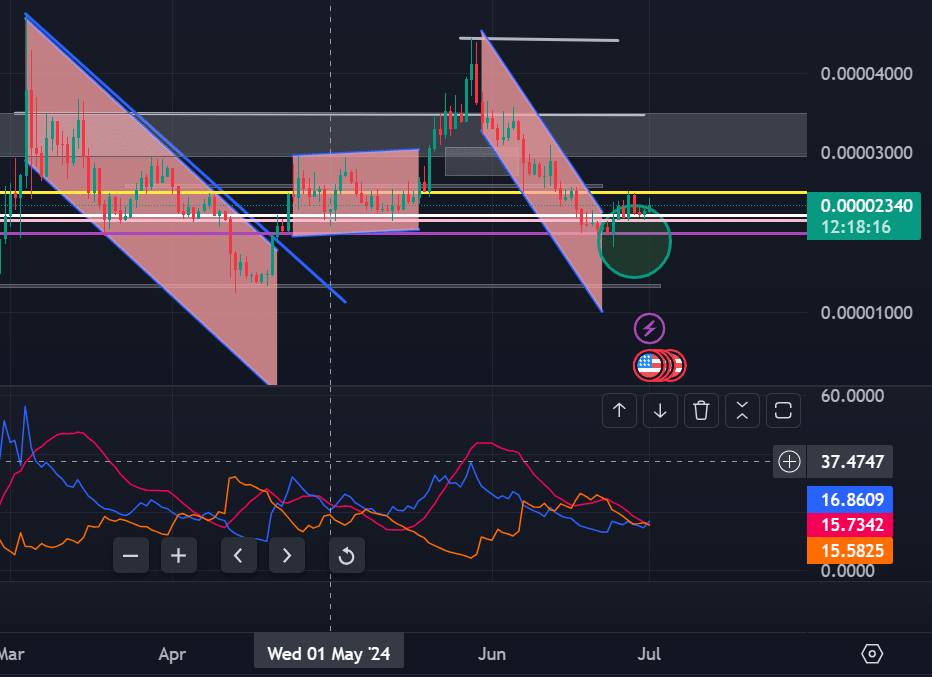

Source: TradingView

AMBCrypto’s analysis of the DMI Directional Movement Index average showed that the uptrend was getting strong. At press time, the positive index at 16.86 rested above the negative directional index at 15.73.

With BONK’s DMI at this state, it was a bullish signal, indicating buying pressure dominated the market at press time.

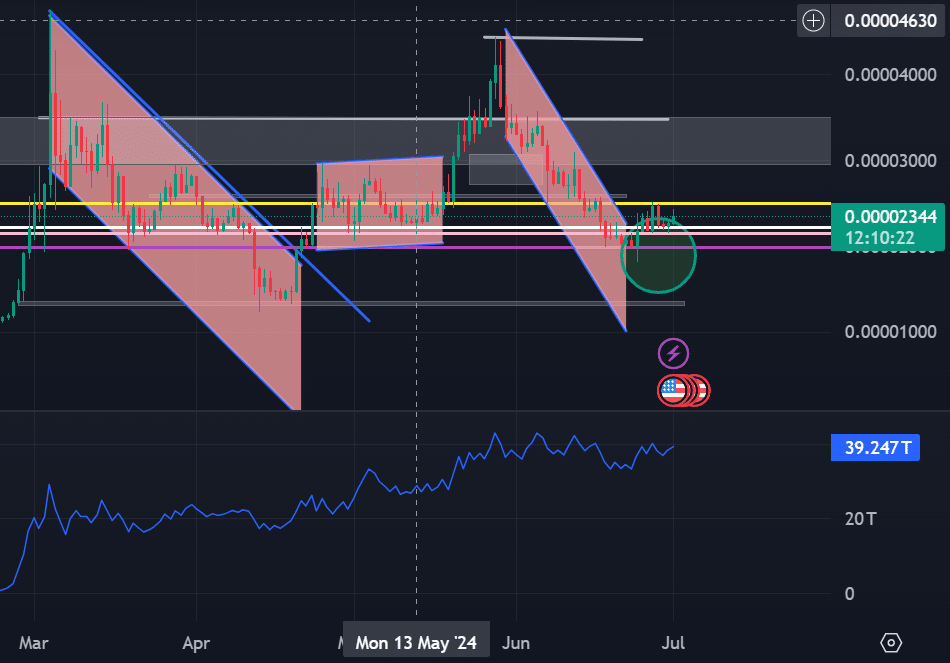

Source: TradingView

Also, the On Balance Volume (OBV) line was upward sloping, showing that the up days were stronger than down days, indicating buying pressure.

