- An unknown wallet transferred BTC worth hundreds of millions to Coinbase

- At press time, BTC seemed to be approaching a crucial support, and a re-test could change the prevailing market trend

Bitcoin [BTC] investors have been a happy crowd lately after it managed to push past $72,000 on the charts over the last few days. However, it couldn’t sustain its positive momentum and soon, BTC started to drop.

Hence, it’s worth taking a closer look at why Bitcoin is down today.

Why did Bitcoin drop below $70k again?

Bitcoin bulls gained control of the market on 27 October. Since then, BTC has performed very well, with its value climbing as high as $73.4k on 30 October. Following the same, the cryptocurrency started to consolidate and remained somewhere near $72k.

However, things took a u-turn over the last 24 hours or so. Bitcoin’s market bears returned and pushed the coin’s price down by more than 4%. At the time of writing, it was trading at $69,063.85 on the charts.

A possible reason behind this latest price correction could be a major transfer. Whale Alerts, an X handle that shares updates related to whale activity, revealed that more than 8000 BTC, worth over $567 million, were transferred from an unknown wallet to Coinbase.

Such major sell-offs often trigger price declines. However, things in this scenario might be different. This wasn’t the case on this occasion, however, as there are chances the transfer was made by a cold CEX wallet. These generally don’t affect prices much.

In fact, Lookonchain’s recent tweet suggested that a whale actually bought the dip.

According to the same, after Bitcoin’s price dipped, a whale bought 550 BTC, worth $38.68 million. Therefore, AMBCrypto checked other datasets to find out whether buying sentiment increased over the last 24 hours or not.

What next for BTC?

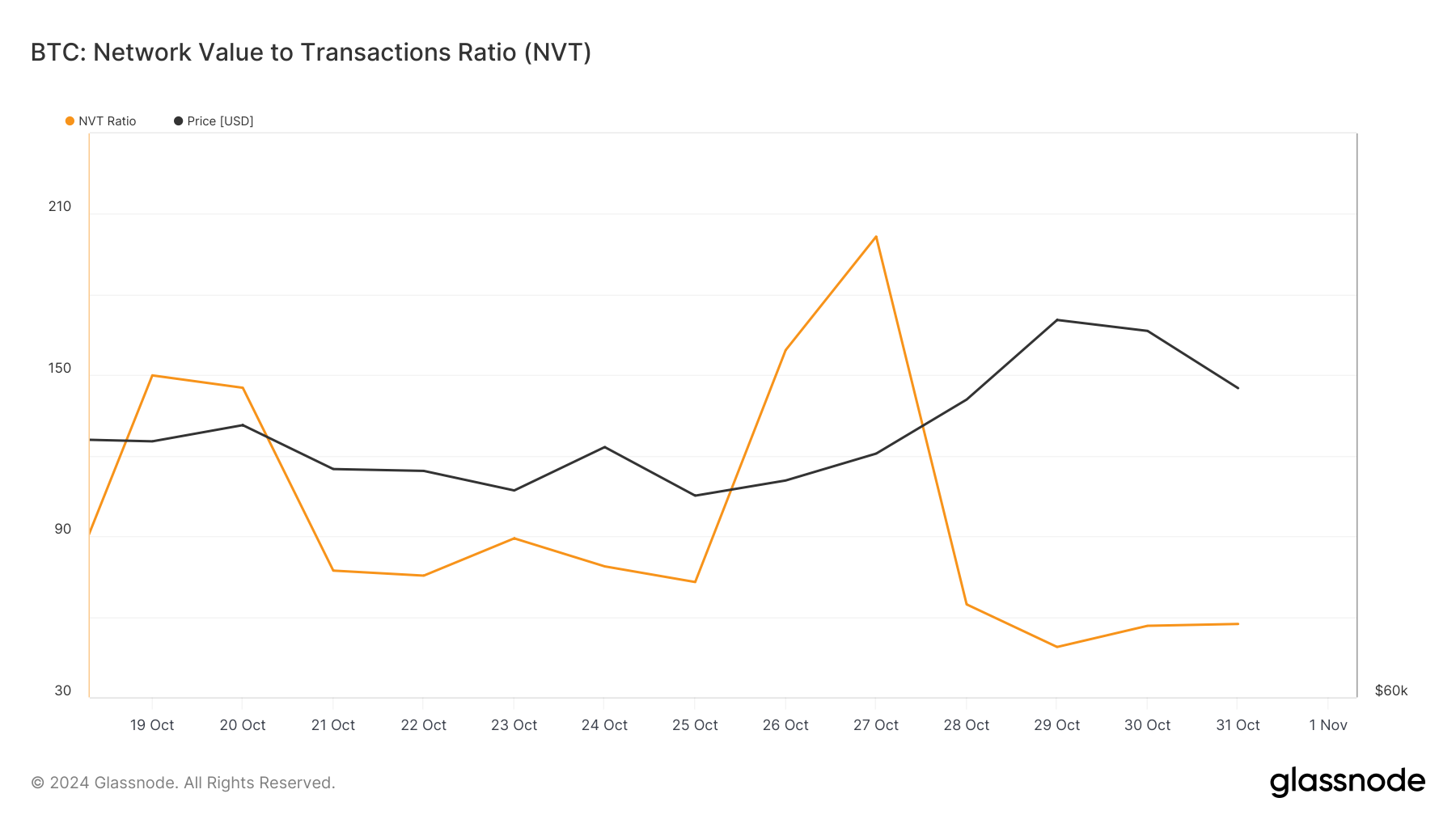

As per our analysis of Glassnode’s data, Bitcoin’s accumulation trend score had a value of 0.88. A number closer to 1 indicates that buying pressure is high. Bitcoin’s NVT ratio also declined sharply over the last few days.

A drop in the metric means that an asset is undervalued. This could have also motivated investors to increase their accumulation while BTC’s price dropped.

Source: Glassnode

To better understand why Bitcoin is down today, AMBCrypto checked its daily chart. We found that BTC’s Relative Strength Index (RSI) declined sharply over the last few days.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Nonetheless, the MA cross indicator revealed that the 9-day MA was well above the 21-day MA, which looked bullish. At press time, BTC was approaching its support at $68.59k. A successful test could once again push BTC towards $73k.

Source: TradingView

Powered by WPeMatico