- DOGE rose 3% to $0.157 in the hours following the Bitcoin halving.

- Whales were taking long positions for DOGE in the futures market.

The crypto industry witnessed one of its most celebrated events — the Bitcoin halving — and immediately, the focus shifted to how the broader market reacted.

DOGE’s historical relationship with halving

Dogecoin [DOGE], the largest memecoin by market cap, rose 3% to $0.157 in the hours following the occurrence, data from CoinMarketCap showed.

While it retraced to $0.152 at press time due to profit-taking, it became clear that DOGE speculators were linking the coin’s growth prospects with the halving.

DOGE existed during the last two halvings of Bitcoin [BTC].

While the one in 2016 failed to impact DOGE decisively, the 2020 event led to a 4% decline in the meme coin’s price in a week, and nearly 6% in a month, AMBCrypto examined.

However, the price started to rise six months after the halving. By the end of 2020, DOGE hit $0.004592, up 75% since halving.

The market then gained bullish momentum, and DOGE exploded to its all-time high (ATH), just about a year since halving.

Source: CoinMarketCap

A faster journey towards ATH this time?

DOGE army would want a repeat of that feat. To their delight, DOGE could achieve it much sooner this time around.

Popular crypto trader Kevin C. aka Yomi made a bold prediction that DOGE could hit or get close to its ATH of $0.73 by July/August. Yomi came to the conclusion by averaging out historical data from previous cycles.

Realistic or not, here’s DOGE’s market cap in BTC terms

Sentiment biased towards the bullish side

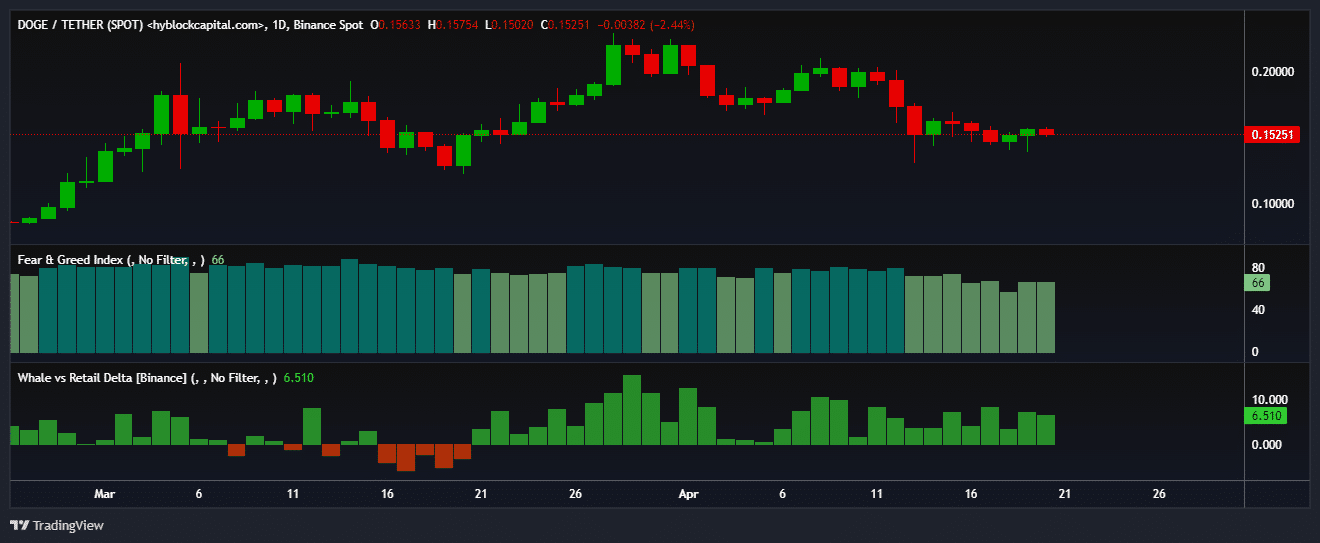

Whale investors appeared bullish on the coin’s prospects. According to AMBCrypto’s analysis of Hyblock Capital’s data, whales had higher long exposure than retail on Binance [BNB] as of this writing.

Source: Hyblock Capital

Moreover, the market sentiment tilted towards greed, suggesting an increase in buying pressure in the days ahead.

Powered by WPeMatico