- BTC’s open interest also dropped by 3% in the last 24 hours, reflecting lower interest or fear among investors.

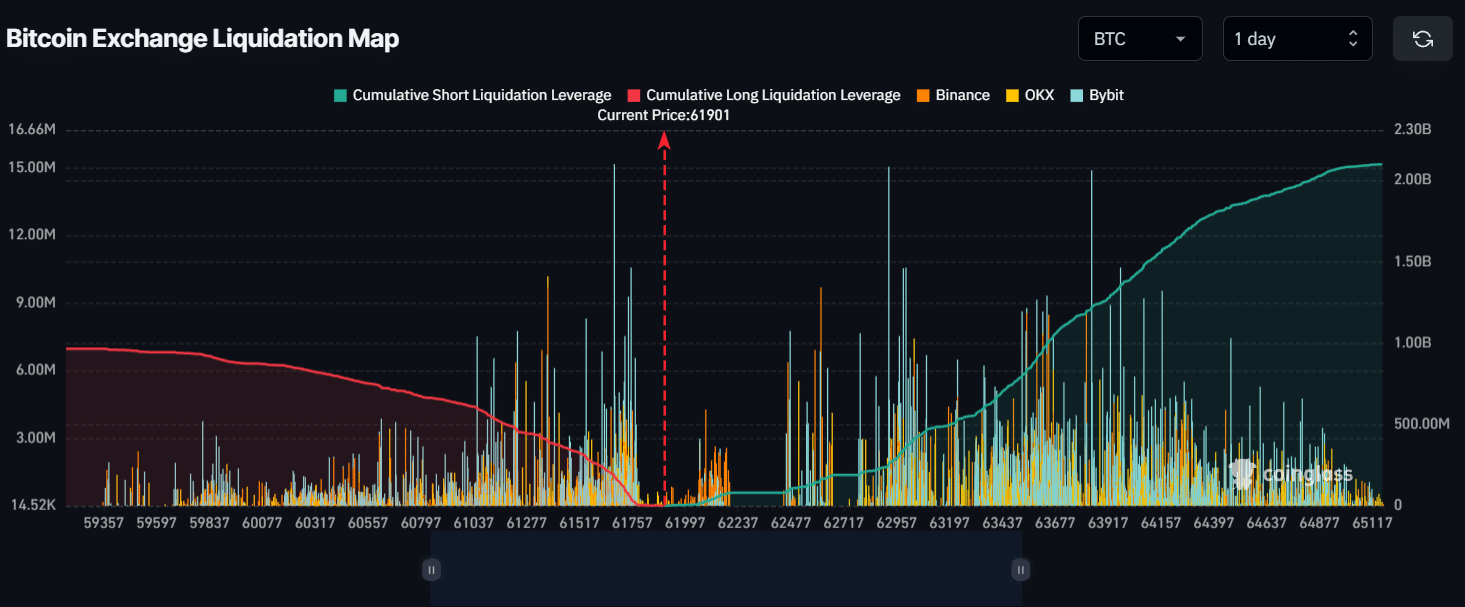

- If BTC price falls to $61,670, nearly $192 million of long positions will be liquidated.

Binance, the world’s biggest cryptocurrency exchange, was found to have made some internal adjustments on 27th August.

According to a report, the Binance Bitcoin Cold wallet which holds 75,177 Bitcoin [BTC], transferred a significant 30,000 BTC to its hot wallet and the remaining 45,177 BTC to another wallet address “3PXB”.

Binance transfers 75,177 BTC

As of press time, Binance has not disclosed the reason behind this notable BTC transfer. However, this transfer occurred following the ongoing money laundering controversy update in Nigeria against Binance and its executive.

