- Investors need to be prepared for a dive toward $33.

- It was likely that the 78.6% Fibonacci level would halt the current short-term downtrend.

Avalanche [AVAX] prices tumbled once again as Bitcoin [BTC] and the rest of the crypto market witnessed a flurry of selling activity over the past four days. The market dynamics have been different during this run.

Traders and investors could buy into new narratives. Alternatively, using technical analysis and finding narratives could also lead to steady profits. What, then, are the pitfalls AVAX bulls must be wary of?

One of the breaker blocks has already been breached

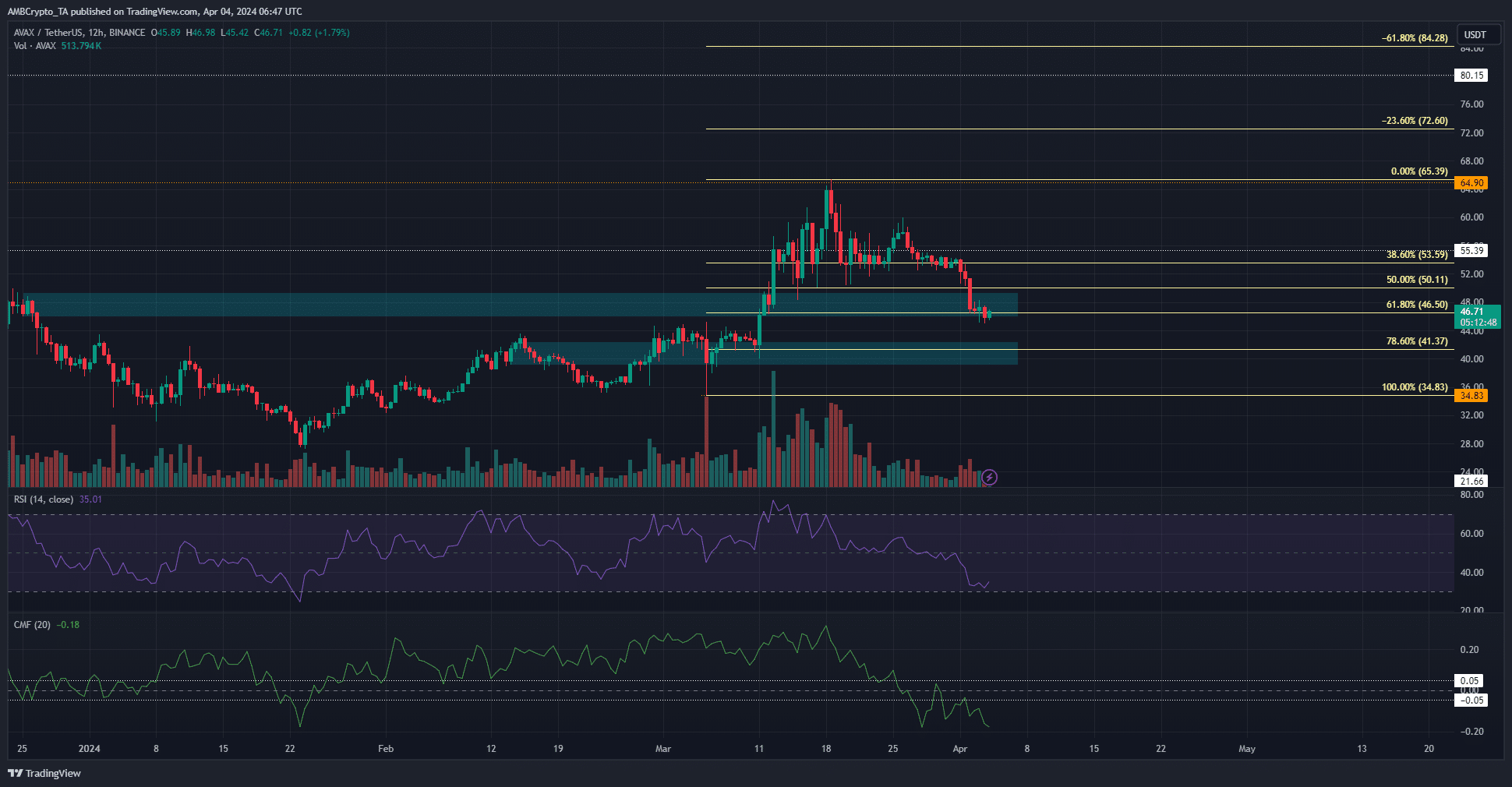

Source: AVAX/USDT on TradingView

Based on the 1-day price action, AMBCrypto plotted two breaker blocks in cyan that represented demand zones.

AVAX was expected to see a bullish reaction at $46.5 because it was also the 61.8% Fibonacci retracement level.

Instead, the price fell below $46.5 briefly on the 3rd of April. It has not yet closed a 1-day or 12-hour candle below $46.5.

