- The exchange listing triggered a price increase before the momentum slowed down.

- The sentiment around TAO remained highly positive.

Shortly after Binance announced that it was listing Bittensor [TAO], the price of the token climbed from $576 to $725. This happened on the 11th of April. However, TAO’s price could not hold on to the upswing and changed hands at $641 at press time.

For context, Bittensor is a decentralized, open-source protocol that uses blockchain machine learning to reward informational value. As an Artificial Intelligence (AI)-themed project, TAO had enjoyed a long period of gain from the buzzing narrative.

TAO leads, and others follow

In the last 365 days, the price of the cryptocurrency has increased by an incredible 936.38%. For this reason, some market participants believe that the Binance listing came a little late.

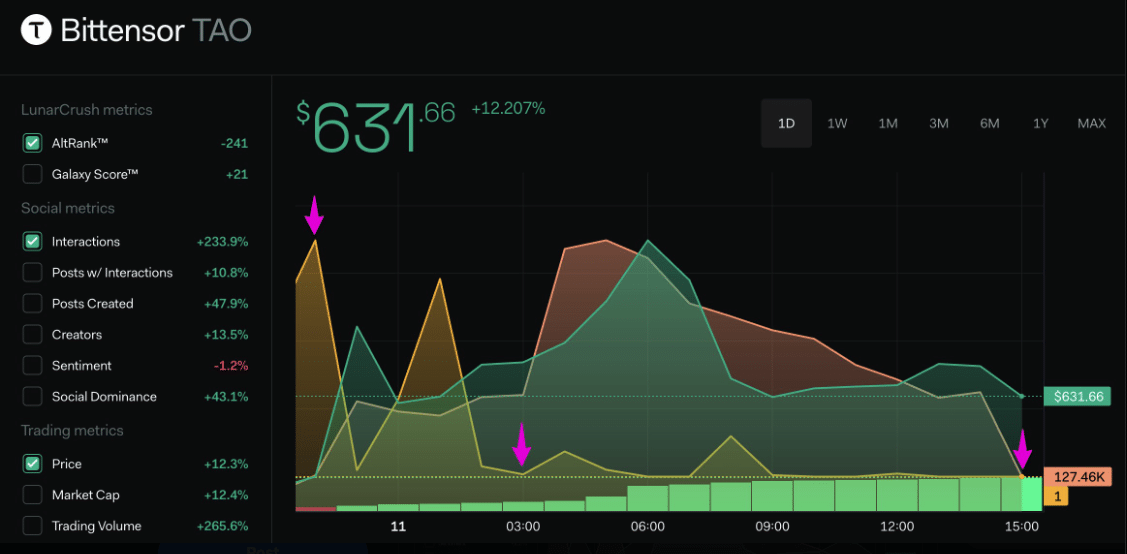

However, the development triggered hikes in metrics related to the cryptocurrency. For instance, according to LunarCrush, TAO became the top project in terms of social and market activity.

Source: LunarCrush

From the data AMBCrypto analyzed, there were over 8.32 million interactions related to the project. This represented a 233.90% 24-hour increase.

Apart from that, the trading volume also increased by an amazing 265.60%. If the volume continues to increase as TAO shows signs of recovery, then the value might jump.

In a highly bullish scenario, the price of the token could head toward $710 within a few days. But a drop in volume while the price rises could weaken the uptrend and invalidate the bullish thesis.

Bulls have all hands on deck

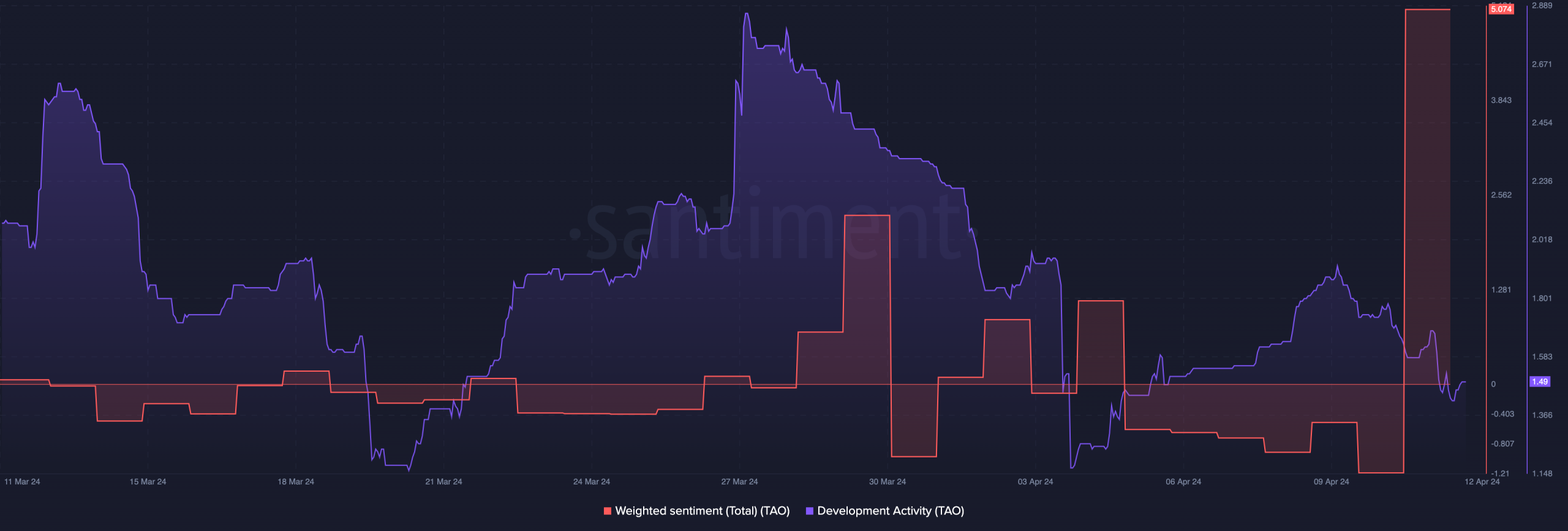

Despite the price decline, the Weighted Sentiment revealed that participants were bullish on Bittensor. By definition, Weighted Sentiment shows if most comments about a project are negative or positive.

Positive values indicate a high level of optimistic remarks. On the other hand, negative values suggest otherwise. At press time, the metric jumped to 5.07, confirming a bullish sentiment toward the project.

If the metric remains in the positive region for some time, TAO’s price might revisit the highs it hit on the 11th of April. Another metric AMBCrypto looked at was development activity.

Source: Santiment

On the 27th of March, Bittensor’s development activity was extremely high. The increase, at that time, was a sign of increased commitment to shipping out new features.

But as of this writing, the metric had declined, indicating that GitHub repositories connected to Bittensor were low. Typically, this could be a bearish signal.

Is your portfolio green? Check the TAO Profit Calculator

However, the hike in social interactions and sentiment around TAO might have neutralized the developmental effect. Going forward, TAO’s volume might be higher than what it has been in the last few months.

This is because of the effect Binance might have on it. Should this be the case, the token might surpass its previous all-time high. But replicating its 356-day performance might be impossible.

Powered by WPeMatico