- Crypto funding rates for Bitcoin and Ethereum declined significantly over the last few days.

- Implied volatility for Bitcoin and Ethereum surged materially during this period.

Bitcoin [BTC] and Ethereum [ETH] holders have been severely impacted by the recent market drawdown. However, it wasn’t just holders who had been affected.

Low on funding rates

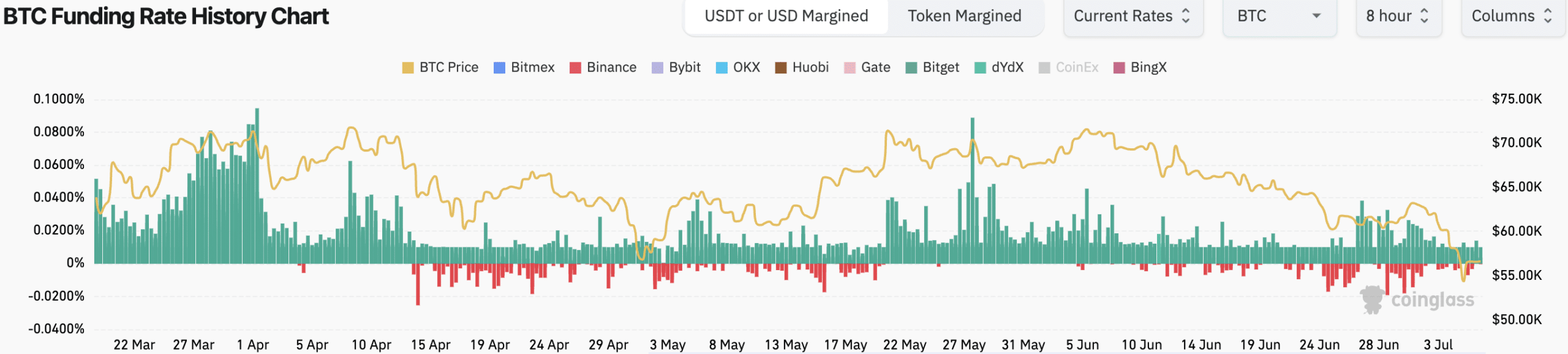

The funding rates for both BTC and ETH fell materially over the last few days. Negative crypto funding rates might lead some investors to believe a price decline is imminent, encouraging them to sell their holdings or take short positions themselves.

This selling pressure can contribute to an actual price drop for BTC and ETH.

With negative funding rates, holding long futures contracts becomes less attractive. The fees eat into potential profits, making some traders unwind their long positions or be more cautious about opening new ones.

This reduces overall buying pressure, which can weaken the price support for BTC and ETH.

The shift in sentiment can lead to higher volatility in the short term. As long and short positions battle it out, price swings for BTC and ETH might become more pronounced.

Conversely, a significant and sustained drop in funding rates could be seen as a contrarian indicator by some investors.

They might view it as a sign of excessive bearishness, presenting a potential buying opportunity for BTC and ETH at what they perceive as a discounted price.

