- ADA’s trading volume increased sharply while its price dropped

- A few of the metrics and indicators hinted at a bull rally on the charts

Like most cryptos, Cardano [ADA] also had a good last 24 hours as its daily chart turned green after several days. There may be better news though, especially as ADA might just be on the verge of a bullish breakout if a few conditions are met.

Let’s see what ADA must do in order to remain bullish on the price charts.

Cardano sees more green

Before its most recent hike, Cardano’s price had dropped by over 9% in just 7 days. Things got better over the last 24 hours though as the token’s price appreciated by more than 6%.

At the time of writing, Cardano was trading at $0.3552 with a market capitalization of over $12.7 billion.

And yet, IntoTheBlock’s data revealed that over 75% of investors were still out of money, which accounted for 3.37 million ADA addresses.

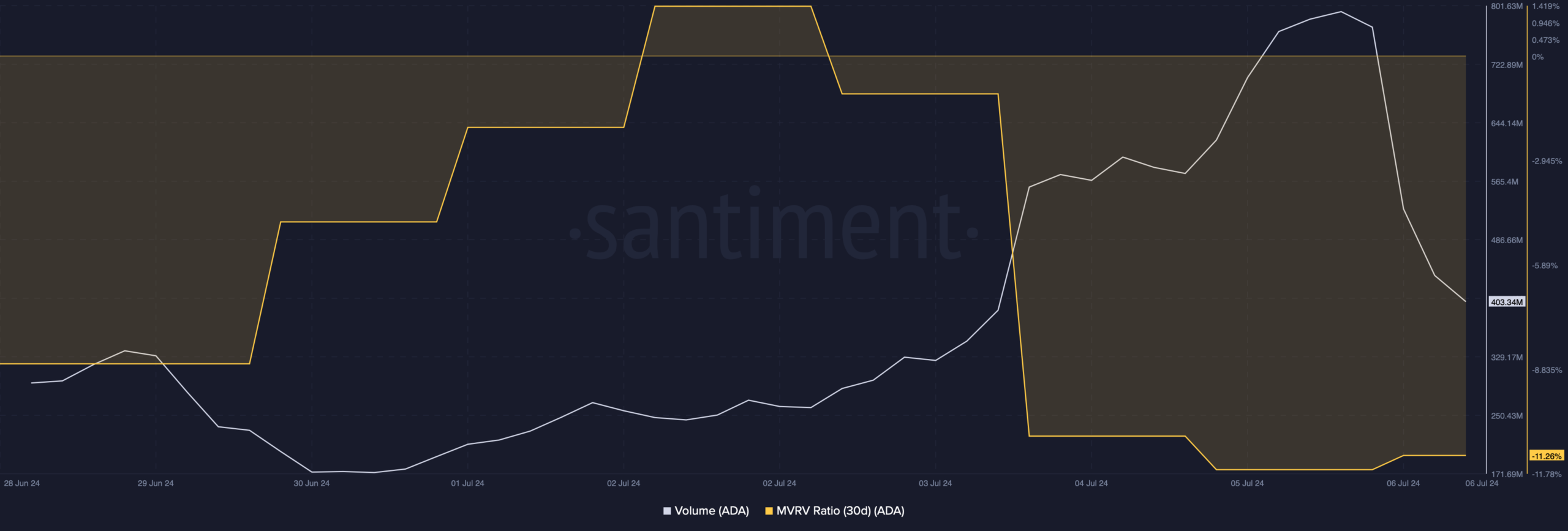

Here, it’s also worth noting that the price drop affected the MVRV ratio negatively too. Its trading volume rose during the price decline – Usually considered to be a negative signal.

