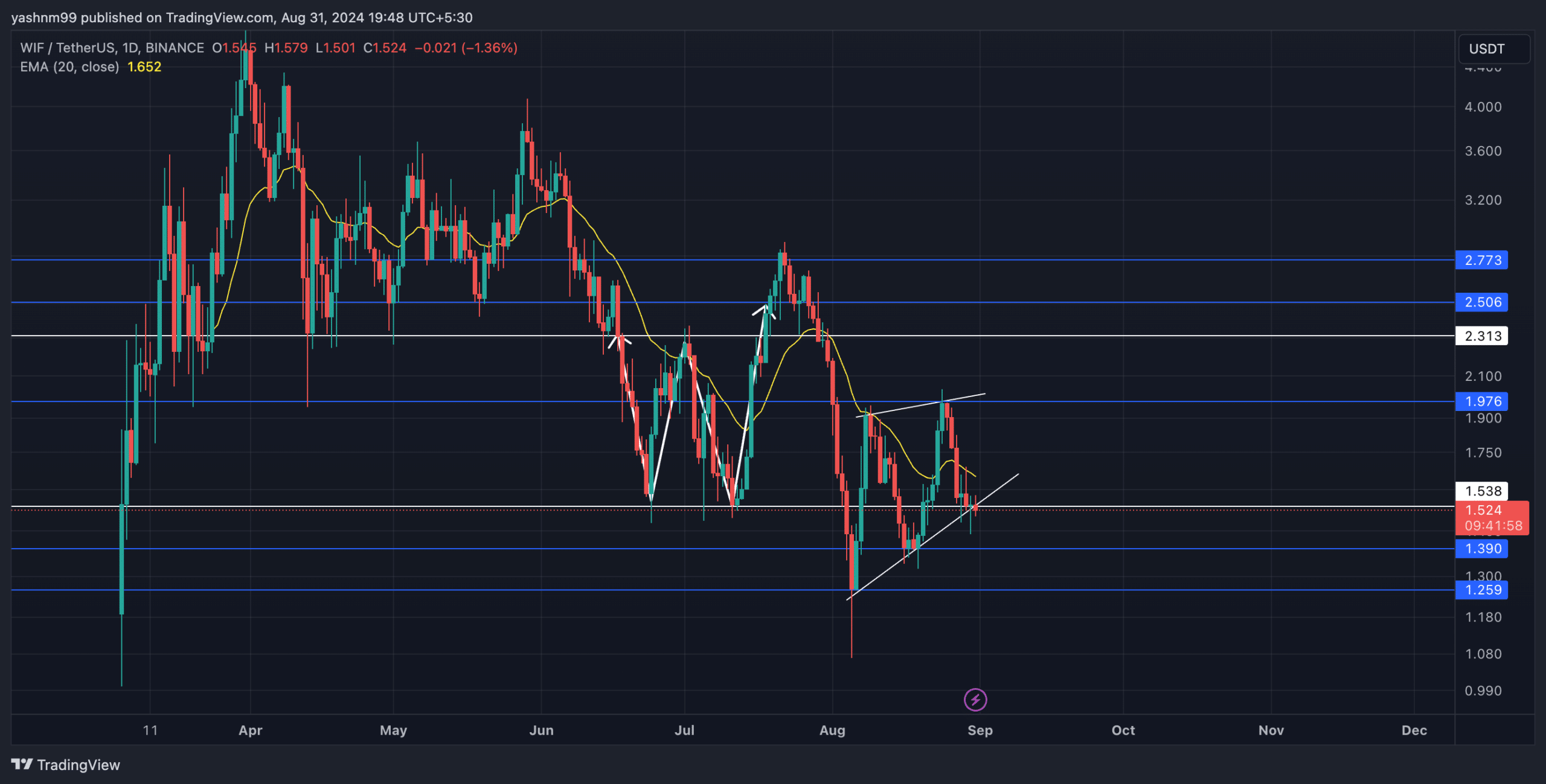

- The recent downtrend pulled WIF toward its 5-month low while the price struggled to break above the near-term EMAs.

