- ONDO’s price surged as interest in the Real World Asset sector grew.

- MakerDAO continued to dominate the space, with the highest TVL accrued.

Ondo Finanace [ONDO] has seen a massive uptick in price over the last week, largely owing to the behavior of whales concerning this token. However, new data suggested that this uptick could be part of a larger trend.

Welcome to the Real World

The sudden interest in ONDO could be driven by the interest in the RWA (Real World Asset) sector. For context, the RWA sector in crypto stands for Real World Asset tokenization. It bridges the gap between traditional finance and crypto by creating digital tokens representing real-world assets like real estate, commodities, or even intellectual property.

This allows these assets to be bought, sold, and traded on a blockchain platform, potentially increasing their liquidity and accessibility for investors. It’s seen as a way to modernize traditional financial markets by leveraging the transparency and efficiency of blockchain technology.

Ondo Finance has emerged as the fourth-largest holder of Blackrock’s Ethereum-based tokenized fund, BUIDL, boasting holdings totaling $15 million.

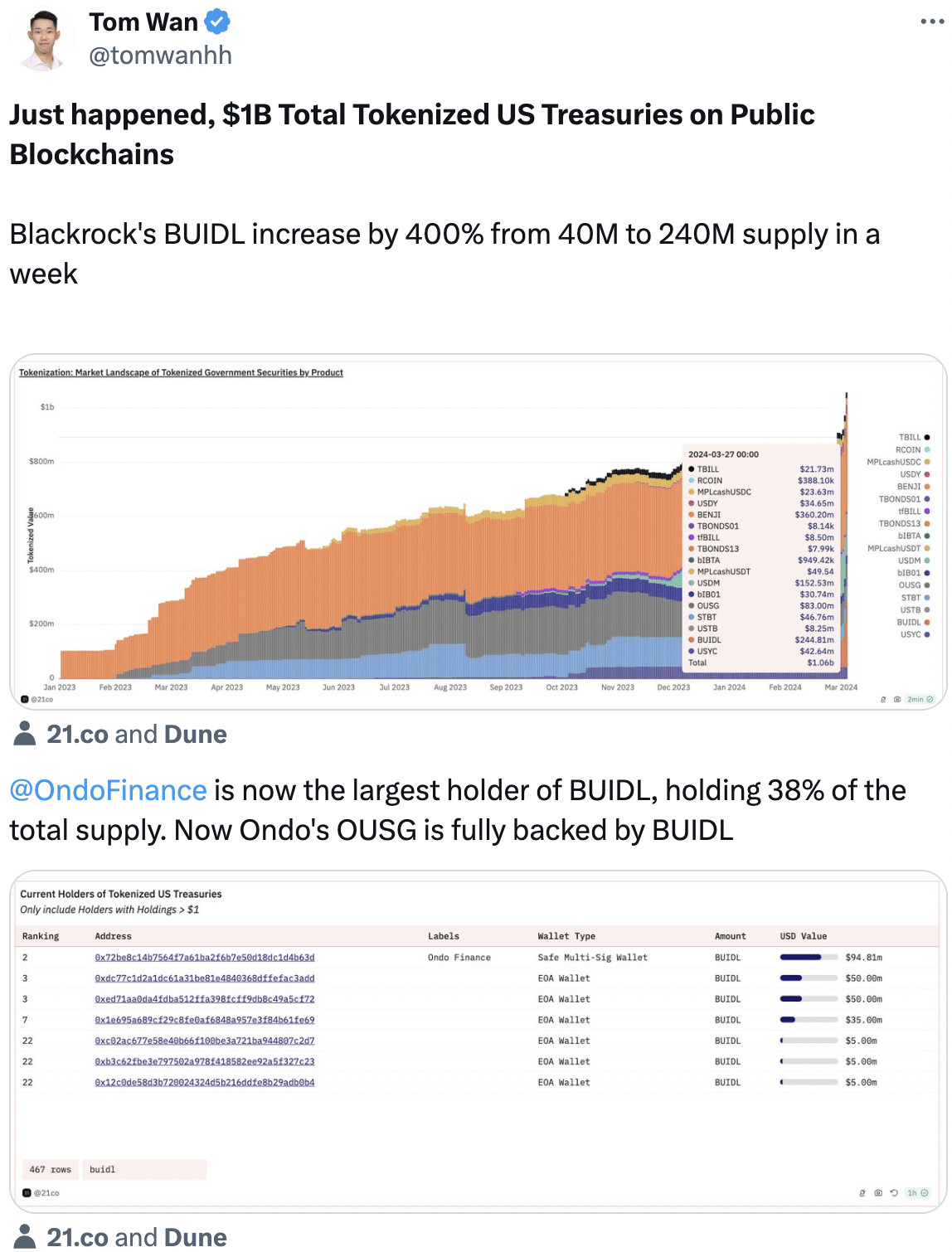

Thanks to the endeavors of ONDO and similar protocols, the total tokenized US Treasuries on public blockchains have reached $1 billion. Within a mere week, Blackrock’s BUIDL saw an astonishing surge of 400%, skyrocketing from a supply of 40 million to 240 million.

