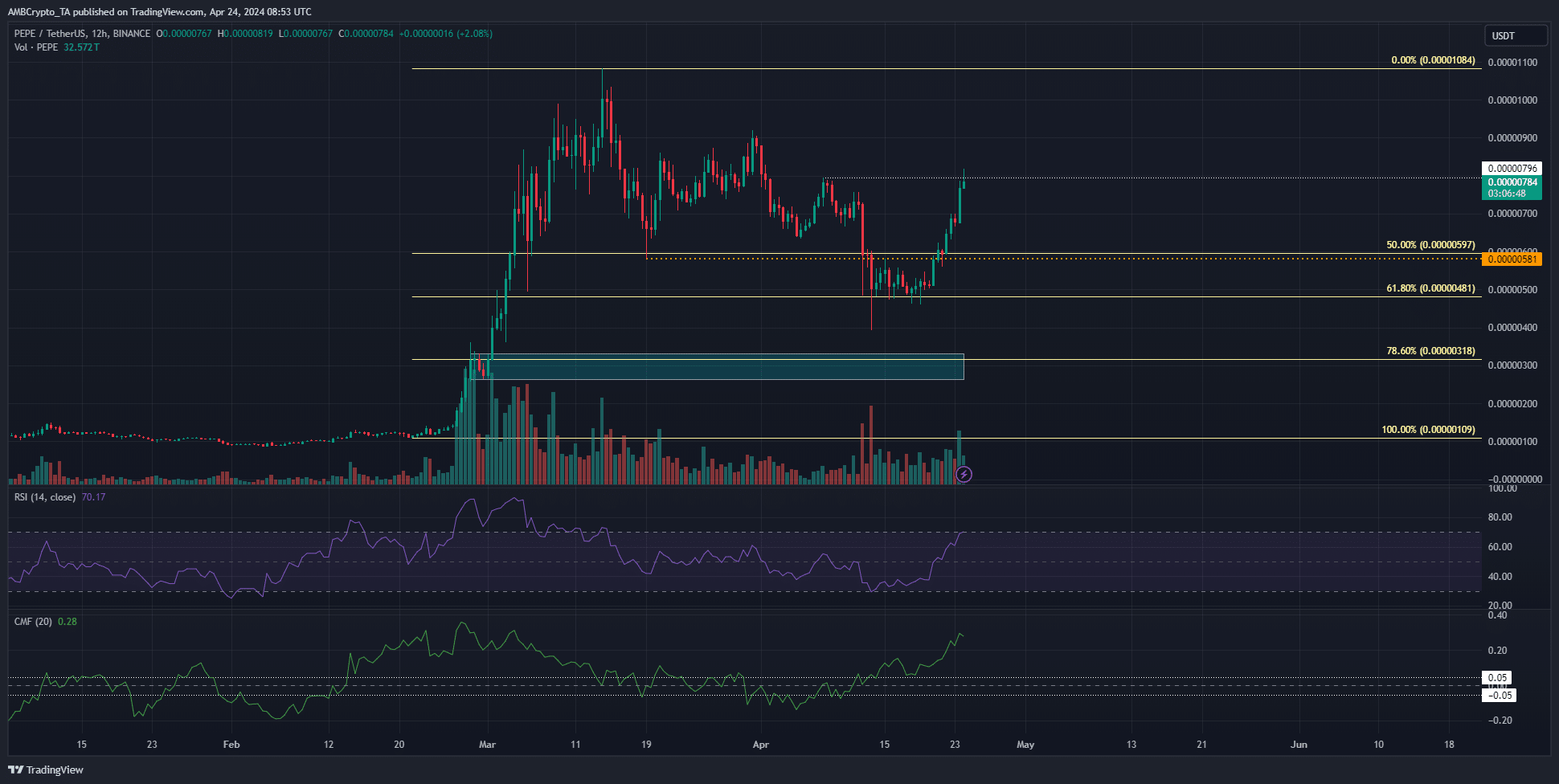

- PEPE retained its higher timeframe bullish structure and was about to flip the H4 structure upward as well

- The boost in trading volume conveyed a bullish conviction

Pepe [PEPE] bulls showed they were no slouches. Despite the market-wide slump over the past two weeks, the meme coin saw a wave of buying that pushed prices higher by close to 70% in five days as of press time.

The Coinbase launch of the memecoin’s perpetual contracts played a part in its recovery. However, there was also reason to be wary of its gains.

The recent lower high was under attack by PEPE buyers

Source: PEPE/USDT on TradingView

PEPE bulls managed to wrest control of the $0.00000581 level from the bears. This was the second sign of strength from the bulls in the past ten days. The first sign was their defense of the 61.8% Fibonacci retracement level.

The buyers did not allow a 12-hour trading session to close below the level. Combined with the flip of $0.00000581 to support, the bullish strength was too much to handle. PEPE exploded higher to test the local lower low at $0.00000796.

