- BTC’s ‘basis trade’ exploded following the recovery in September.

- The rising basis premium was being driven by hedge funds.

Bitcoin [BTC] basis trade, where investors buy spot BTC ETF and sell CME (Chicago Mercantile Exchange) futures contracts at higher prices to lock the profit from the price difference, is back in a big way.

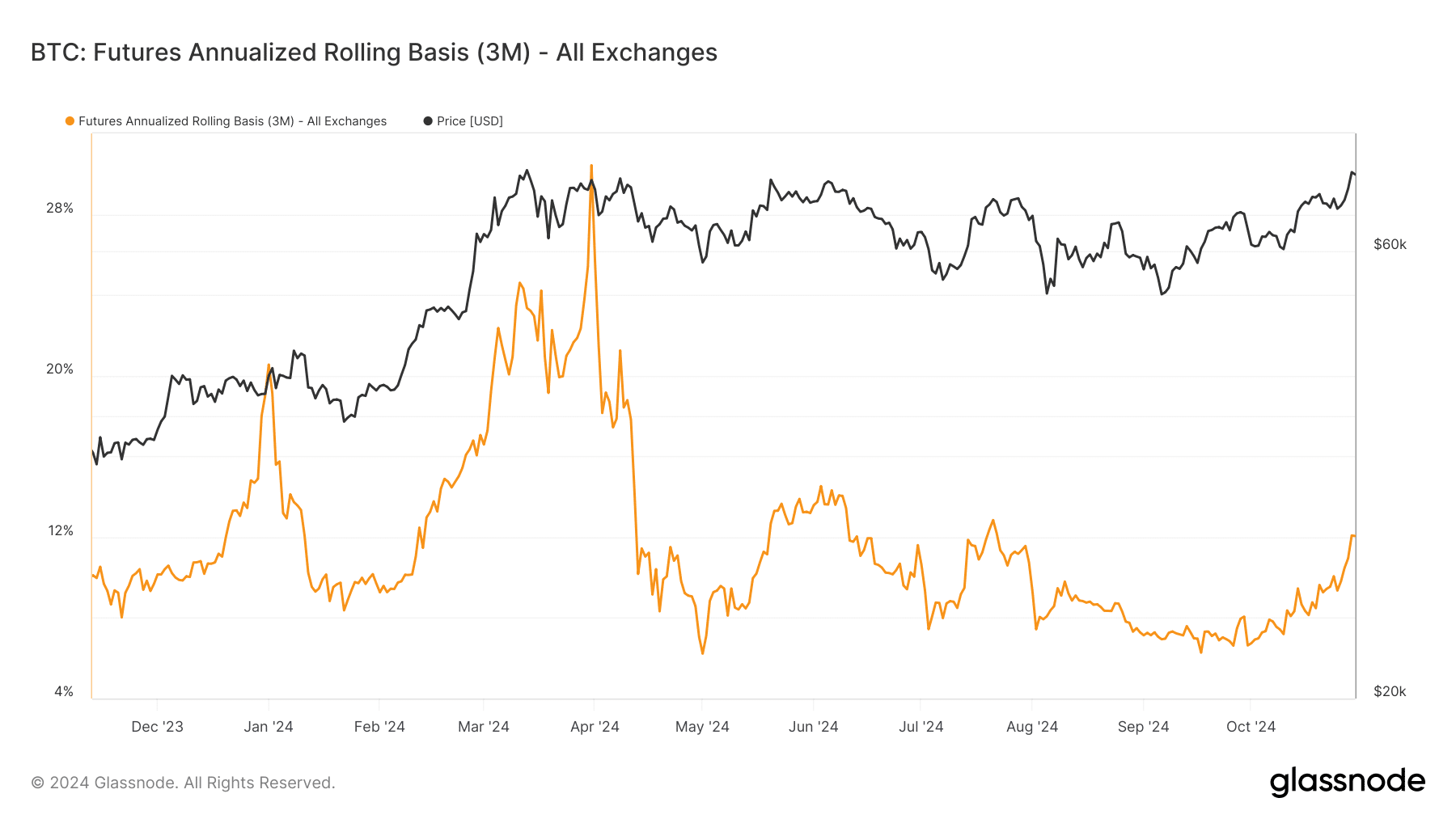

Typically preferred by hedge funds and asset managers, the basis trade premium doubled in October. This happened as BTC crossed $70K, shown by the Futures Annualized Rolling Basis metric.

In mid-September, the premium dropped to 6.2%; however, it stood at 12% as of the 31st of October. That’s about a 2x surge in a few weeks.

