- Dogecoin and other memecoin projects still appeal to retail investors, despite their limited utility.

- Adoption of memecoins has been aided by deployment platforms like Pump.fun, which have simplified the process of launching tokens

The crypto market kicked off the week fairly well, after slumping late last Friday. Bitcoin reclaimed $68,500 early on Monday, before advancing to set a 24-hour high of $69,225 on the charts. The crypto’s restored momentum erased losses from over the weekend, which occasioned a slightly disappointing weekly close for Bitcoin bulls on Sunday.

The market-wide dip towards the end of last week was triggered by news of the U.S Department of Justice probing Tether, which disrupted prevailing positive sentiment in the second half of October. Tether CEO Paolo Ardoino, however, addressed the claims, confirming the reporting as inaccurate. This stabilized crypto prices across the board.

With three days until the monthly close, commentators have forecasted more volatility in the crypto market. This is likely to be fueled by Election Night in the United States and expectations for more Fed rate cuts.

Memecoins are dominating the conversation, AI tokens not so much

Driven by sentiment as opposed to underlying utility, memecoins have continued to draw the attention of many speculators in Q4. Crypto projects in this category have stood out as the top performers thus far in October.

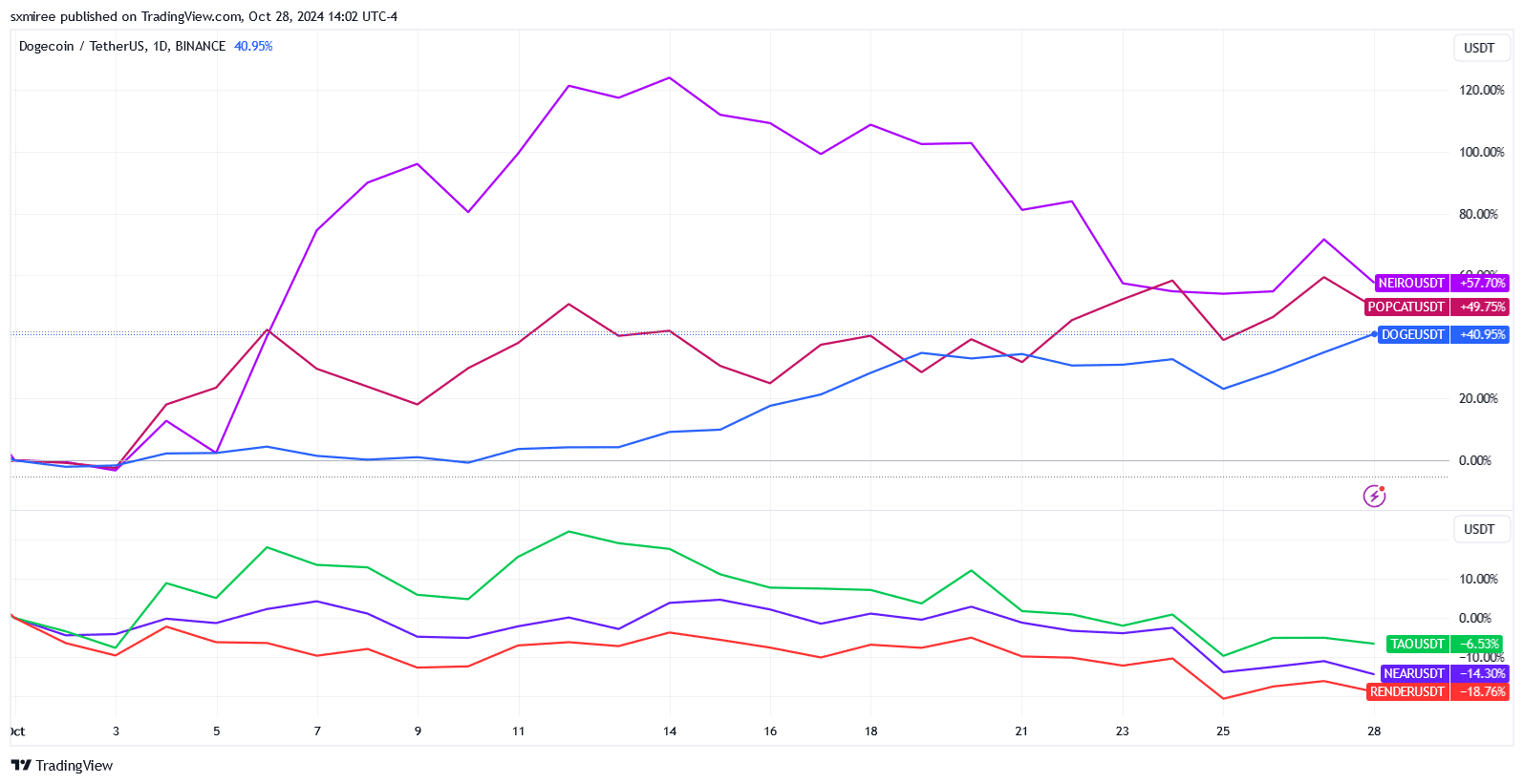

In fact, TradingView data revealed that DOGE, POPCAT, and NEIRO have tracked gains of 40%, 49%, and 57%, respectively, so far in October, outpacing other major alts. Only Solana ecosystem’s Raydium (RAY) token has posted higher returns among the top 100 cryptocurrencies by market capital.

Source: TradingView

On the contrary, AI-focused tokens have suffered losses during the same period. For example – TAO, NEAR, and RENDER prices have declined by 6.5%, 14%, and 19%, respectively.

The diverging performances of memecoins and AI tokens underscores the cyclical nature of market trends, given the fact that the latter dominated in previous quarters, spurred by developments around Nvidia. The fast adoption of newer memecoin entrants like NEIRO and GOAT further exemplifies the power of retail-driven sentiment, one where hype-driven narratives take precedence over fundamentals.

Narratives to play a role in defining Q4 crypto landscape

October has already seen multiple crypto fads, including the convergence of AI and crypto in play. Still, memecoins remain in favor, given many investors are more focused on speculative opportunities at the expense of long-term fundamentals.

Earlier this month, CryptoQuant founder Ki Young Ju observed that search interest in memecoins has been growing and is on course to reach a new record high. Conversely, Bitcoin search interest fell and hovered at yearly lows at the time.

The popularity of memecoins has been primarily driven by the potential for massive returns for early adopters based on past cycles. Mental exhaustion among traders who have been eagerly waiting to book profits has also contributed to the greater appetite for these highly speculative assets.

Powered by WPeMatico