- Crypto Fear and Greed Index’s reading at 29 indicated that now might the time to accumulate.

- Will the increase in ETH network activity spur Pepe/ETH price to new highs?

The Crypto Fear & Greed Index remained near its lowest point this year, at 29 at press time, signaling fear and market consolidation.

This sentiment reflected the aftermath of the Japanese rate hikes on the 5th of August, which shook global financial markets.

While the index gives insight into market sentiment, it’s not a reliable buy/sell signal, as it can stay low for extended periods, offering opportunities for long-term trading.

This could be an ideal time to accumulate more crypto.

Source: Coinglass

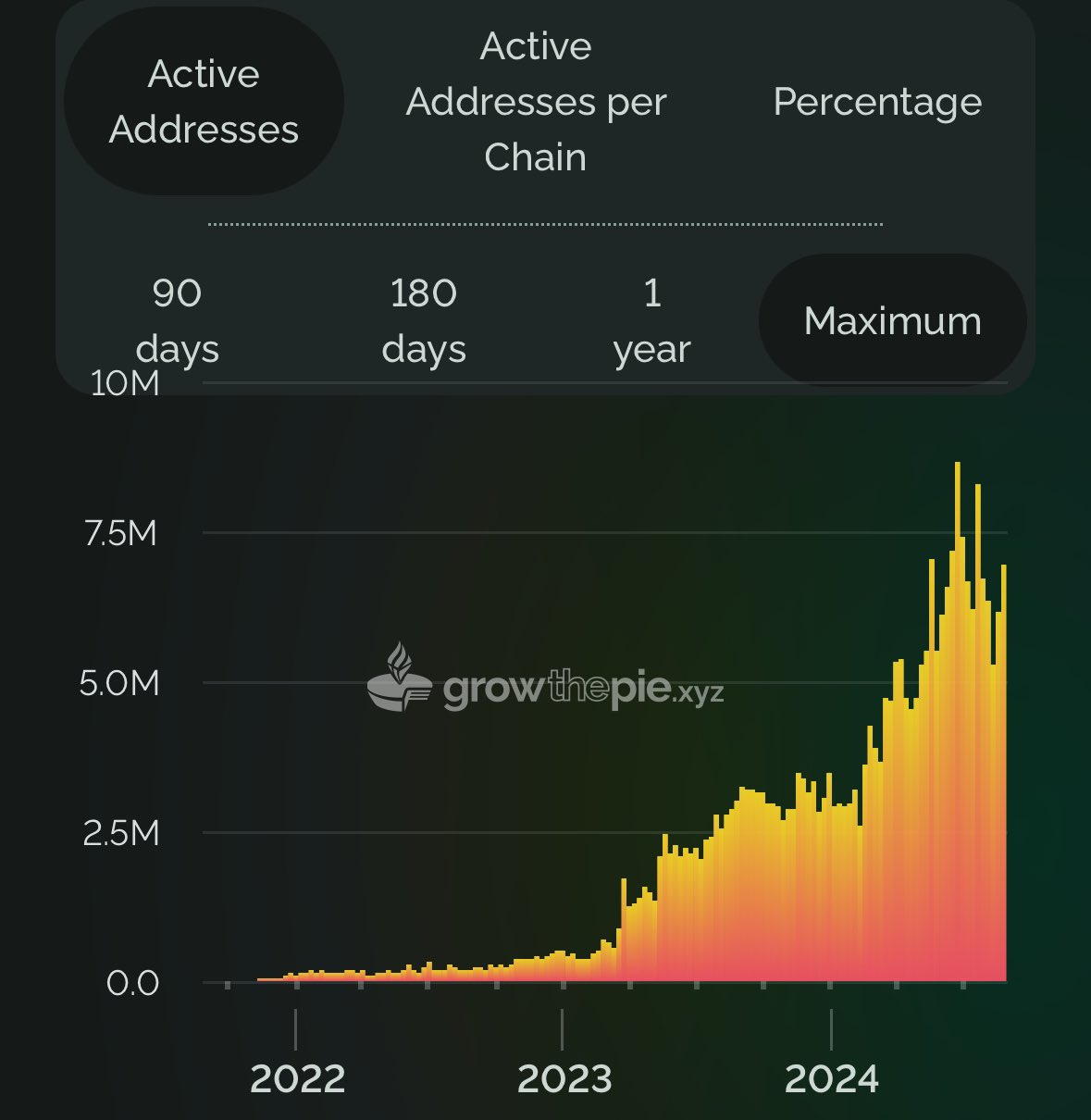

ETH network sees increased on-chain activity

With Ethereum [ETH] continuing to show strength with increased on-chain activity despite lagging prices presents a great opportunity on the network.

Recently, a whale wallet recently claimed 30,007 ETH ($78.67M) and deposited 24,007 ETH ($61M) to Coinbase, while another wallet withdrew 21,912 ETH ($55.32M) from Coinbase and staked it in Lido.