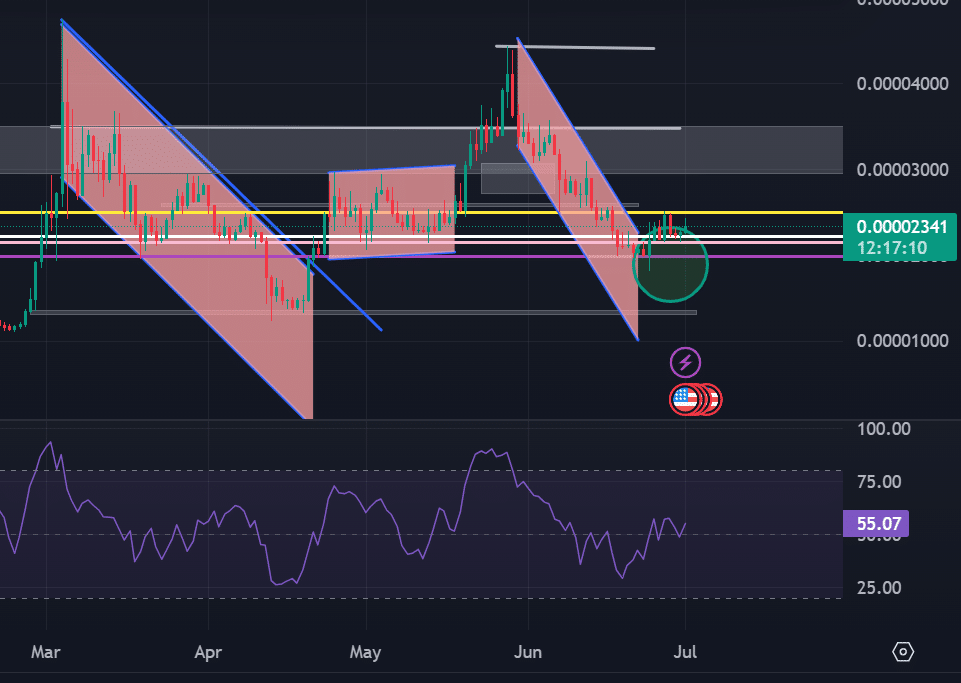

Source: TradingView

BONK’s MFI at 54, rising from a low of 49, indicated a continued uptrend as well. The increasing Money Flow Index indicated a rising buying pressure from a period of sustained selling pressure.

Thus, it’s a reversal from bearish to bullish.

