- Bitcoin nears record highs, just 1.8% away from its previous ATH, signaling strong bullish momentum.

- Increased accumulation by long-term holders and rising whale transactions suggest potential for a further rally.

Bitcoin [BTC] has continued its impressive climb, now just a 1.8% decrease away from its all-time high (ATH) of $73,737 reached in March 2024.

Trading above $72,000 at press time, BTC has posted a nearly 10% increase over the past week and is up by 0.2% in the past day. This consistent upward trend reflects renewed investor confidence, bolstered by metrics signaling strength in Bitcoin’s fundamentals.

Additionally, this recent price rally appears to be largely driven by long-term holders (LTH) who are actively accumulating Bitcoin, as highlighted by CryptoQuant analyst Darkfost.

Whales accumulate like never before

According to the CryptoQuant analyst, the LTH 30-Day Net Position Change—a metric that tracks the monthly growth or reduction of Bitcoin held by long-term holders—shows that, despite BTC nearing its ATH, there’s only a slight dip in net position change.

Source: CryptoQuant

Darkfost explains that this minor dip in net position change is “approximately 2.5 times smaller than the reduction seen at the previous ATH,” indicating that the current sell-off is more measured.

This trend suggests that long-term holders are displaying confidence in Bitcoin’s short-term potential by holding rather than selling.

