- Jupiter has announced the launch of its native DAO.

- Solana has seen a decline in user activity in the last month.

Solana-based decentralized exchange Jupiter [JUP] has announced the launch of its native decentralized autonomous organization (DAO), which is funded by 10 million USD Coin [USDC] and 100 million JUP tokens worth around $132 million.

We have officially funded 10M USDC and 100M JUP into a DAO wallet.

This operational budget provides the DAO the capability to fund the ideas with USDC and have the JUP allocation for long term incentive alignment with J.U.P Catributors.

Besides LFG selection, the DAO will also…

— Jupiter 🪐 (@JupiterExchange) March 27, 2024

According to the 27th March announcement, the DEX stated that the DAO can fund its ideas with USDC and can distribute JUP tokens to J.U.P Catributors as an incentive for a long-term alignment.

According to Jupiter, the budget will be topped up yearly to ensure that the DAO is able to execute its objectives in the long term.

State of Solana

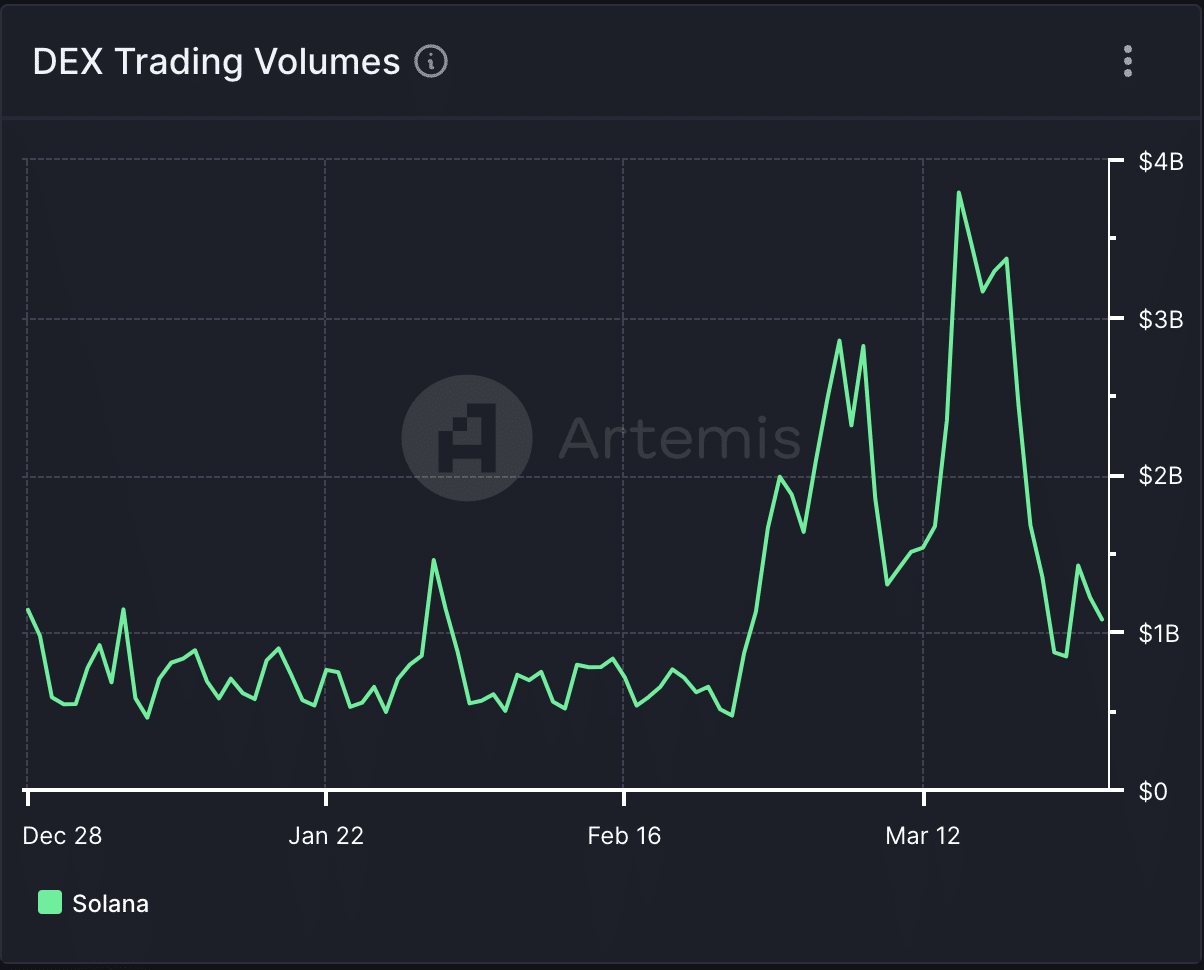

Despite this month’s meme coin frenzy, the volume of daily transactions completed on the DEXes housed within Solana began to drop on 15th March. According to Artemis’ data, this has since plunged by 71%. As of 27th March, Solana’s DEX volume totaled $1.1 billion.

Source: Artemis

The decline in Solana’s DEX volume is due to the general decline in user activity on the network. Per Artemis’ data, the daily count of unique active addresses has plummeted by 40% since 18th March.