Source: Santiment

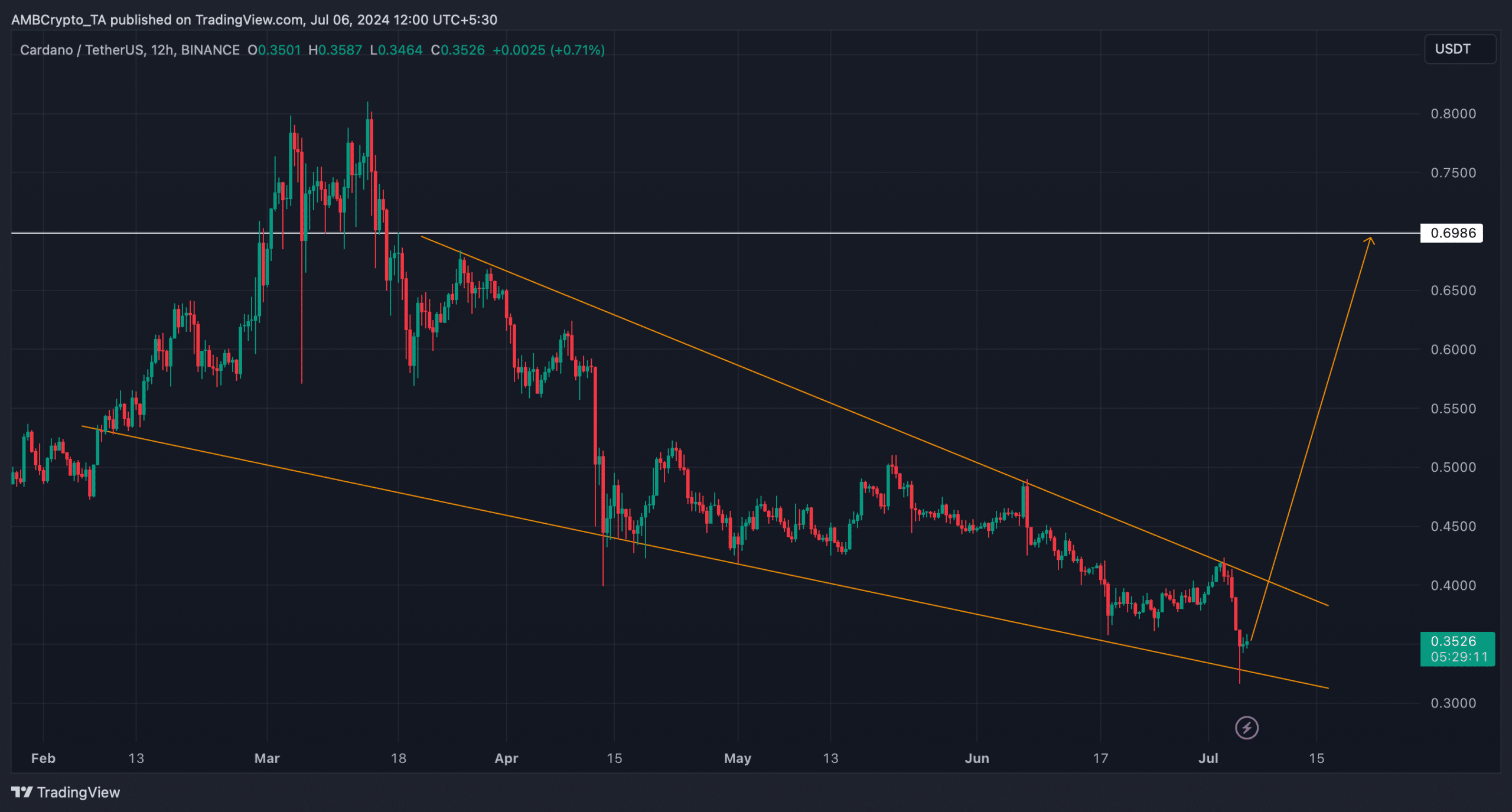

However, all these metrics and the market situation can turn around as a bullish pattern appeared on the token’s 12-hour chart.

As per AMBCrypto’s analysis, Cardano’s price has been consolidating inside a falling wedge pattern since March. At the time of writing, it was about to test the lower limit of the pattern.

In order for ADA to kickstart a bull rally, it must paint 3–4 green candlesticks. If that happens, then it won’t be surprising to see ADA bulls register massive gains, allowing it to retest its March highs in the coming weeks or months.