Source: X

Don’t forget about Maker

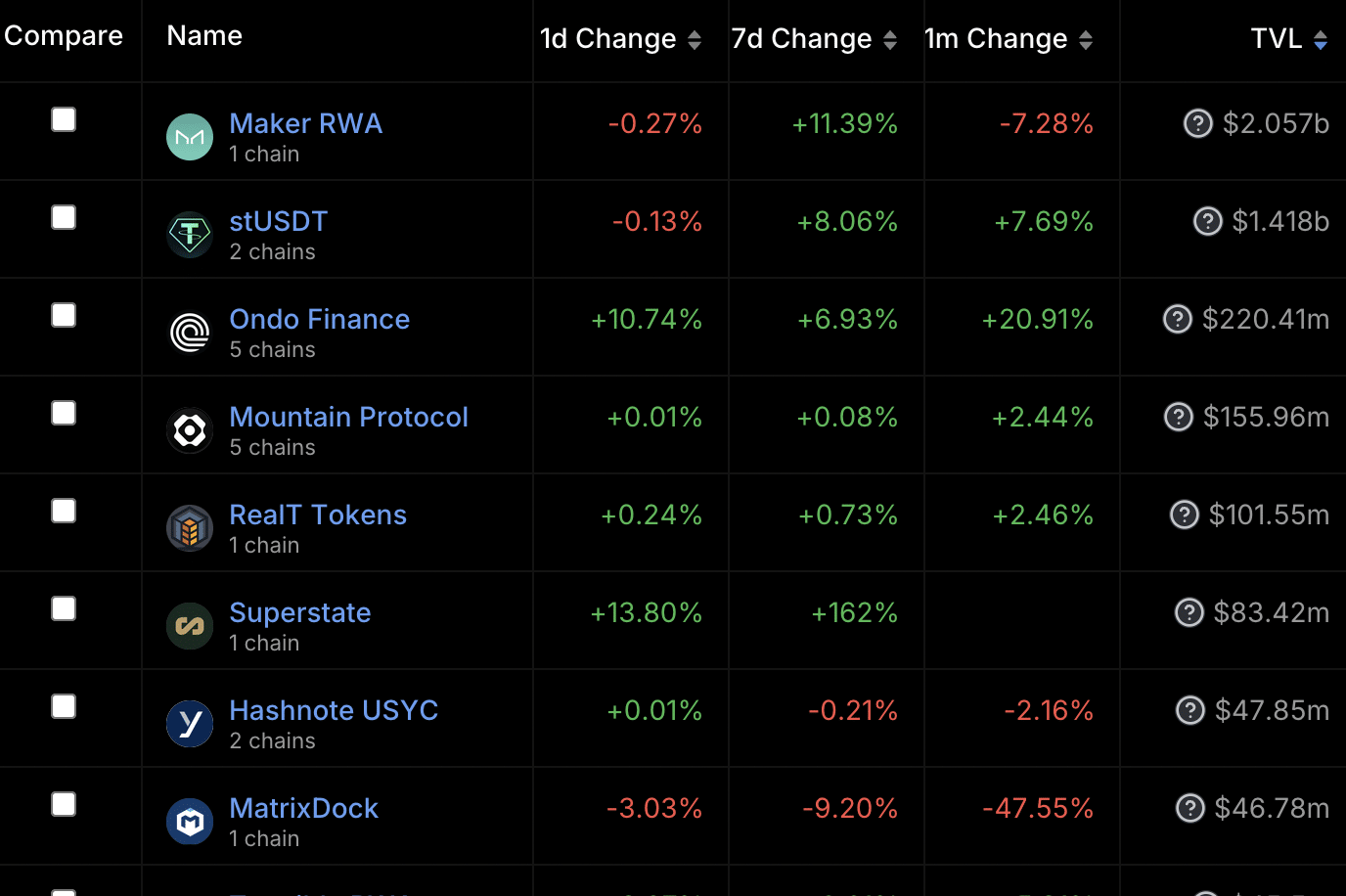

Apart from Ondo Finance, other networks such as MakerDAO[MKR] have also been showing large amounts of growth. At press time, MakerDAO had the largest amount of TVL (Total Value Locked) collected on its network.

It was the leader in the space and despite the protocol’s considerable resources, the price of the MKR token had declined by 7.28% over the past month.

Source: DeFi Llama

Due to the vast difference between the value collected by RWA protocols and their market cap, market speculators believe that these tokens may be undervalued.

