- Bitcoin fell below $60,000 on the 4th of July.

- Following Bitcoin’s massive breakdown, altcoins were significantly impacted.

On 4th July, the world’s biggest cryptocurrency Bitcoin [BTC] fell by more than 3.4% and breached its crucial $60,000 level.

In the wake of this major breakdown, veteran trader and analyst Peter Brandt spotted a bearish inverted flag and pole price action on BTC’s chart.

Peter’s X post highlighted bearish sentiment, adding a chart where BTC not only breaks a major support level but also breaks down from a bearish flag pattern.

Source: X

Why is Bitcoin falling?

However, the potential reason behind the massive fall in BTC’s could be a recent update from a Bloomberg ETF expert James Seyffart.

On 4th July, James made a post on X stating there is a low possibility that the United States Securities and Exchange Commission (SEC) will approve a spot Ethereum ETF (Exchange Traded Fund) by the predicted launch dates.

James stated that,

“I have fairly low confidence in those launch date predictions at this point. Theres no deadline & SEC’s Corp Fin is taking their time here (I dont blame them). But these changes were very minimal and idk why the ETFs wouldn’t be ready to go within a couple weeks”

Impact of BTC on altcoins

Following Bitcoin’s massive breakdown, altcoins were significantly impacted. Top altcoins, including Ethereum, Solan, BNB, XRP , and Dogecoin experienced notable price drops.

According to CoinMarketCap data, in the last 24 hours ETH, SOL, BNB, XRP, and DOGE have experienced a price drop of 4.8%, 10%, 6%, 5.5%, and 6.5% respectively.

Additionally, this price drop in BTC has created fear in the market, as Bitcoin’s open interest (OI) has dropped by 3.5%, according to an on-chain analytic firm CoinGlass.