Source: TradingView

Odds of ADA breaking out

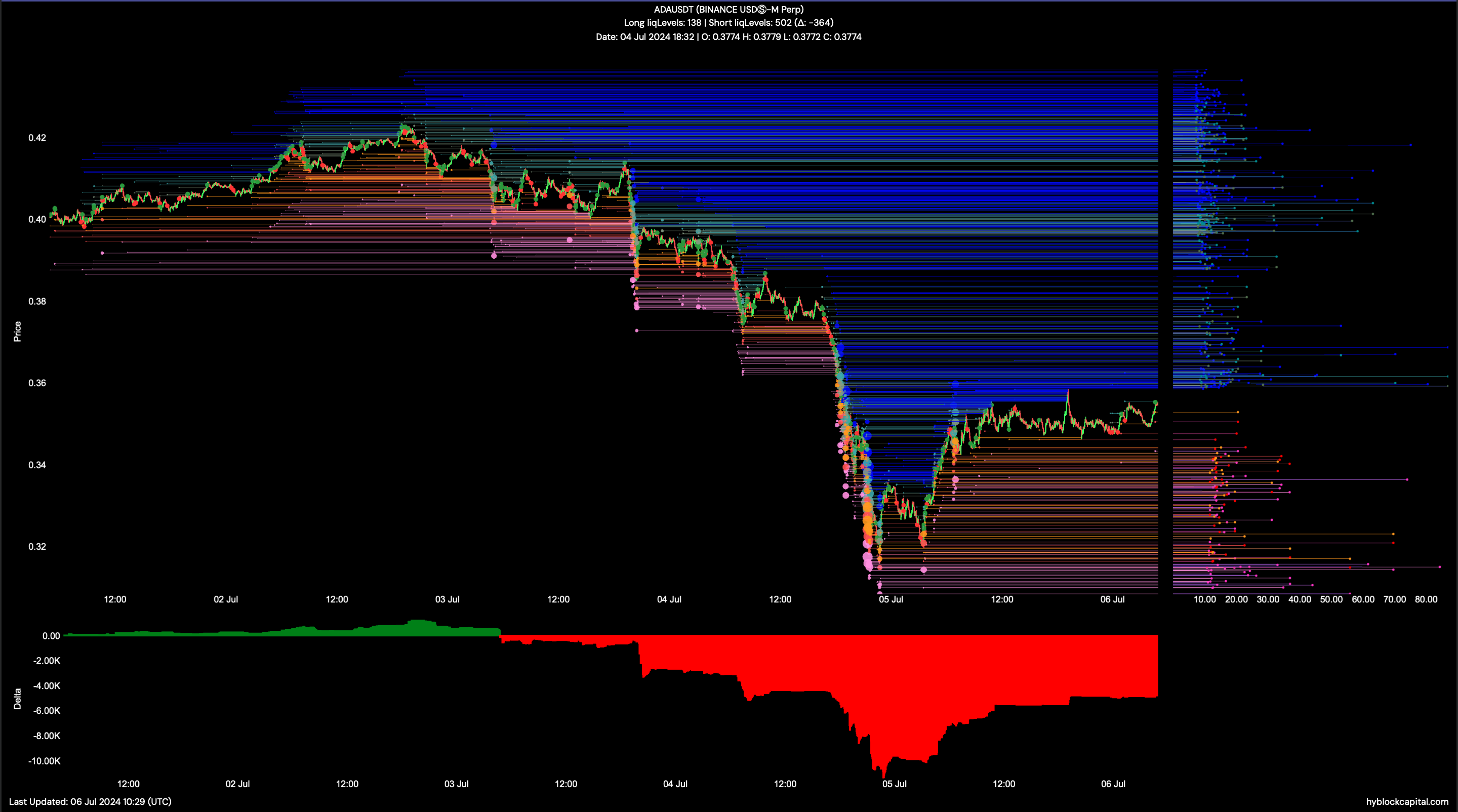

When AMBCrypto looked at Hyblock Capital’s data, an interesting relationship could be seen too.

According to our analysis, whenever ADA’s Cumulative Liquidation Level Delta turns green, ADA’s price rises. Similarly, when the metric turns red, the token’s price falls.

At the time of writing, though the metric was red, its figure was declining. Simply put, ADA might soon initiate a bull rally on the charts.

Source: Hyblock Capital

Similarly, the technical indicator Relative Strength Index (RSI) seemed bullish as it registered an uptick after touching the oversold zone.

Is your portfolio green? Check out the Cardano Profit Calculator

Nonetheless, the rest of the indicators were bearish. The MACD, for instance, displayed a bearish crossover.

Finally, the Chaikin Money Flow (CMF) moved down and lay under the neutral mark too. This might restrict ADA’s price from moving up in the coming days and maybe, weeks.

Source: TradingView

Powered by WPeMatico