- XRP has declined by 3.22% in seven days and 6.33% in 24 hours.

- Despite the price drops, market sentiments remained positive, with analysts eyeing $35.

XRP has suffered from external speculations regarding Ripple’s ongoing legal issues in the last few weeks. Over this period, XRP has experienced high volatility, and prices have been declining.

In the previous seven days, XRP has declined by 3.22%. Despite these price drops, analysts are suggesting that it’s the end of the bear trend and an upcoming trend reversal.

Pointing to historical data, various crypto analysts have argued that the price will surge in the coming months.

According to MikybullCrypto, a crypto analyst on X (formerly Twitter), the upcoming reversal pattern based on a 2017 similar trend. On his page, he shared that,

“It might pull a huge 2017 rally given the current PA path is following. The sentiment surrounding it is bleak, which made me believe such a scenario can occur”.

Another analyst shared the same opinion, sharing the cyclical pattern analysis in 2017 and how the current trend mirrors the past.

On his X page, Tylie Eric expressed his optimism on the upcoming price spike, stating that,

“BEAT BY BEAT. I think XRP has ticked all the boxes and held all requirements to continue with wave 3 of wave 5, the same way it did in 2017!”

During 2017, XRP made an impressive surge of 1400% in a year, even more than BTC did within the same period. Thus, based on the same pattern, in 2017, the double bottom pattern pushed the prices to $0.3.

Thus, prices could rise to as high as $35 if the same trend continues.

What price charts indicates

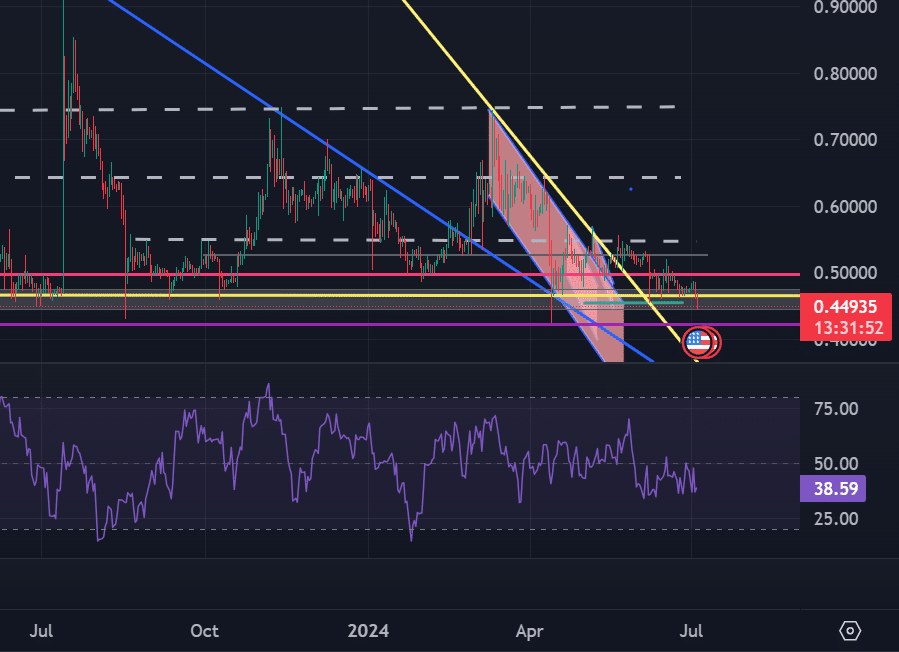

According to AMBCrypto’s analysis, XRP has experienced a downtrend over the past weeks. At press time, XRP traded at $0.4523 after a 6.33% decline in 24 hrs.

In the same period, its trading volume surged by 69.78% to $1.5B. According to CoinMarketCap, XRP’s market cap has declined by 6.33% to $25.1B.

