- Worldcoin noted high capital outflows in recent months, leading to an 81% price drop.

- A price bounce of 9%-10% could commence on the 19th of August.

Worldcoin [WLD] has been in a strong downtrend of late, one that has not yet slowed down. A report earlier this month highlighted that Alameda still held 24 million WLD tokens.

This added concerns of selling pressure in the future.

The heavy price losses were not close to ending. What are the next price targets, and when do the bulls explore re-entering long positions?

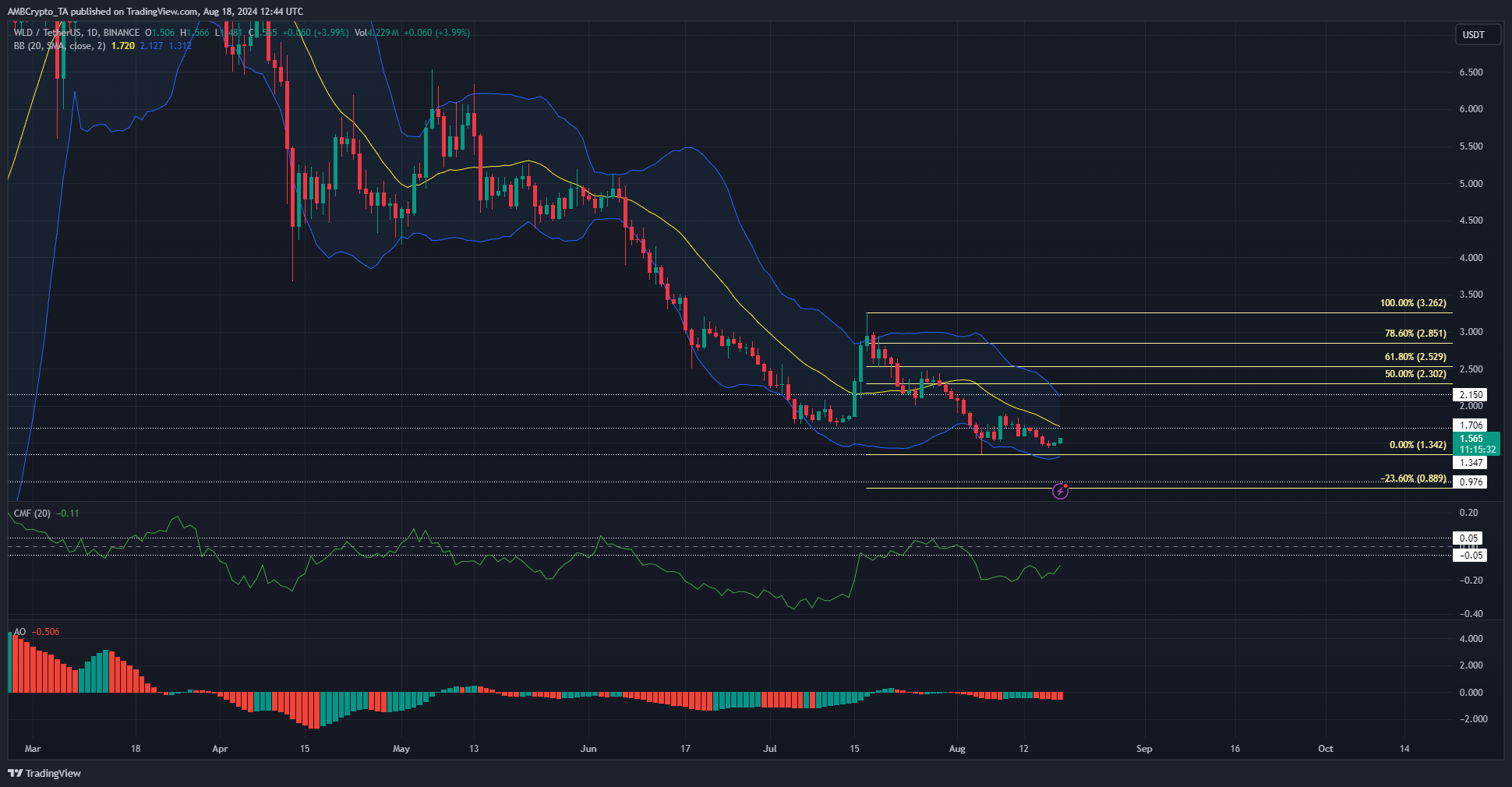

The $1.7 is a confluence of resistance

Source: WLD/USDT on TradingView

The price was below the 20-day moving average to indicate downward momentum. This DMA also lined up with the $1.7 level which had served as support in early July.