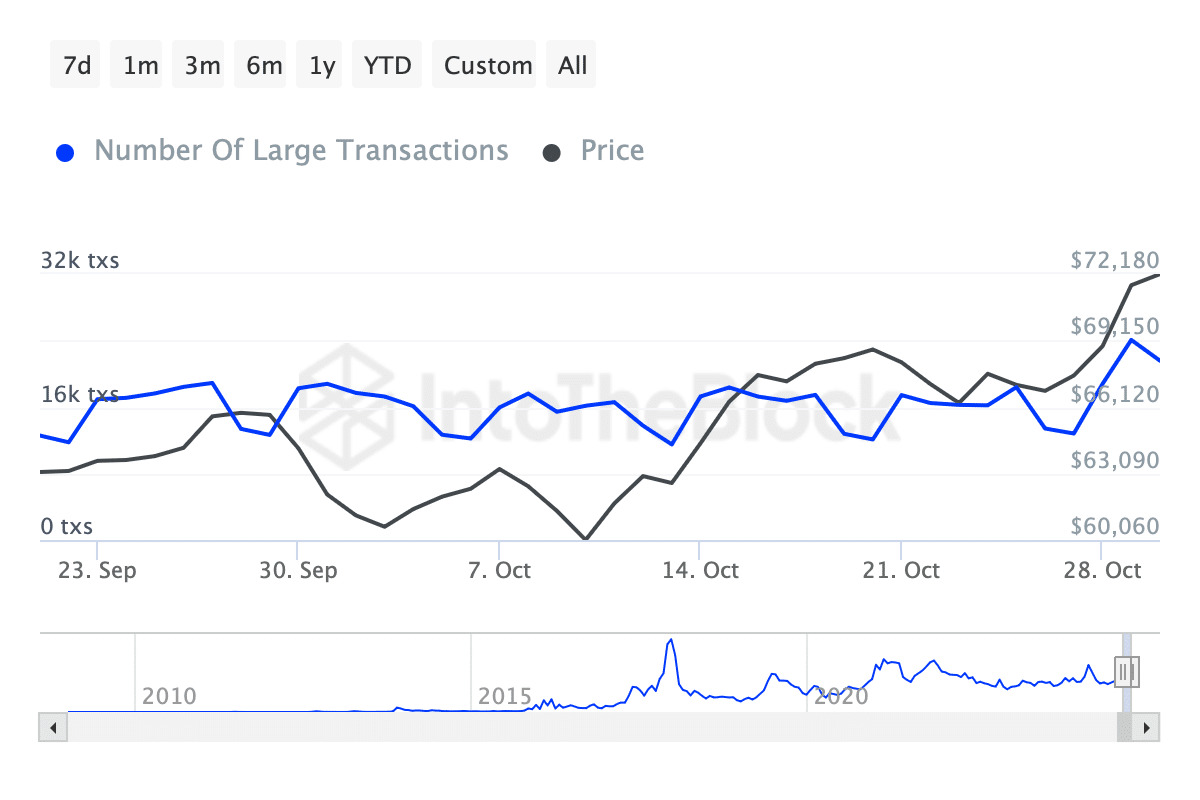

In addition to activity from long-term holders, Bitcoin is witnessing heightened interest from major investors, often known as “whales.” Data from IntoTheBlock indicates that whale transactions have seen a noticeable increase, rising from 15,000 transactions last week to over 20,000 as of press time.

Source: IntoTheBlock

Such a spike in whale transactions generally points to substantial interest in Bitcoin from large investors, who may be positioning themselves for further price gains.

In crypto markets, whale activity can drive significant price shifts, as their substantial holdings have the potential to influence supply and demand dynamics.

Positive indicators align as Bitcoin approaches key price milestone

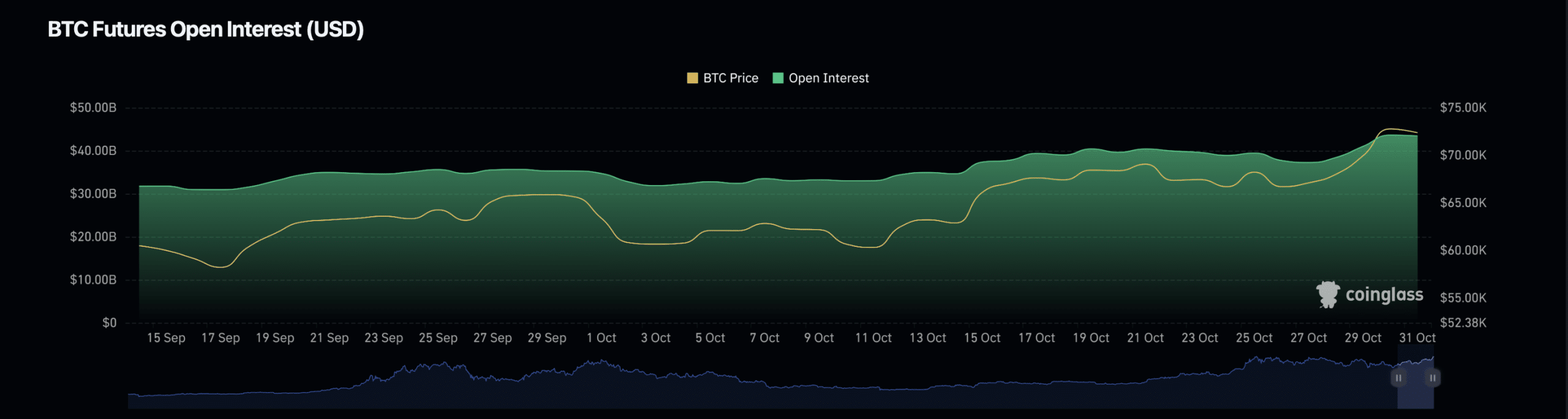

Another key indicator of strong investor sentiment is Bitcoin’s open interest, which measures the total number of outstanding derivative contracts tied to the asset.

Data from Coinglass reveals that BTC’s open interest has seen a slight rise, increasing by 0.33% to reach a valuation of $43.59 billion.

Source: Coinglass

However, Bitcoin’s open interest volume has shown a contrasting trend, with a decrease of 37.63% to a valuation of $56.13 billion.

A rise in open interest generally signals that traders are actively engaging with the asset, while a dip in volume could indicate caution among some investors, possibly waiting for additional price signals before making substantial trades.

The convergence of these factors—long-term holder accumulation, heightened whale interest, and increased open interest—has set a favorable backdrop for Bitcoin’s continued upward momentum.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Long-term holders showing resilience and holding back on selling at near ATH levels suggests a prevailing sentiment of optimism within the Bitcoin community.

Darkfost concludes that this cautious but steady accumulation by long-term holders could pave the way for a potential rally in the near future.

Powered by WPeMatico