- Trump survives a second assassination attempt, impacting both prediction and crypto markets.

- Bitcoin drops 3% post-attack, contrasting with its previous rally during an earlier attempt.

In a shocking turn of events, presidential candidate Donald Trump narrowly escaped a second assassination attempt, this time at his Florida golf club.

The incident comes just two months after a previous attempt at a Pennsylvania rally.

Trump’s assassination attempt

While Trump’s campaign has confirmed that he is safe and unharmed, the incident has sent ripples through both prediction markets and the cryptocurrency space, with notable impacts on market dynamics and forecasts for the upcoming election.

Trump’s health was further confirmed by Vice President Kamala Harris, who took to X and stated,

“I have been briefed on reports of gunshots fired near former President Trump and his property in Florida, and I am glad he is safe. Violence has no place in America.”

Impact on Polymarket data

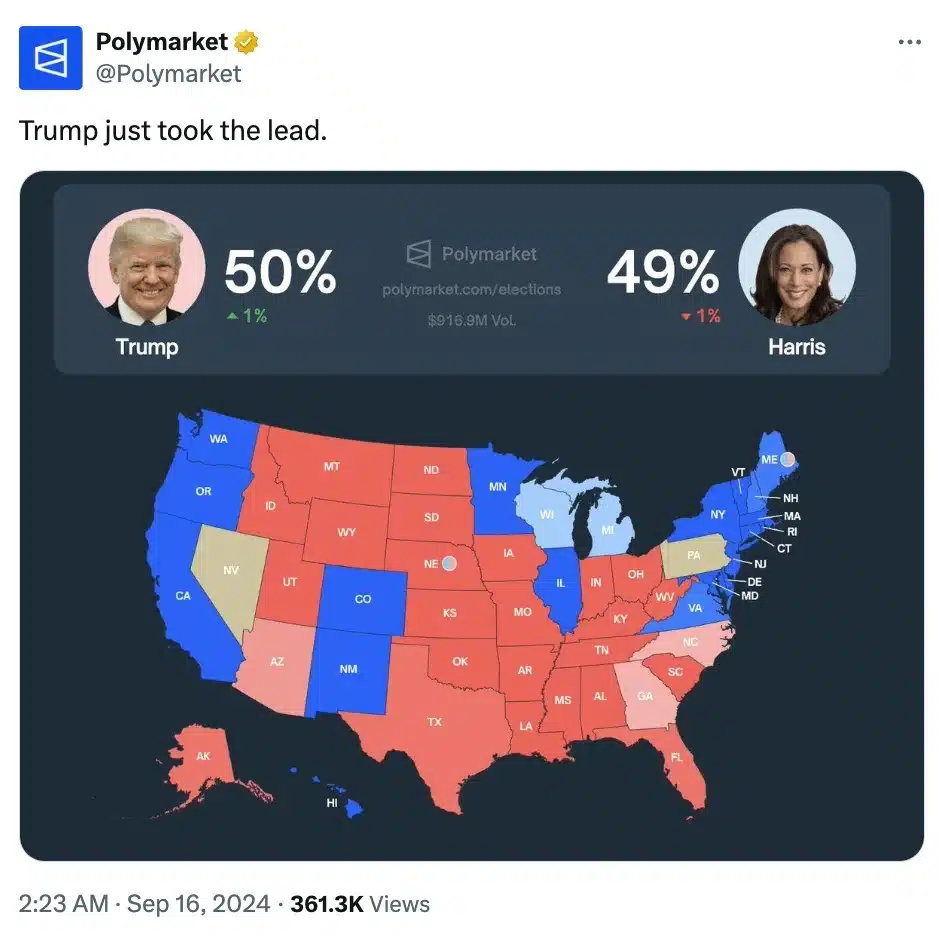

Following the assassination attempt, Polymarket data showed a significant shift in the race, with Trump holding 50% of the projected votes and Harris close behind at 49%.

Source: Polymarket

This marked a reversal from the post-debate standings, where Harris had surged to 50%, leaving Trump trailing at 49%.

Source: Polymarket

However, the aftermath of the assassination attempt seems to have leveled the playing field once more.