Due to the low user activity on the network, the amount generated in the form of protocol fees and revenues has also dwindled. Data from DefiLlama showed that total transaction fees received by Solana have trended downward since 19th March. In the past eight days, this has dropped by 60%.

Likewise, revenue derived from the fees has witnessed a corresponding decline. The network’s revenue totaled $1.4 million on 27th March, having declined by 44% in the last week.

SOL is not lacking in this regard

SOL’s price has risen by 70% in the last month. Despite the recent general market pullback, demand for SOL persists amongst spot market participants.

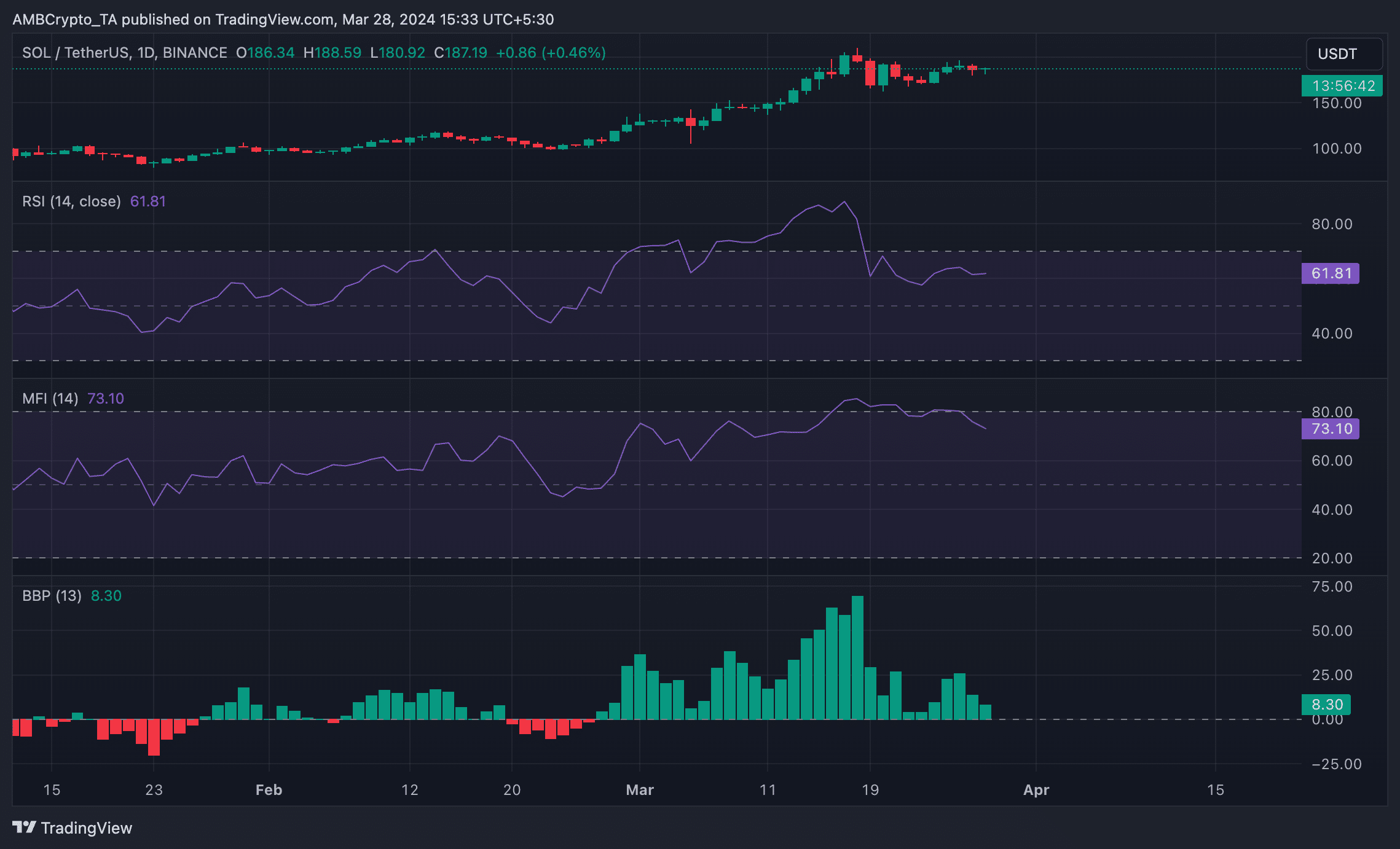

Source: SOL/USDT on TradingView

The coin’s key momentum indicators indicate that buying activity continues to outpace selling pressure. For example, its Relative Strength Index (RSI) was 61.81, while its Money Flow Index (MFI) was 73.10.

Read Solana [SOL] Price Prediction 2024-25

At these values, these indicators showed that traders have continued SOL accumulation despite the rise in profit-taking activity.

Confirming the bullish trend, its Elder-Ray Index, which estimates the relationship between the strength of buyers and sellers in the market, was positive at press time. A positive Elder-Ray Index value is a bullish signal, depicting an uptick in buying activity.

Powered by WPeMatico