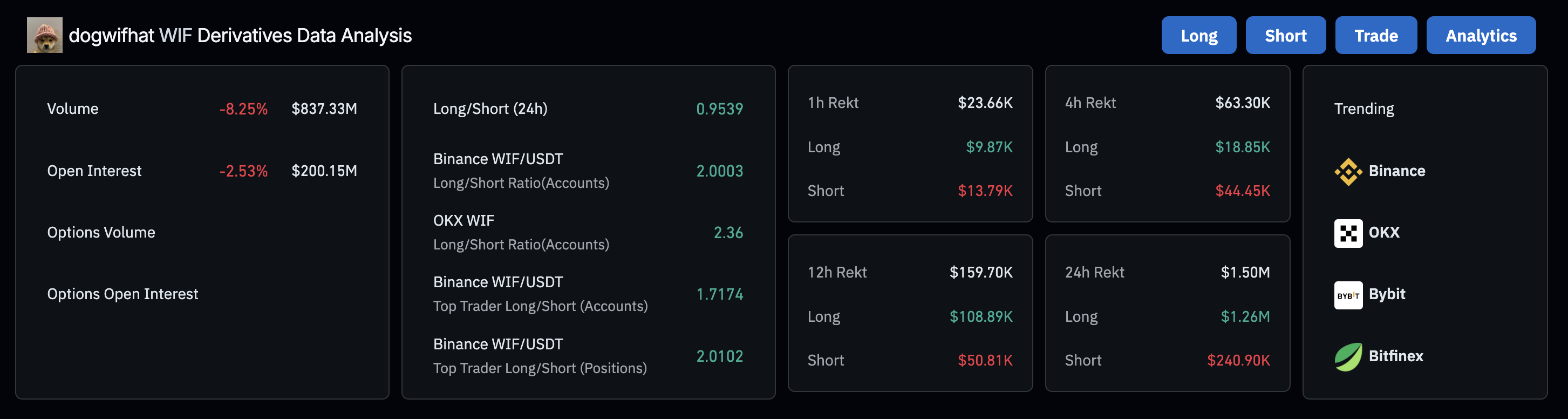

- Derivates data reaffirmed a bearish edge, but the long/short ratio on Binance showed some bullish interest.

dogwifhat [WIF] finally saw a glimmer of hope as buyers entered the market after WIF’s recent rebound from the $1.2 support level. The meme coin traded around $1.53 at press time and faced resistance around the 20-day EMA near the $1.6 mark.

Looking at the confluence of support levels near the $1.53 level, WIF could see a near-term uptrend before likely continuing its long-term downtrend.

dogwifhat struggled to sustain above the 20 EMA

Source: TradingView, WIF/USDT

After witnessing a consistent downtrend since hitting its ATH around five months ago, WIF struggled to hold key support levels. After losing nearly 66% in two months, the recent rebound from the $1.2 support has finally set the stage for the buyers to retest the 20 EMA resistance.

It’s worth noting that the recent price movement also formed a rising wedge structure on the daily chart. Such a structure typically depicts a continuation trend, i.e., it could lead to a continued downtrend in the coming weeks.

In the short term, WIF could likely see a rebound from its immediate support level near $1.5. Since this support level is at the confluence of multiple support levels, any rebound from here would push WIF toward the $1.8-$2 resistance range.

However, the bearish pressure remained prevalent since the meme coin remained below the 20 EMA. So, any decline below the $1.5 support would confirm a patterned breakdown and provoke a downtrend toward the $1.2 support.

The Relative Strength Index (RSI) recently fell below the 50 mark and its moving average, depicting a somewhat bearish edge. Traders should look for a close above the equilibrium before taking any long position.

Derivates data revealed THIS

Source: Coinglass

dogwifhat trading volume decreased 8.25% to $837.33 million, indicating potential caution among traders. Open interest declined by 2.53% over the past day, suggesting that traders are closing their positions—possibly in anticipation of further losses.

The 24-hour long/short ratio was slightly below parity at 0.9539, indicating a slight bearish sentiment. However, on Binance, top traders’ long/short ratio was above 2, suggesting that some traders are positioning for a potential rebound.

Realistic or not, here’s WIF’s market cap in BTC’s terms

Traders should monitor for a potential breakout above the 20 EMA or a breakdown below the immediate support level, which could dictate the short-term market direction.

It’s also essential to consider Bitcoin’s sentiment and other macroeconomic factors, as they often influence the broader altcoin market dynamics.

Powered by WPeMatico