Legion’s new investor scoring system aims to level the playing field, prioritizing real contributions over speculative capital.

Legion aims to prioritize community value over capital in token raises.

Posted October 29, 2024 at 8:00 am EST.

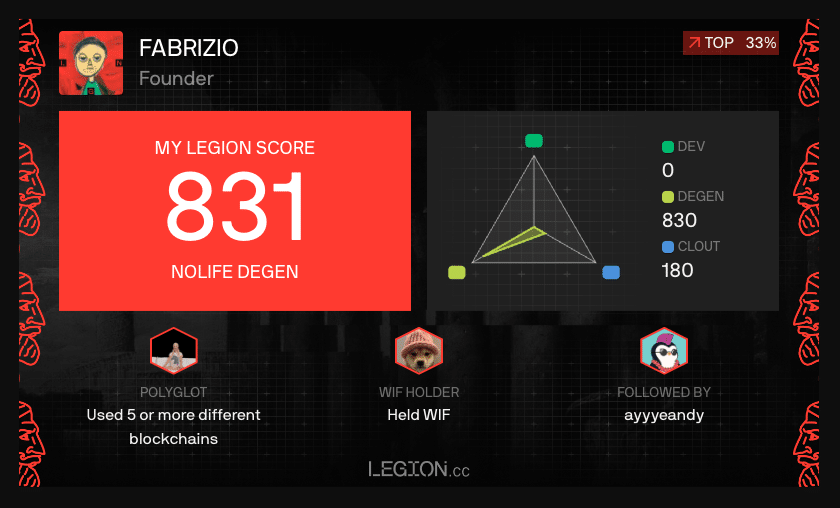

Crypto fundraising platform Legion today announced the launch of the Legion Score, a new reputation system designed to evaluate investors on criteria that go beyond simply their financial contributions.

The system, incubated by Delphi Labs and operating across multiple blockchains including Solana and Ethereum, aims to create a more balanced, transparent fundraising environment in the crypto space.

The Legion Score assigns investors a rating from 0 to 1,000 based on factors such as their social influence, technical skills, community involvement, and recommendations supporting them.

Projects seeking funds can use the scores to identify investors that align with their values and goals, prioritizing qualities beyond capital resources.

“Legion Score flips the narrative on who gets to participate in token raises … where non-financial contributions — like time, expertise, or community-building — are valued just as much as capital,” Alex Svanevik, founder of Nansen and an early Legion investor said in a Legion press release.

The launch comes amid increasing scrutiny of venture capital (VC) practices in the crypto universe, with critics arguing that VCs often extract value from token launches by securing significant allocations at low valuations, a trend that has birthed the term “VC coins.”

These practices are perceived by some as unfair to retail investors, who often face price distortions once tokens go public. Such sentiment has spurred a wave of memecoins this cycle that have been celebrated as “fair launches” because they lack pre-sales and allocations for insiders, unlike many VC-backed projects.

By emphasizing investor contributions over speculative capital, Legion aims to counter concerns over equality of opportunity in token raises.

Legion Scores will also undergo adjustments based on investor behavior post-fundraising, promoting accountability.

Additionally, the platform uses the EigenTrust algorithm to minimize bot and sybil activity and requires know-your-customer documentation, ensuring that all investors are unique participants.

“By incentivizing individuals to maintain a positive standing within the community, Legion creates a powerful feedback loop that enhances the quality of communities formed through our platform,” Fabrizio Giabardo, Legion’s co-founder, said in the company’s release.

Legion’s platform, which is compliant with the EU’s MiCA regulations, also allows project teams to save time when vetting investors by identifying those who bring more to the table than just deep pockets.

Powered by WPeMatico