Bitcoin technical and price-performance analysis

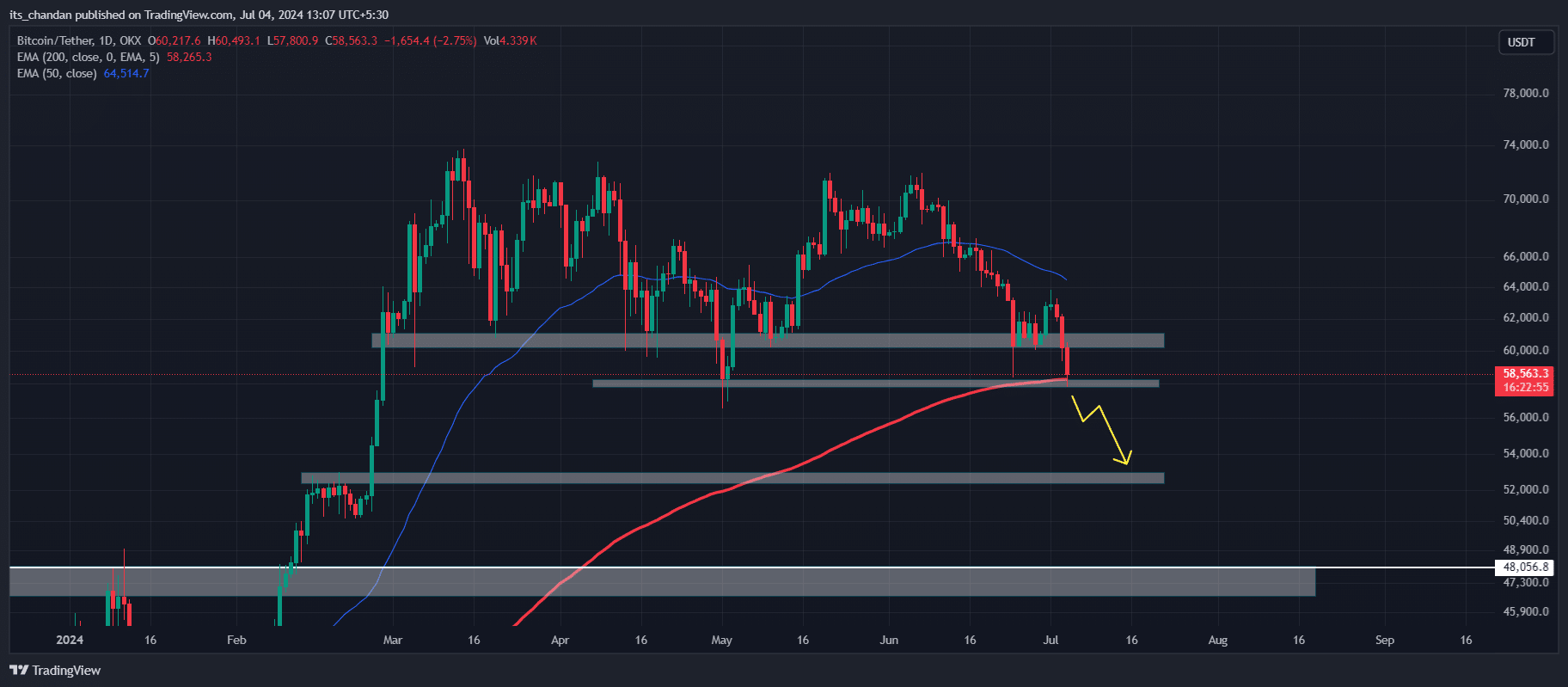

According to expert technical analysis, Bitcoin is looking bearish and is currently at 200 EMA (Exponential Moving Average).

While this 200 EMA might provide support, the current market sentiment and investors’ interest signal a bearish outlook for BTC.

Source: TradingView

Read Bitcoin’s [BTC] Price Prediction 2024-25

If BTC on a daily time frame gives a daily candle closing below 200 EMA and $57,700 level, then in the coming days we may see a massive price drop of 8% to $53,000.

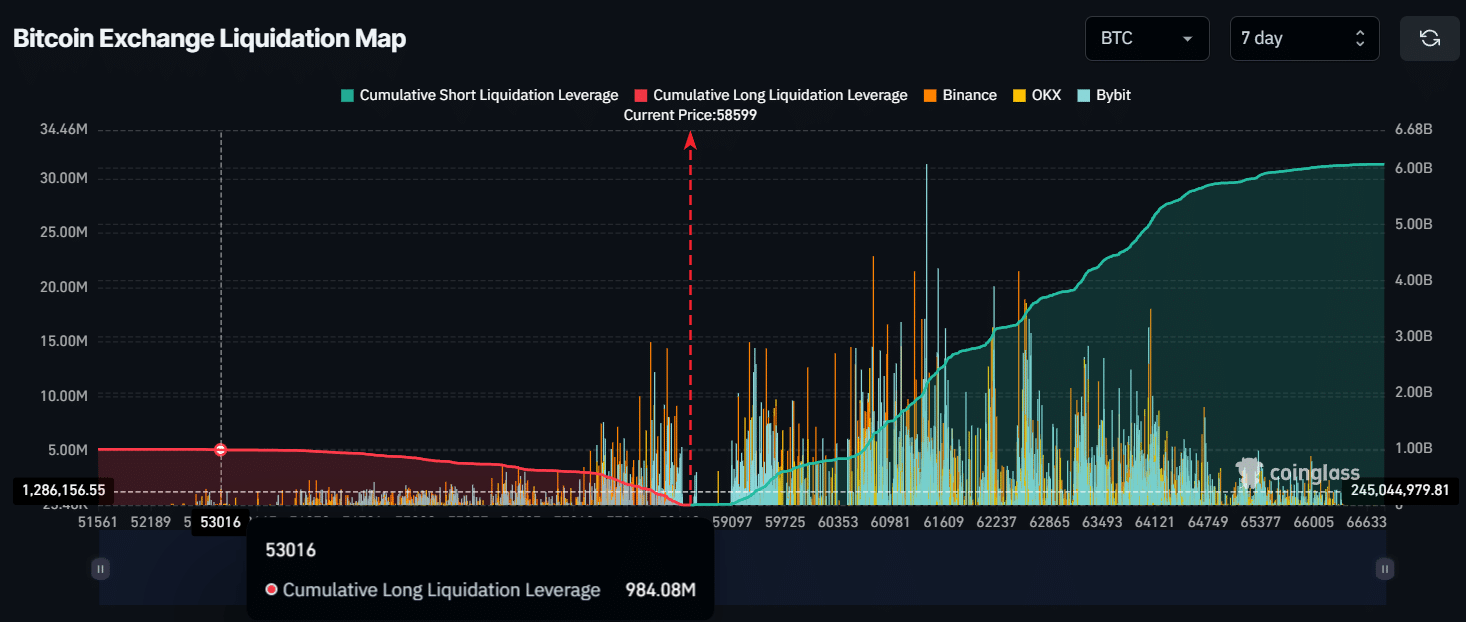

Additionally, if this happens then nearly $1 billion worth of long positions liquidate, according to Coinglass data.

Source: CoinGlass

Powered by WPeMatico