The Awesome Oscillator reflected bearish momentum as well.

The CMF was even more negative and has not stayed above +0.05 for multiple days since March.

The persistent capital flow out of the market saw Worldcoin fall from $8.3 to $1.565 in just under five months, an 81% depreciation.

The 23.6% Fibonacci extension level at $0.89 is the next bearish target, although a price bounce to $1.7 and $2.15 was possible before that.

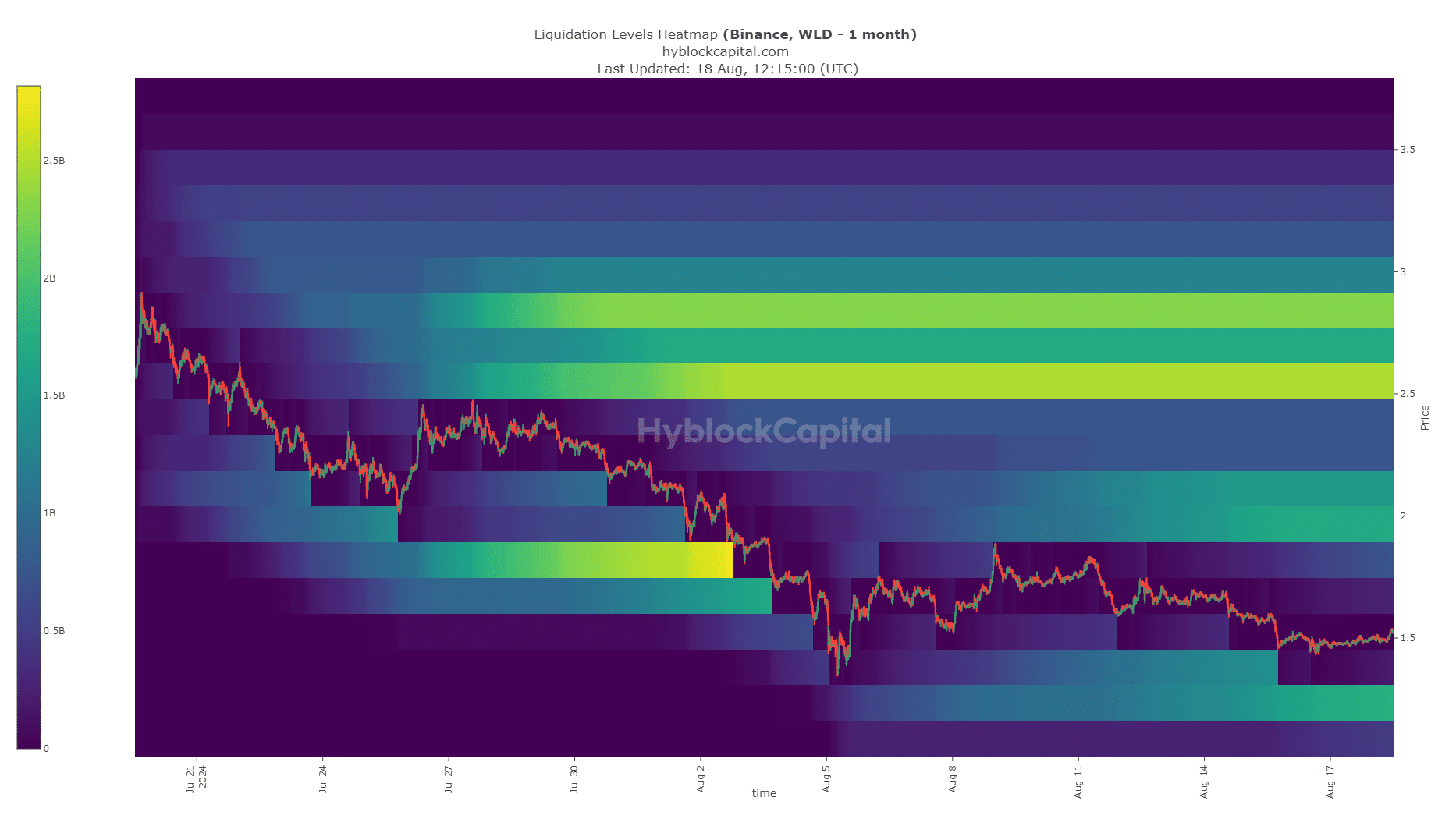

Clues from Worldcoin’s liquidity level

Source: Hyblock

The $1.96-$2.11 was a large liquidity cluster above the current market price. To the south, the $1.22 was a region where Worldcoin bullish reversal might occur.