Source: growthepie

These moves highlight the growing activity on the Ethereum network, positioning ETH-based memecoins like Pepe [PEPE] to benefit from the increased liquidity.

Falling wedge on PEPE/ETH

The $PEPE/USD chart is also looking fearful, but key focus lies on the pairing with ETH which is the parent chain, not just USD which is a subsidiary.

The Pepe/ETH chart is showing resilience, maintaining its structure while forming a bullish falling wedge over support.

With $PEPE down only 30% from its ATH, is some strength compared to other coins, also a bullish signal.

Source: TradingView

Historically, $PEPE leads the meme coin surge when ETH rises, and the liquidity from $PEPE’s rally drives the performance of most other meme coins.

The chart is extremely promising, indicating potential for significant gains. Short-term, $PEPE could reach a $10 billion market cap, with a possible cycle top between $20 billion and $30 billion.

Altcoins fractal of 2021 vs. 2024

The altcoin price action in 2024 mirrors the 2021 bull run, with dips being gradually bought, shifting sentiment from extreme fear to cautious optimism.

Confidence grows with consistent buying during dips. If the total market cap for altcoins excluding top 10 cryptos breaks out above the $250 billion level, this could signal a bull market.

Source: TradingView

If unemployment remains stable and the US sees rate cuts, recession fears may fade, supporting a positive market shift.

With altcoin sentiment at an all-time low, this could signal the market bottom, setting the stage for potential gains.

Read Pepe’s [PEPE] Price Prediction 2024–2025

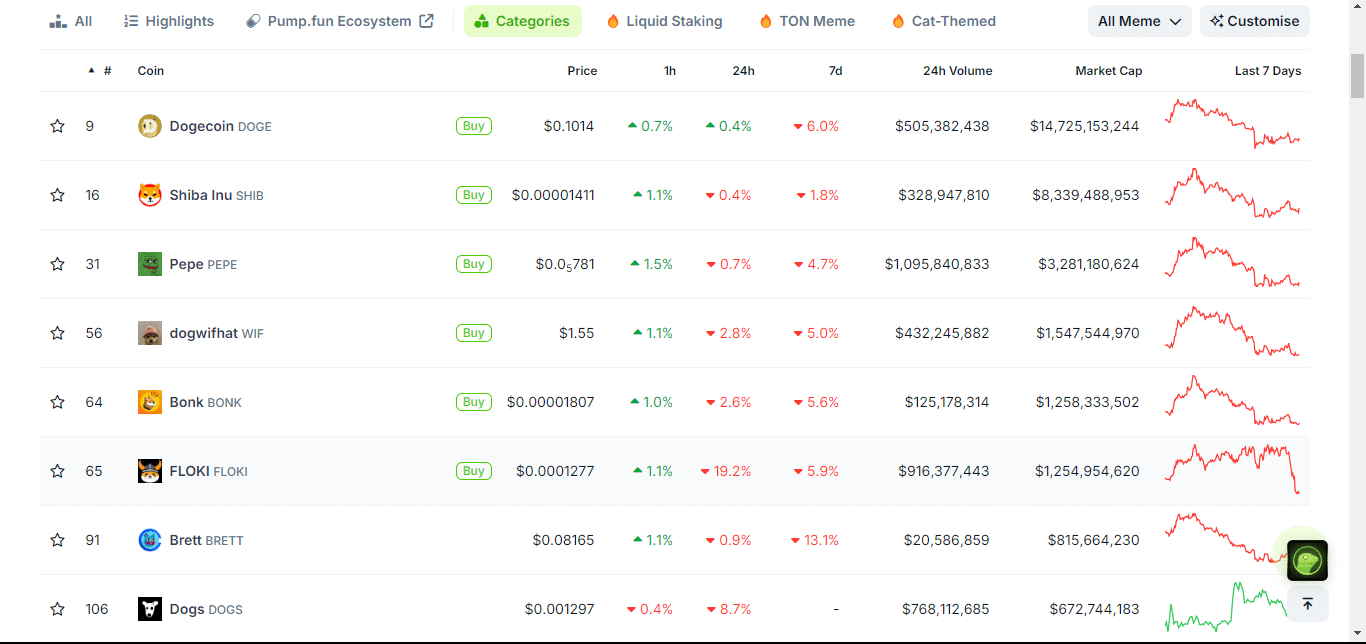

PEPE vs. top memecoins by market cap

Finally, Pepe has outperformed all other top eight memecoins by market cap, gaining 1.5% in the hourly timeframe.

This performance, combined with increased on-chain activity on the Ethereum network, suggests that now might be an opportune time to accumulate PEPE, positioning it well for a surge if the markets improve.

Source: CoinGecko

Powered by WPeMatico