As of the most recent Polymarket update, Harris still leads with 50%, while Trump has slipped slightly to 49%, reflecting the ongoing volatility in voter sentiment.

Impact on Bitcoin’s price

Meanwhile, the crypto market reacted to the recent assassination attempt with a notable drop in Bitcoin’s [BTC] value.

Following the attack, Bitcoin fell by 3%, and as of the latest update from CoinMarketCap, it was down 2.67%, trading at $58,592.

This stands in contrast to the previous assassination attempt, where Bitcoin experienced a sharp rally, climbing and pushing past the $60,000 mark, eventually trading above $65,000.

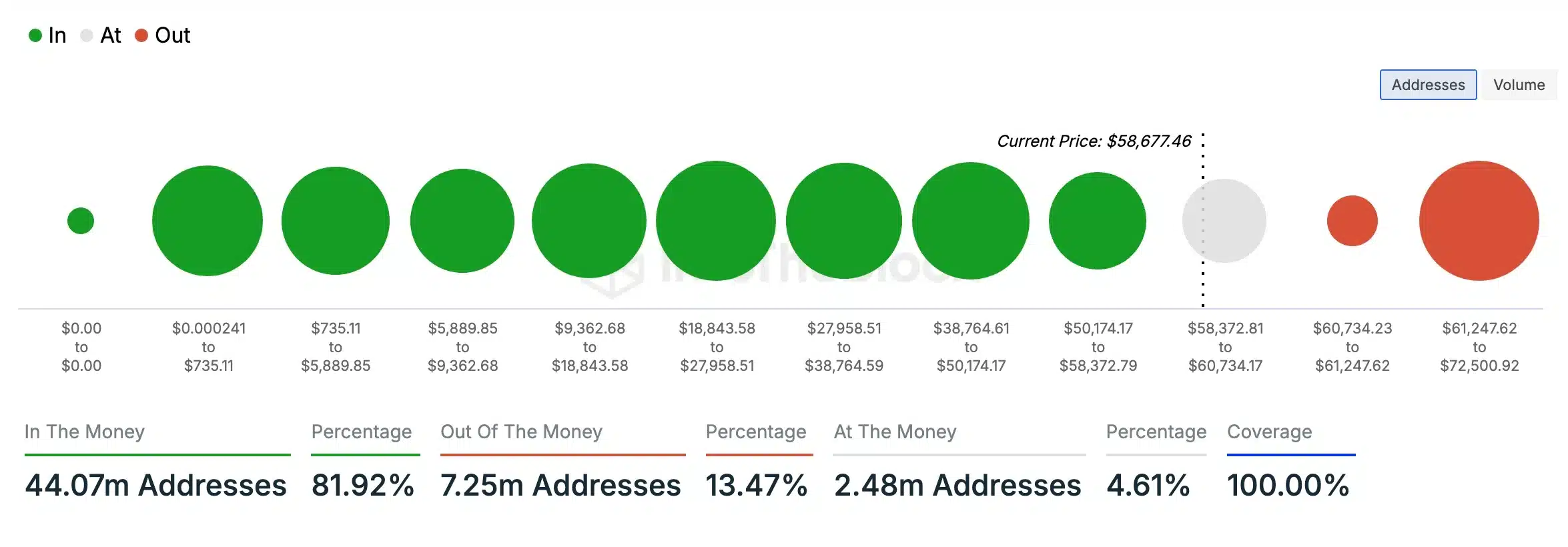

However, according to an analysis by AMBCrypto, based on data from IntoTheBlock, a significant 81.92% of Bitcoin holders were “in the money” at press time, meaning their tokens were valued higher than their original purchase price.

On the flip side, 13.47% of holders found themselves “out of the money,” with BTC worth less than what they paid.

Source: IntoTheBlock

This trend suggests that Bitcoin may be gearing up for a bullish shift in the near future.

Additionally, the Trump-themed meme coin MAGA saw an 11.71% drop in its daily charts following the recent assassination attempt.

This downturn is in stark contrast to the reaction after the first attempt when the MAGA coin surged by 40.81% within 24 hours.

On the other hand, the ETF market, which recorded inflows of $263.2 million on 13th September as per Farside Investors, could face potential impacts following the assassination attempt.

Powered by WPeMatico