- Solana handled more than $7 million in NFT sales in the last 24 hours.

- SOL dropped lower in the last 24 hours but a rebound to $200 didn’t seem too far away.

Meme coins, decentralized exchanges (DEXs), and now non-fungible tokens (NFTs). Is there any sector left where the Solana [SOL] ecosystem wasn’t growing?

Another high for Solana

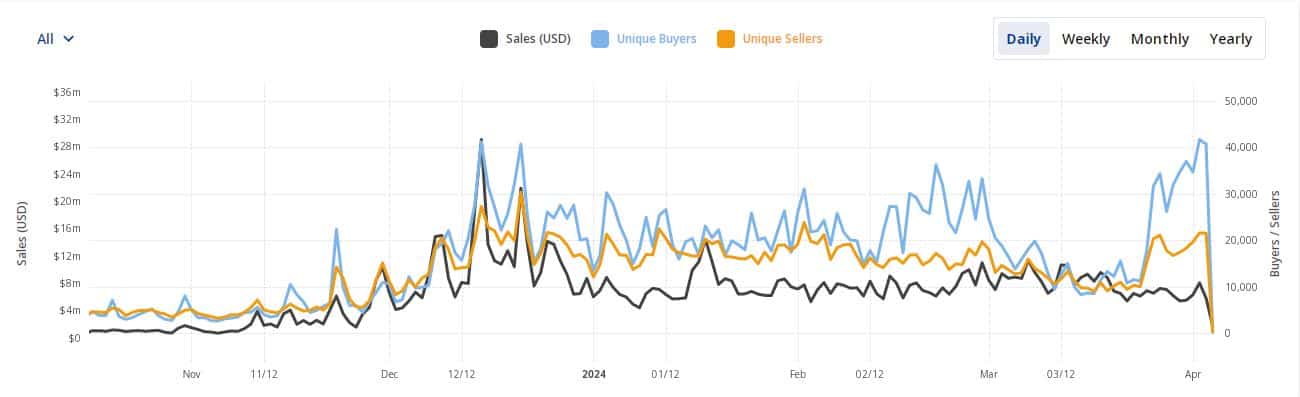

Solana surpassed Bitcoin [BTC] to log the second-highest NFT sales volume in the last 24 hours, according to AMBCrypto’s analysis of CryptoSlam’s data. While volume for Solana-based NFTs exceeded $7 million, NFTs on Bitcoin fell short of the mark at $6.9 million.

On the weekly front, Solana remained at the third spot with more than $45 million in cumulative sales.

Source: CryptoSlam

The surge was driven by Tensorians, a collection launched by NFT marketplace Tensor, and Mad Lads, the marquee profile picture (PFP) collection.

Mad Lads registered weekly sales of more than $7 million, representing a 7% increase. It accounted for 15% of the Solana’s total NFT volumes over the week.

Similarly, Tensorians logged over $4 million in NFT sales, after a whopping 131% jump. Sharp uptick was also observed in the number of transactions, buyers, and sellers.

While it might be too early to predict, Solana could challenge traditional powerhouse Ethereum [ETH], and newly-successful Bitcoin, in NFT trades in the near future.

A lot would depend on how the network enhances its appeal in the NFT landscape. Solana already has a significant transaction fee advantage over Ethereum.

When will SOL reclaim $200?

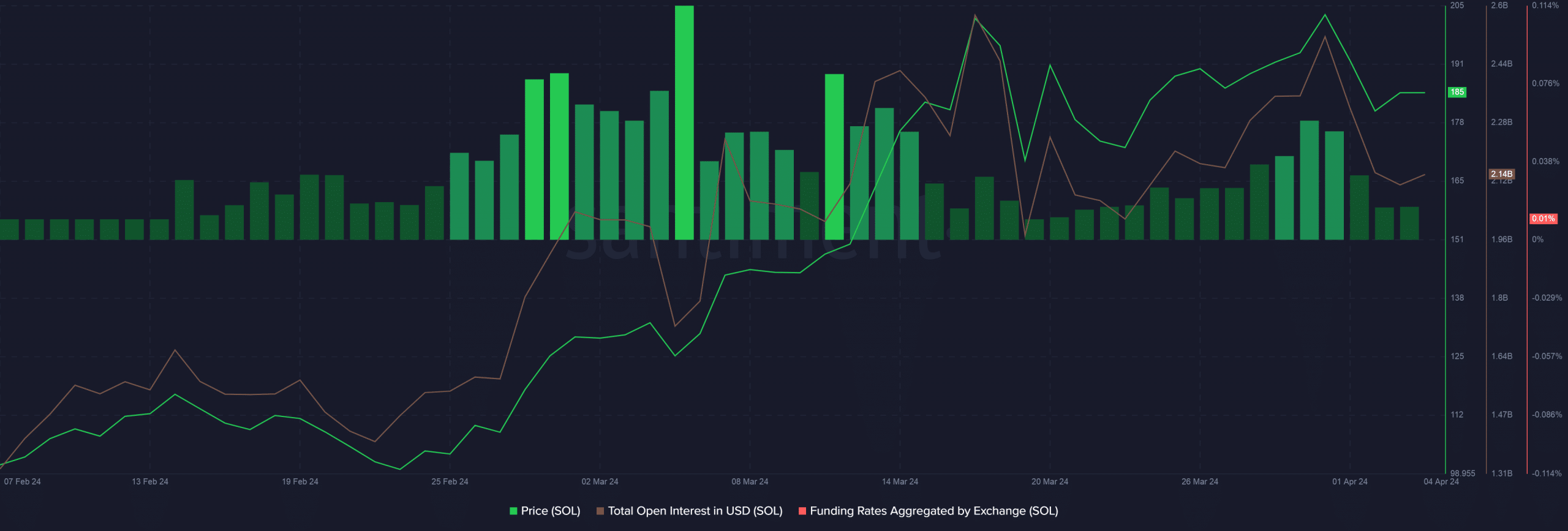

Meanwhile, the ecosystem’s native token SOL traded 2.62% lower in the last 24 hours, according to CoinMarketCap. The fifth-largest cryptocurrency faced stiff resistance after breaching $200 at the beginning of the week.

However, it could be a matter of time before SOL reclaims $200, for it has been one of the best high-cap tokens over last month, with gains of more than 40%.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Solana’s latest slump triggered a proportional decline in Open Interest (OI) in its futures market, AMBCrypto noticed using Santiment data.

Moreover, funding rates dropped over the week. The drop indicated exit of over-leveraged longs, paving way for what could be another ascent in coming weeks.

Source: Santiment

Powered by WPeMatico