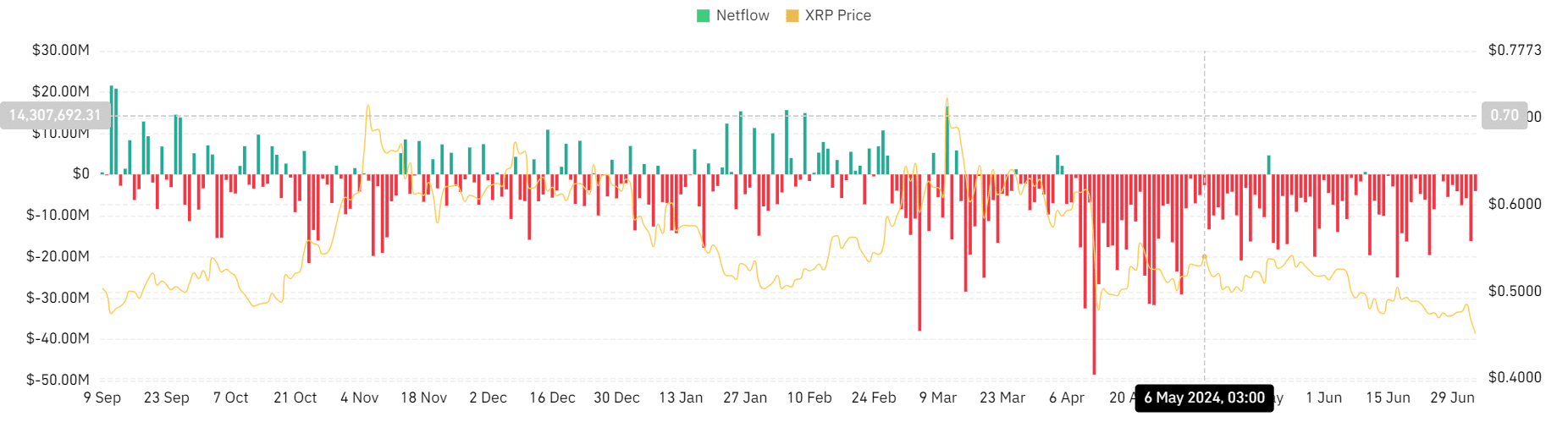

Source: Coinglass

Despite this price drop, the market sentiment remained largely positive. According to Coinglass, XRP’s Netflow has been negative for the last month — it was -$4.03 as of this writing.

A negative Netflow suggests that investors are withdrawing assets from exchanges to store in private wallets. Such moves indicate that investors are holding their crypto long-term rather than selling them.

This is a sign of confidence in the crypto’s future value.

Source: TradingView

XRP had a Money Flow Index (MFI) of 38 at press time, indicating consolidation. Equally, MFI at this level suggested a buying opportunity since the crypto is less expensive.

With a buying opportunity comes buying pressure, resulting in a trend reversal.