The technical indicators were strongly bearish, showing that a move toward $1.22 was more likely. Such a move might be preceded by a short-term price bounce.

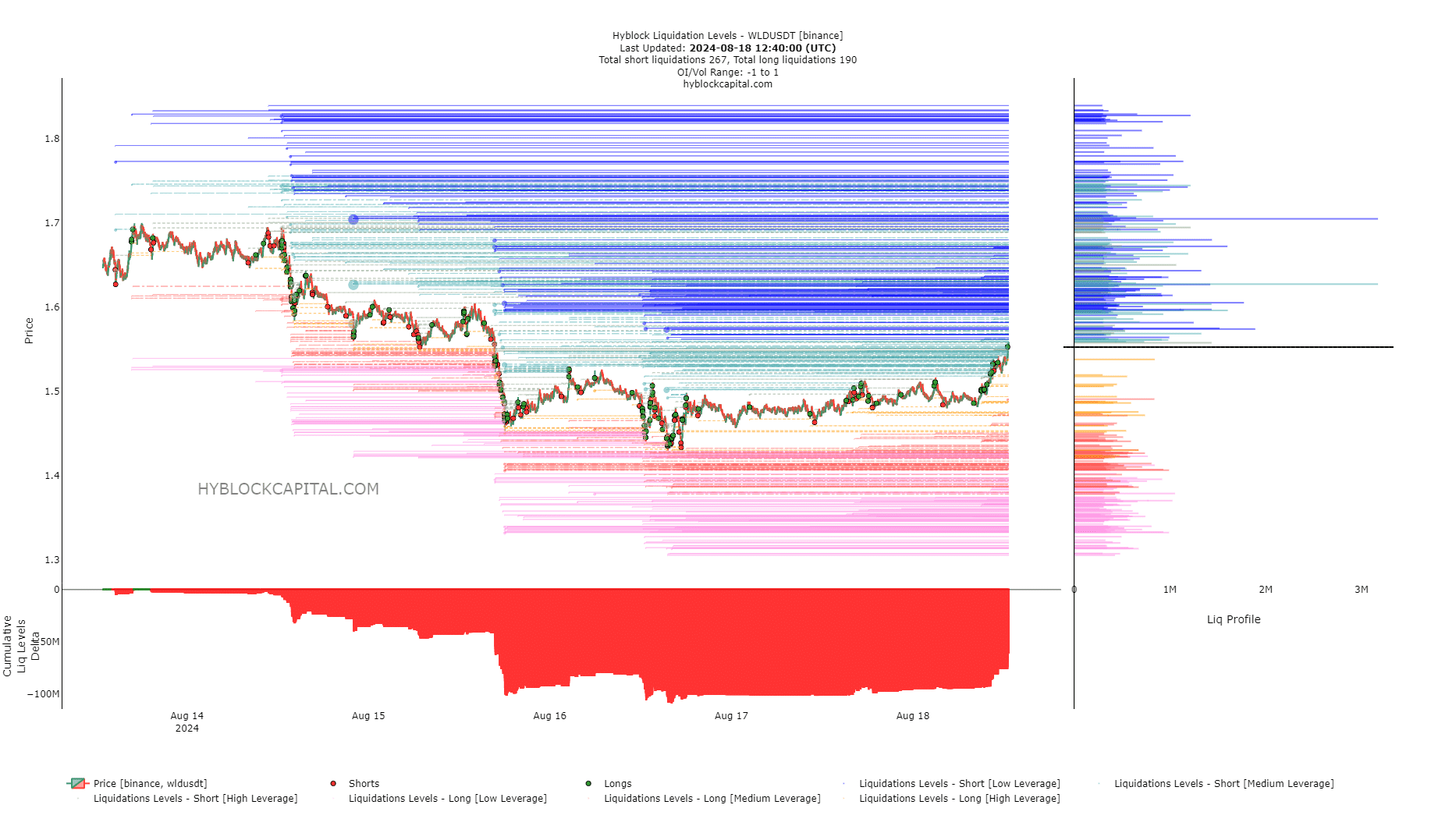

Source: Hyblock

Realistic or not, here’s WLD’s market cap in BTC’s terms

The liq levels delta was highly negative, showing that Worldcoin is likely but not guaranteed to bounce higher to balance this out. The largest liquidity pools overhead were at $1.62 and $1.7.

Therefore, short-sellers can wait for a bounce to these levels before looking to go short and take profits around the $1.22 area.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Powered by WPeMatico