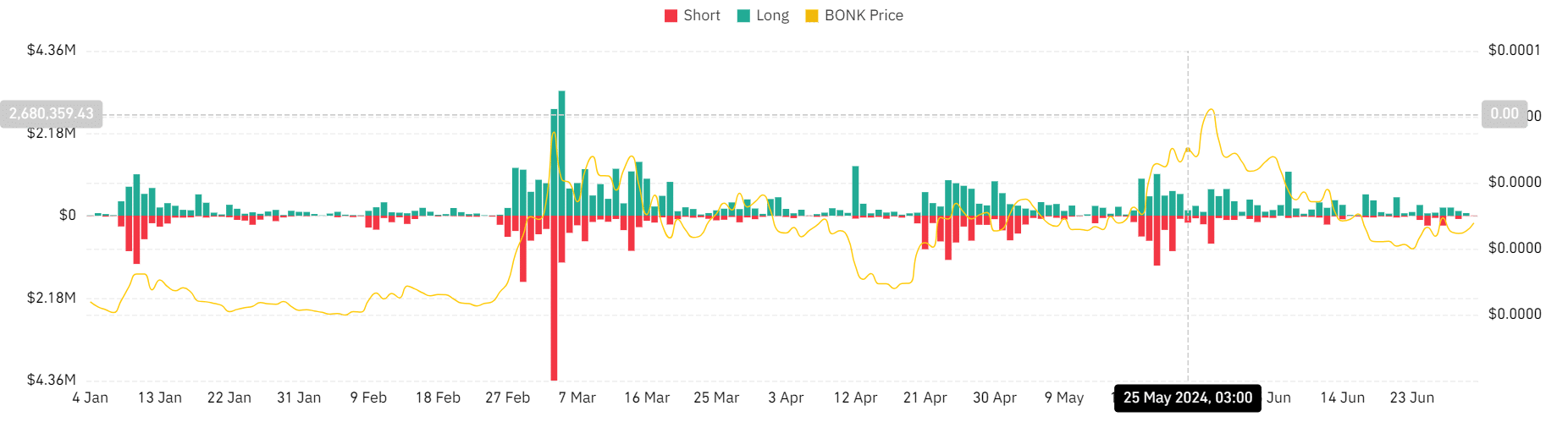

Source: Coinglass

Looking further, AMBCrypto’s analysis of Coinglass showed lower liquidations for long positions since the 25th and higher short positions.

On the 25th of June, liquidation for short positions was $262.4k, with long positions at $60.6k. Short positions were $9.4k at press time, while long positions were $2.3k.

Thus, investors betting against the market were out of the money, with long holders taking their positions and opening new ones.

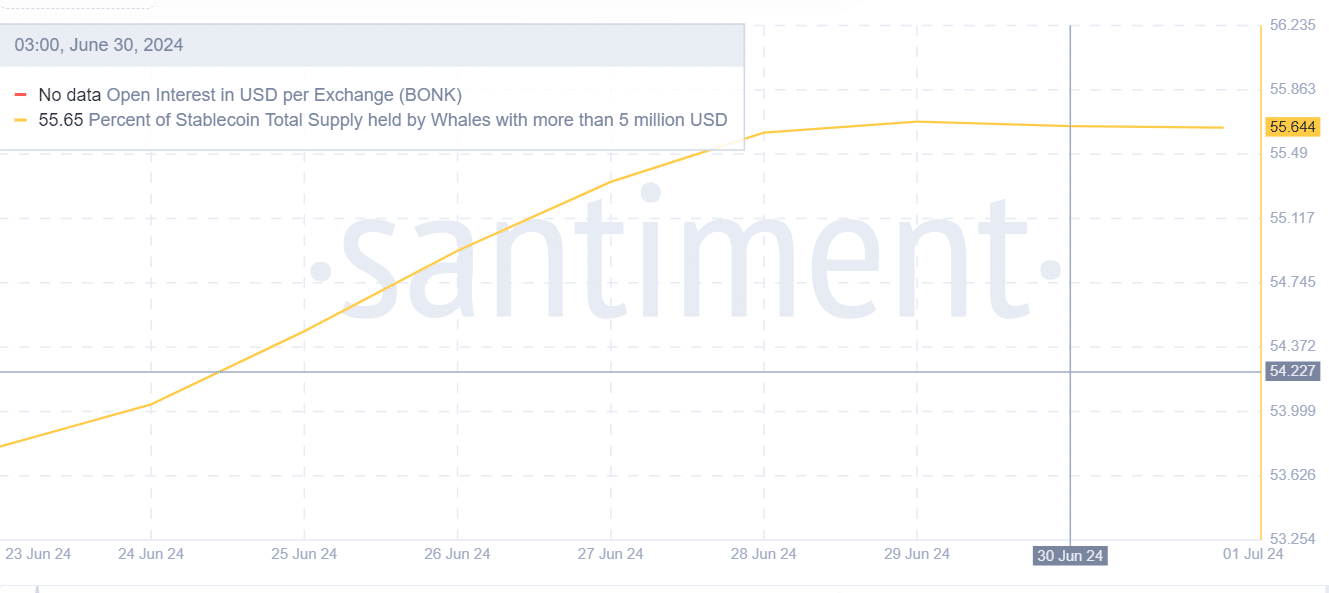

Source: Santiment

Finally, the total supply held by whales has increased from $53M to 56.6M in the last seven days. The increase in whale accumulation showed confidence in the crypto’s direction.

Thus, whales hoped to sell in profit, which was a bullish signal.

Can BONK maintain the uptrend?

At press time, BONK was trading at $0.0000238 an 8.46% gain on the daily charts. If MFI and DMI continue to rise, BONK can build a strong uptrend momentum.

Is your portfolio green? Check the Bonk Profit Calculator

If the $0.000022 support level holds and closes above $0.00002394 on daily charts, BONK will reach $0.000025.

Conversely, if the market experiences correction, the price will decline to the critical support level of $0.000022 and $0.00002151, respectively.

Powered by WPeMatico