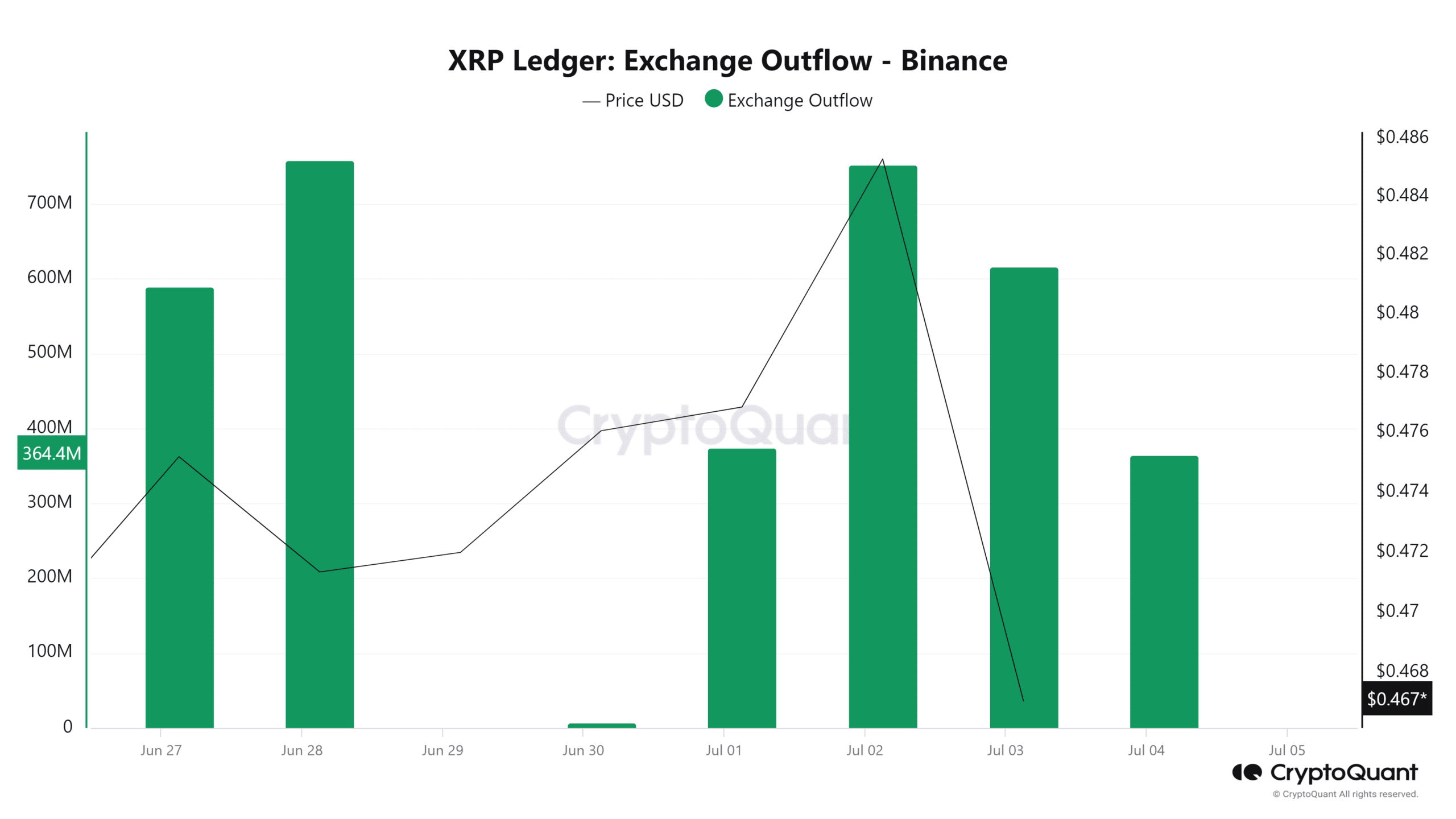

Source: CryptoQuant

Looking further, AMBCyppto’s analysis of CryptoQuant showed that the exchange has been high for the last seven days. Over the past week, XRP has reported a high of $757.7M and a low of $1.3M.

This month, it has reported a sustained high exchange, with a high of $752 M and a low of $364M.

Higher Exchange Outflow suggests increased holdings with investors keeping for the future. This is a bullish sentiment, with investors confident in the altcoin’s future price.

Can XRP actually reach $35?

XRP has been consolidating for the last seven days. With a 3.22% decline in 24 hrs, the token has been eyeing its next resistance level at $0.49.

If XRP breaks out of this level in a very bullish short-term scenario, it will attempt to challenge the $0.549 resistance zone.

Is your portfolio green? Check out the XRP Profit Calculator

However, after failing to hold the support level around $0.459, if the bears increase the selling pressure, the prices will further decline to $4.245.

Although the market sentiment is positive, with metrics supporting a potential trend reversal,$35 is a long bite, and estimates predict that level can be reached in 2025.

Powered by WPeMatico