Realistic or not, here’s MKR’s market cap in BTC’s terms

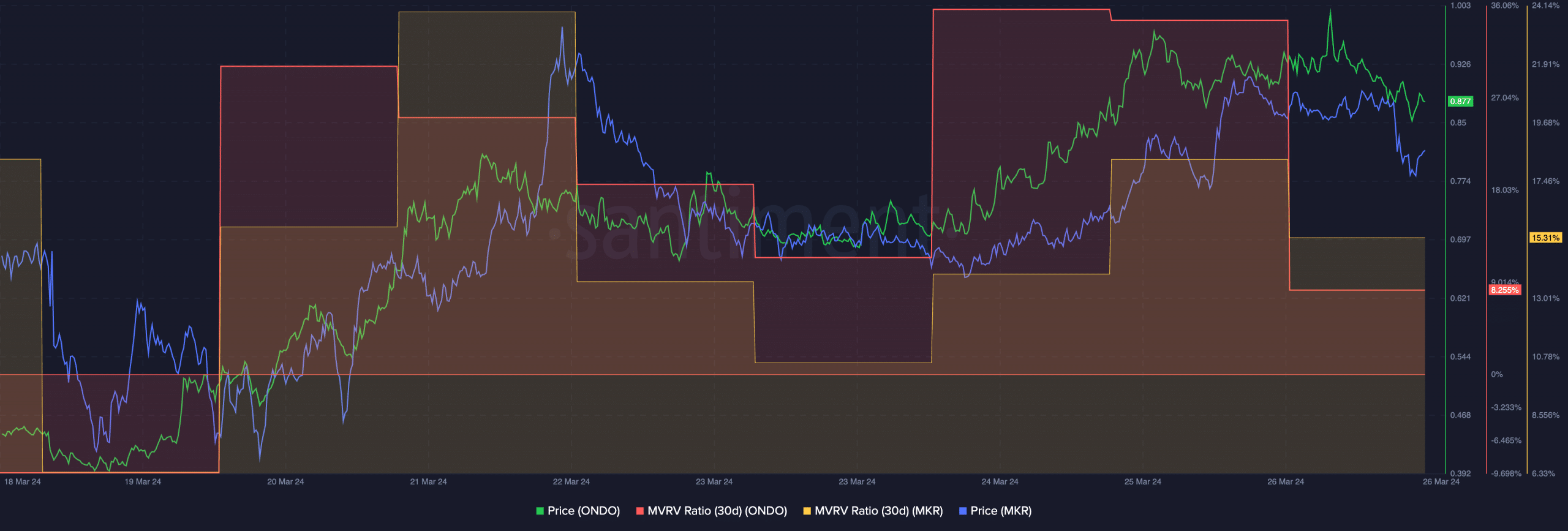

At press time ONDO was trading at $0.9011 and its price had grown by 0.84% in the last 24 hours. MKR on the other hand was trading at $3,353.13 and its price had grown by 3.64% during the same period.

Most of the holders of these tokens were profitable as suggested by their high MVRV ratios. Only time will tell whether these addresses will sell their holdings or continue to hold them going forward.

Source: Santiment

Powered by WPeMatico