Further south, the $41.37 level was important as a demand zone for the same reason- a confluence of breaker block and fiber retracement level.

The technical indicators showed a dire situation for the bulls. The RSI was at 35 to reflect firm bearish momentum. The CMF was at -0.18 to signal intense capital flow out of the market.

Should investors be prepared for a revisit to $30?

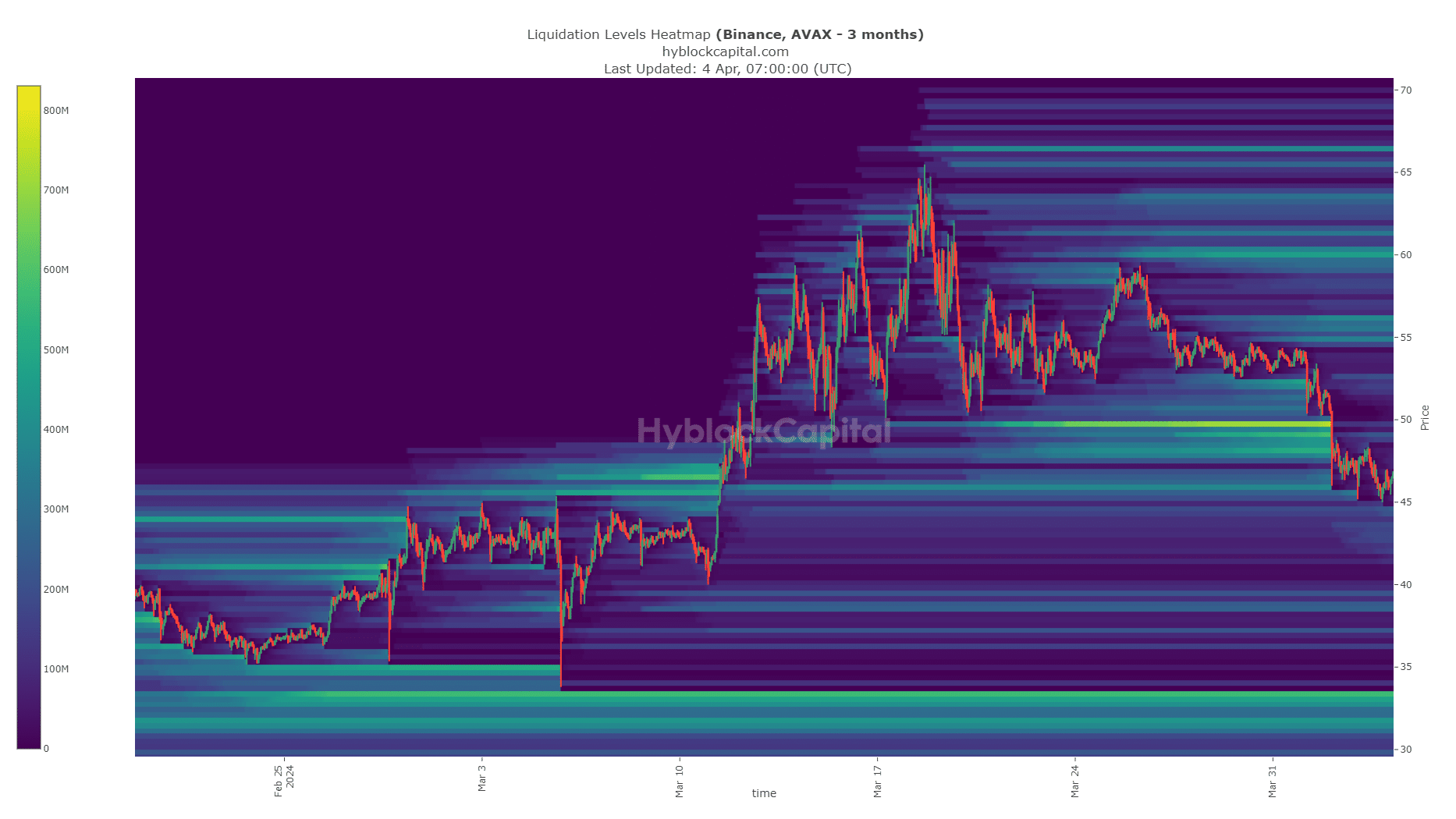

Source: Hyblock

The liquidation heatmap of the past three months highlighted the $50 area as a pivotal pocket of liquidity. When prices crashed beneath it, a liquidation cascade ensued that pushed prices further downward.

Read Avalanche’s [AVAX] Price Prediction 2023-24

At press time, the $42.6 and the $38.6 levels were the next pockets of liquidity that could attract AVAX prices.

A high concentration of liquidations was also present at $33-$33.3. Avalanche could dive to these levels, and such a move would shift the market structure bearishly.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Powered by WPeMatico