At press time, it was trading just below this key level. The RSI was at 70 and showed intense upward momentum. The CMF’s reading of +0.28 also reflected noteworthy capital flow into the market. Overall, further gains were more likely.

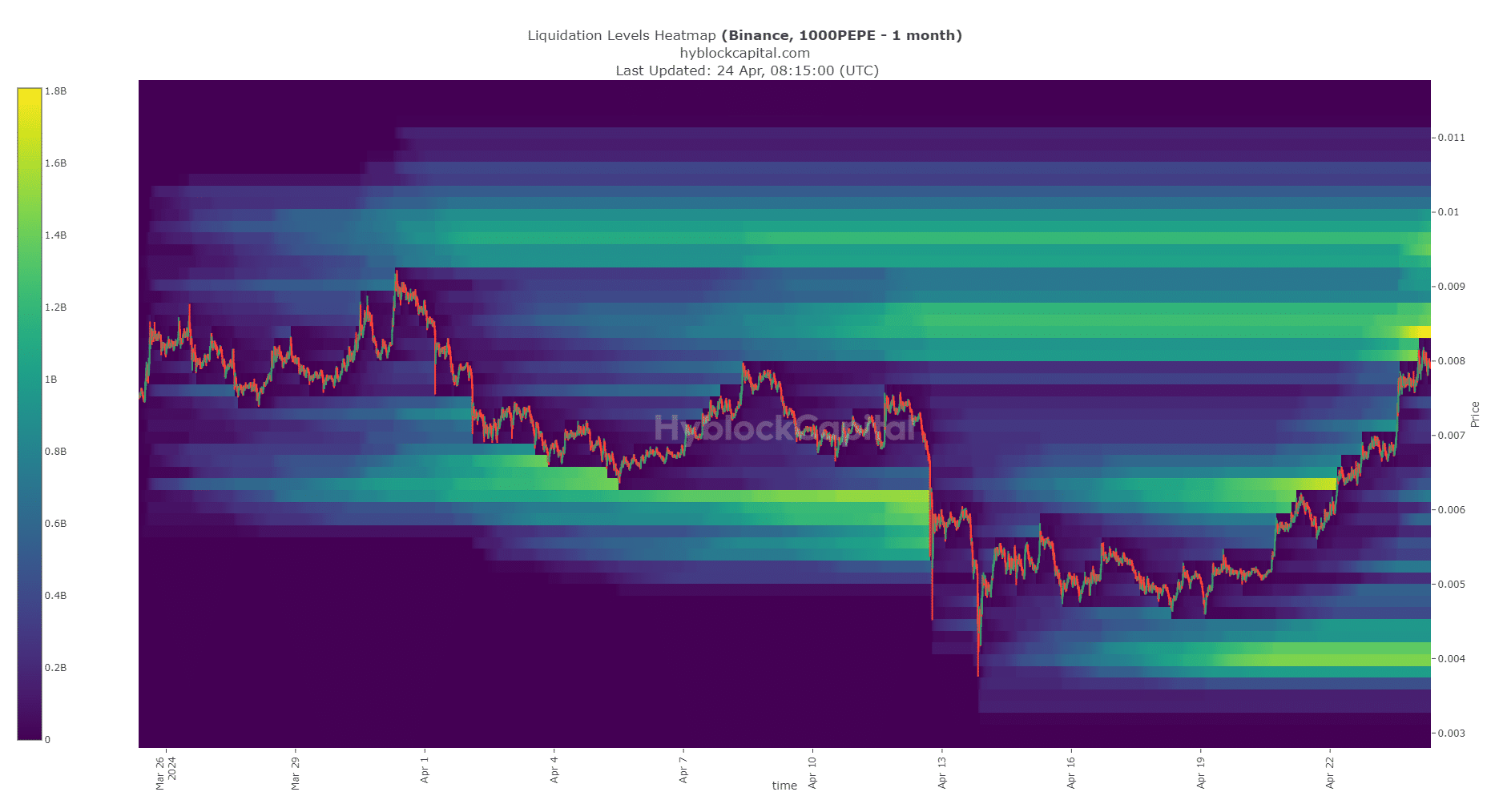

Will we see a short squeeze on PEPE?

Source: Hyblock

AMBCrypto analyzed the liquidation heatmap of PEPE using data from Hyblock. The $0.000008-$0.00001 region was filled with liquidation levels of sizeable concentration. The closest and biggest liquidity pocket was at $0.0000084.

A PEPE move just beyond this level would trigger the short liquidation orders. Their market buy orders would force prices higher, hitting an increasing number of short liquidations.

Is your portfolio green? Check the Pepe Profit Calculator

It could quickly become a liquidation cascade and drive prices above $0.00001 at least momentarily.

Hence, traders need to be wary of short-term volatility. Given the momentum and demand behind the meme coin, further gains were likely and a retracement from $0.0000084 was improbable.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Powered by WPeMatico