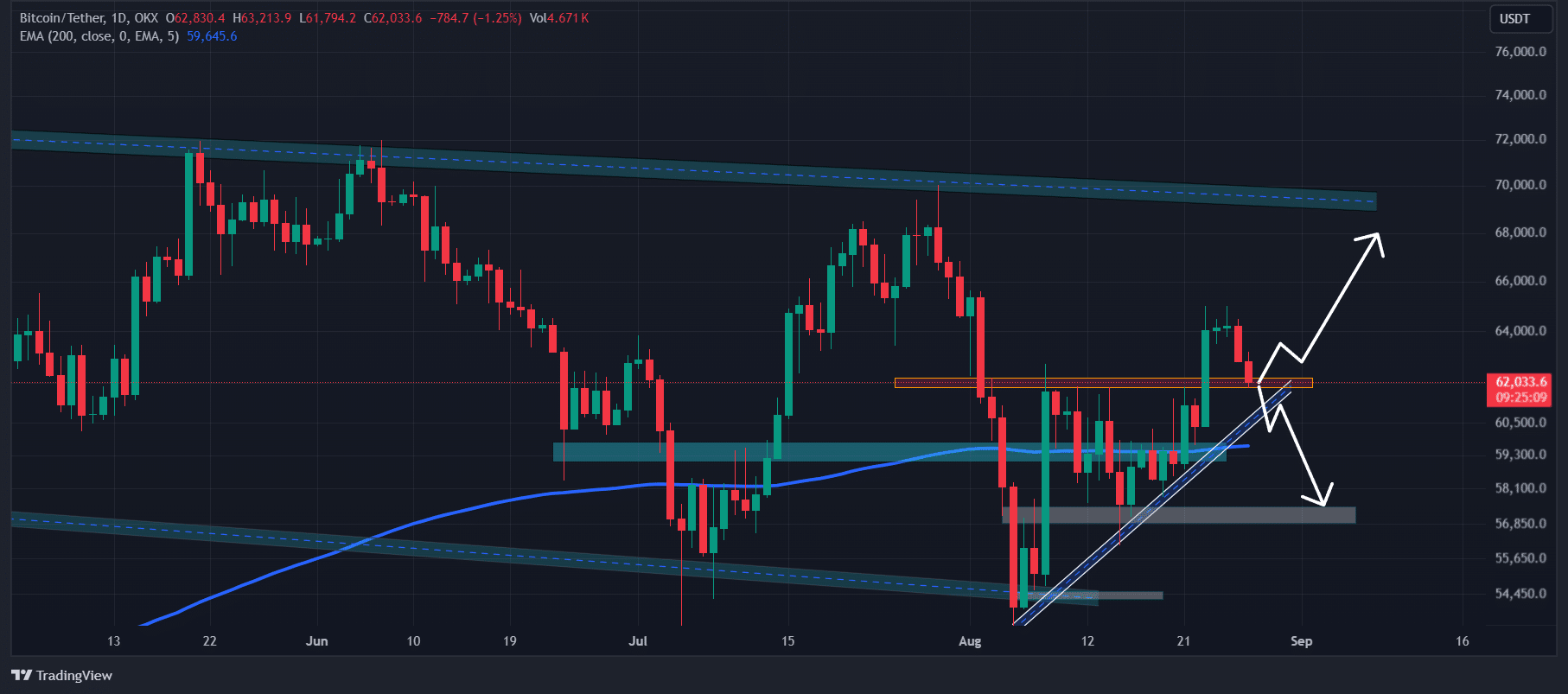

With these significant BTC transactions, expert technical analysis indicates a bearish outlook for Bitcoin. Currently, BTC is in an uptrend as it maintains itself above the 200 Exponential Moving Average (EMA) on a daily time frame.

Besides this uptrend, it is currently there at a crucial breakout level of $61,850 level, which it previously broke following the rate cut announcement.

Source: TradingView

Based on the price action and historical price momentum, if BTC experiences a price reversal from this crucial level, there is a high possibility of a significant price rally to the $68,000 level in the coming days.

Conversely, if BTC continues to fall, we may see a major crash in the coming days.

At press time, BTC was trading near the $61,900 level and has experienced a price decline of over 2.6% in the last 24 hours. Meanwhile, its trading volume has increased by 33% during the same period, indicating higher participation from traders amid the recent price decline.

Additionally, BTC’s open interest also dropped by 3% in the last 24 hours, reflecting lower interest or fear among investors regarding the ongoing price drop.

Major liquidation levels

Currently, the major liquidation levels are near $61,670 on the lower side and $63,900 level on the upper side, as traders are over-leveraged at these levels, according to the on-chain analytic firm CoinGlass.

Source: CoinGlass

Read Bitcoin’s [BTC] Price Prediction 2024-25

If the sentiment remains bearish and the price falls to $61,670, nearly $192 million of long positions will be liquidated.

Conversely, if sentiment shifts and the price rises to the $63,900 level, nearly $271 million worth of short positions will be liquidated.

Powered by WPeMatico