Source: Glassnode

The Fed rate cuts and implications

According to James Van Straten, a BTC analyst, the rising BTC basis trade could be linked to ongoing Fed rate cuts.

He stated that the lower interest rates made BTC basis trade a better option with higher returns than traditional opportunities.

“This is over double the current Fed Funds effective rate of 5%, in addition to the Fed cutting further in the next 3 months. I would assume the use of the “basis trade” will only increase.”

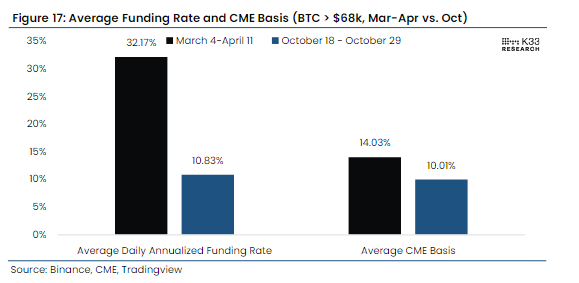

During the peak of market froth in March, when BTC printed its all-time high (ATH) of $73.7K, the premium topped 14%. This was followed by funding rates peaking above 30%.

Compared to the current readings, the euphoria has not crept into the market to signal an overheated scenario, noted Mathew Sigel, VanEck’s head of digital assets research. He said,

“Past BTC peaks have coincided with surging perp premiums, hardly the environment today. Also, current spot volumes are half of March/April, indicative of substantially less panic buying from retail participants – a welcome observation for continued strength.”

Source: K33 Research

That said, the overall BTC Open Interest (OI) rate surged to an ATH of $43 billion, dominated by CME futures at $12.69 billion. This indicated huge interest from institutions.

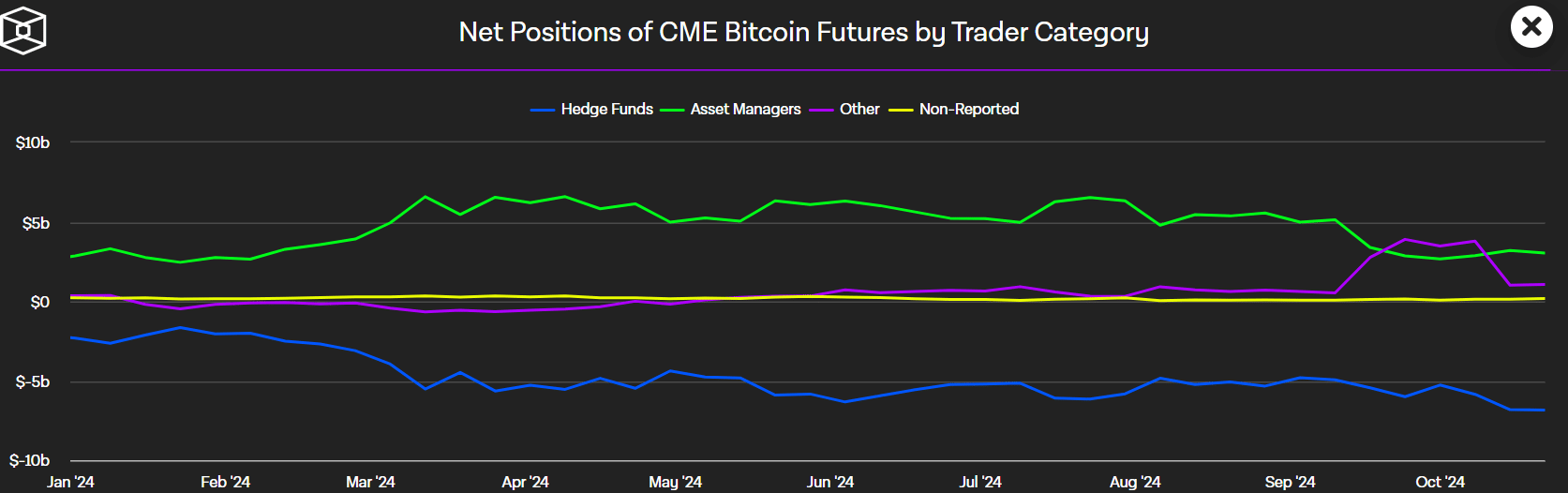

However, the CME Futures market positioning showed that hedge funds drove the widening basis trade premium.

According to The Block data, hedge funds (blue line) had a net short position of $6.84 billion, indicating massive hedging against the BTC price decline.

Source: The Block

By extension, this also widens the basis between spot BTC and futures prices and could attract even more players.

However, a sharp drop in the premium might signal bearish sentiment and a potential BTC pullback. At press time, BTC was valued at $72.2K, up 13% in October.

Powered by WPeMatico