- TON maintained its dominance in the market, leaving SOL in the dark

- While other metrics surged, development slowed down on the blockchain

For the umpteenth time, Toncoin [TON] has demonstrated why it is a token to watch out for this cycle. On previous occasions, AMBCrypto explained in detail how TON has been giving other projects a run for their money.

In the last 24 hours, that did not change as the price of the cryptocurrency jumped by 18.15%. Though the value of other cryptocurrencies jumped too, none of the top ones outperformed TON.

A “TON” of supremacy

An assessment of the market showed that only Solana [SOL] closed in on TON’s performance with a 10.38% hike. However, Toncoin’s price was not alone in its hike on the charts.

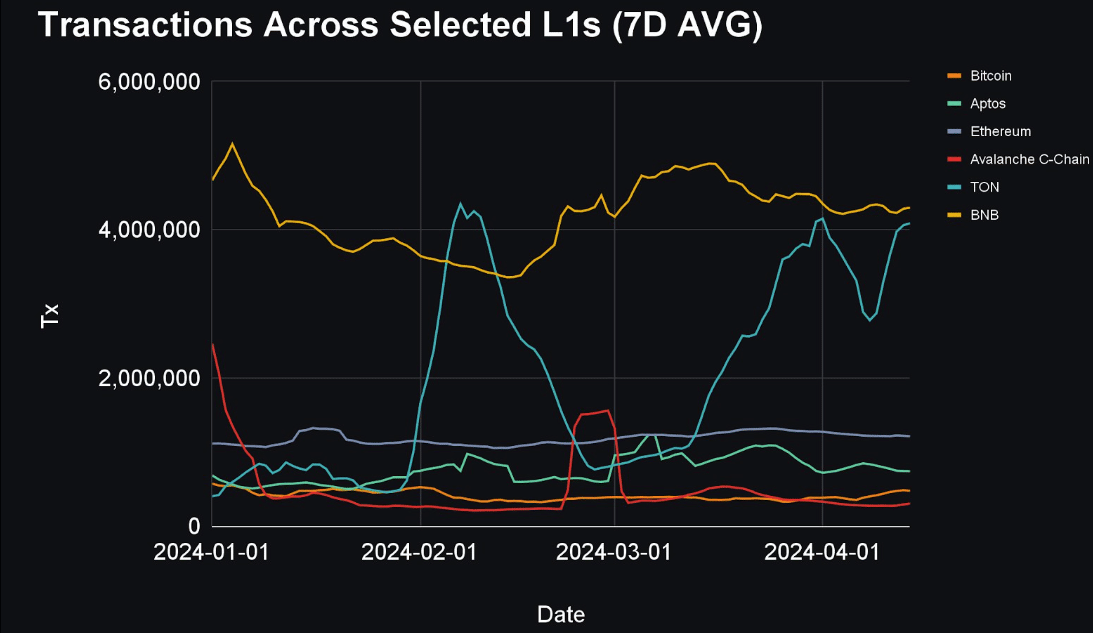

According to our analysis, several metrics on the blockchain have been surging over the past month. For instance, transaction growth on the network has risen by an amazing 100% since mid-March, according to Artemis data.

Source: Artemis

When transactions rise, it implies increasing interest in a project. Based on AMBCrypto’s evaluation, it can be inferred that Toncoin is now competing with BNB Chain, in terms of transactions per day.

With this data, one can affirm that TON has the potential to flip other Layer-1 projects. Apart from the transaction hike, Toncoin also had the highest liquid staking rate, which led the research platform to note,

“TON stakers have HIGHEST liquid staking rate: We were looking at the liquid staking rate of different chains, and TON Stakers is doing an incredible job of attracting liquid TON and is well ahead of established protocols.”

Will the project continue to attract more?

A high staking rate is proof that TON has enticed many investors, with many showing confidence in its price action. However, staking might not be as rewarding if the price of the token collapses.

If TON loses its recent gains, stakers on the blockchain might have to cope with inflation. For now, however, the opposite is the case.

Confidence in the project was also reflected by the Total Value Locked (TVL). At the time of writing, TON’s TVL was $161.08 million. While the value for the same fell slightly in the last 24 hours, it did so on the back of a 262% 30-day increase.

Source: DeFiLlama

If demand for TON continues to rise, so will its TVL. However, if market participants take out liquidity from the protocol, the metric might fall.

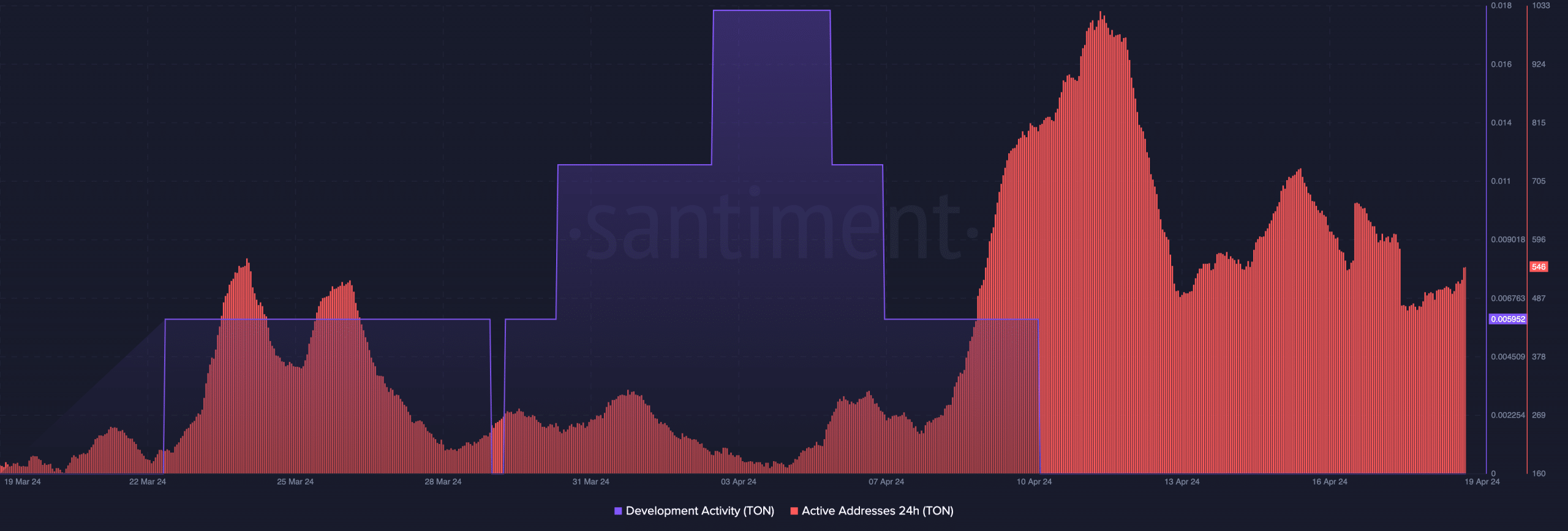

Meanwhile, the project’s development activity dropped. Previously, the metric spiked after Toncoin confirmed partnerships with Telegram and HumanCode, an AI development firm.

A fall in development activity indicates a sliding commitment to deploying new features on the blockchain. While this could be a bearish signal, rising active addresses can invalidate this thesis.

Source: Santiment

Is your portfolio green? Check the TON Profit Calculator

At press time, on-chain data revealed an increase in this metric, indicating better user activity. Should user activity continue to climb, TON’s price might stay higher than $7.15.

On the contrary, if growth stalls, the token’s price might head south.

Powered by WPeMatico