Source: Coinglass

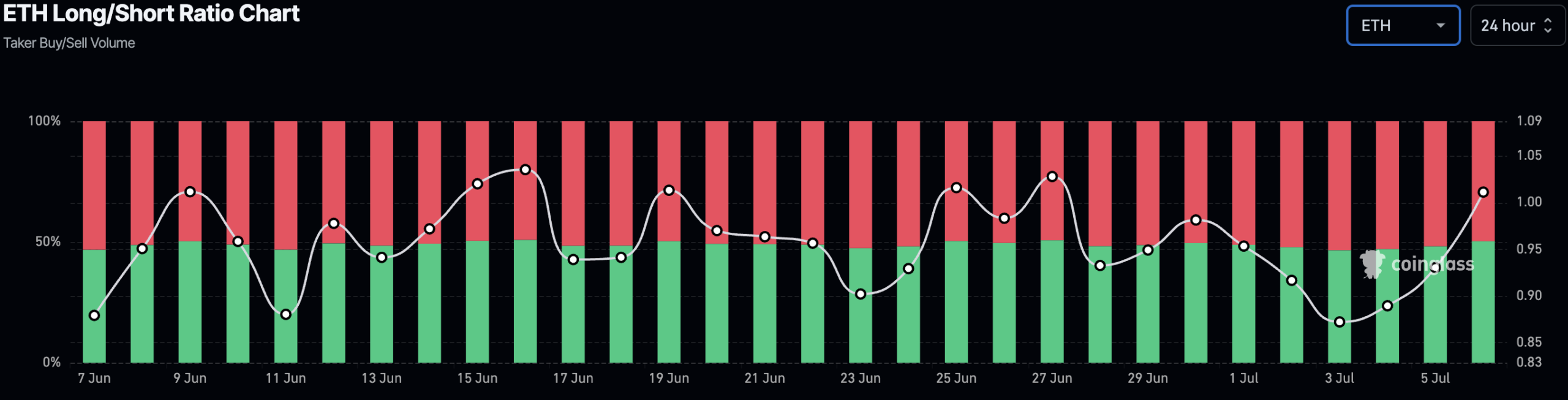

At the time of writing, traders were slightly bullish around Bitcoin as longs had finally surpassed short positions accounting for 50.7% of all trades.

Ethereum witnessed a similar rise in bullish sentiment as percentage of long positions on ETH grew 50.9%.

Source: Coinglass

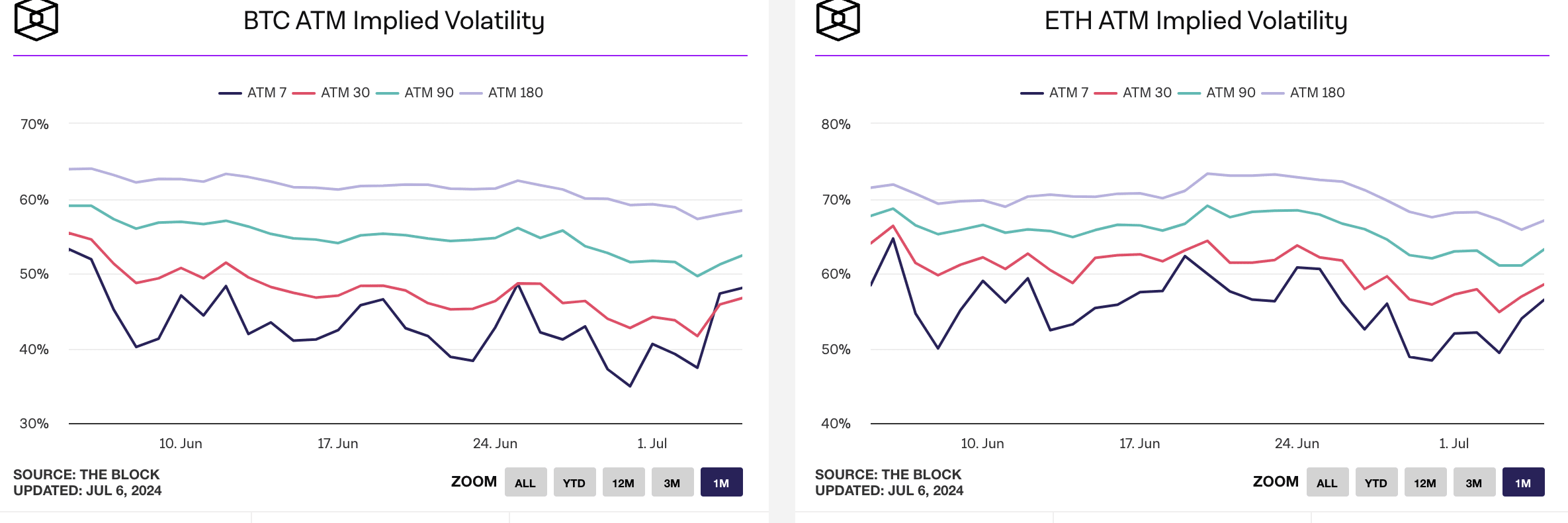

IV grows as prices fluctuate

The Implied Volatility for both BTC and ETH also grew during this period. A rise in IV indicates that option traders are pricing in a higher likelihood of significant price movements for BTC and ETH in the future.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This suggests growing uncertainty about the future direction of the markets. If the market sentiment sways heavily towards bearish, the negative funding could amplify any price drop due to increased short selling.

In contrast to that, a sudden positive shift could lead to a more significant price rise due to higher volatility.

Source: IntoTheBlock

Powered by WPeMatico