- PEPE maintained a bullish structure on the H12 timeframe

- The key swing points marked on the chart could see PEPE short-term trends reverse

Pepe [PEPE] was stuck beneath a lower timeframe resistance level over the past few days. The bullish momentum from earlier this month had stalled, but the long-term bias remained positive for the memecoin.

A recent AMBCrypto report highlighted that the weighted sentiment behind PEPE was low. The selling pressure was also on the rise according to the report.

PEPE bulls unable to fight off short-term selling pressure

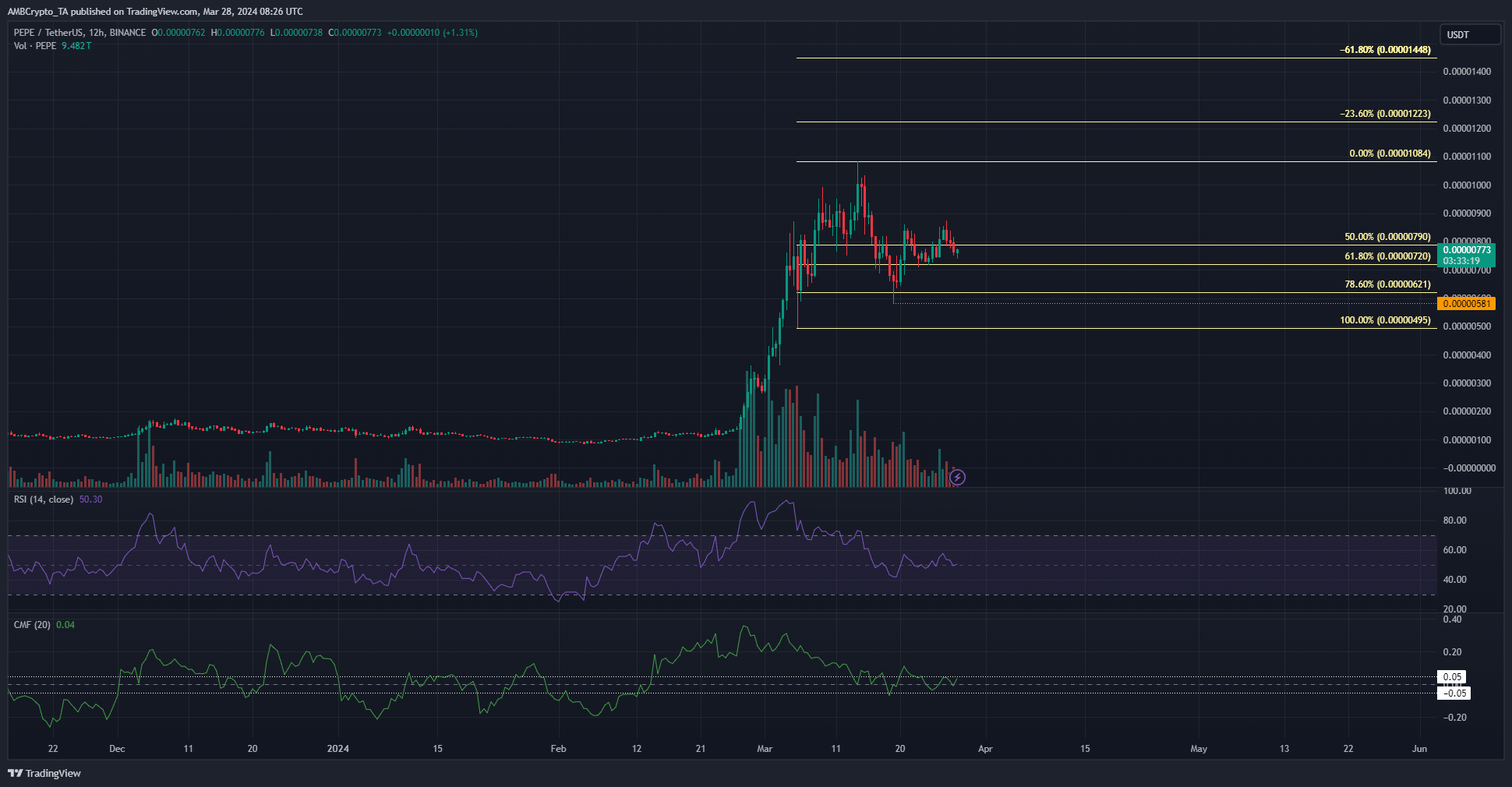

Source: PEPE/USDT on TradingView

The market structure of PEPE was bullish on the 12-hour chart. It needs to fall below the swing low at $0.00000581 to flip the structure bearishly. The momentum was neutral, according to the RSI.

It showed a reading of 50 and has not climbed above 60 in two weeks. The momentum was not bullish. Similarly, the Chaikin Money Flow was also unable to climb above +0.05. If it succeeded, it would reflect significant capital inflow to the PEPE market.

The evidence at hand showed that a consolidation phase was underway. Any retests of the golden pocket between the 50% and 61.8% Fib retracement levels would present a buying opportunity.

PEPE could be attracted to the local highs in search of liquidity

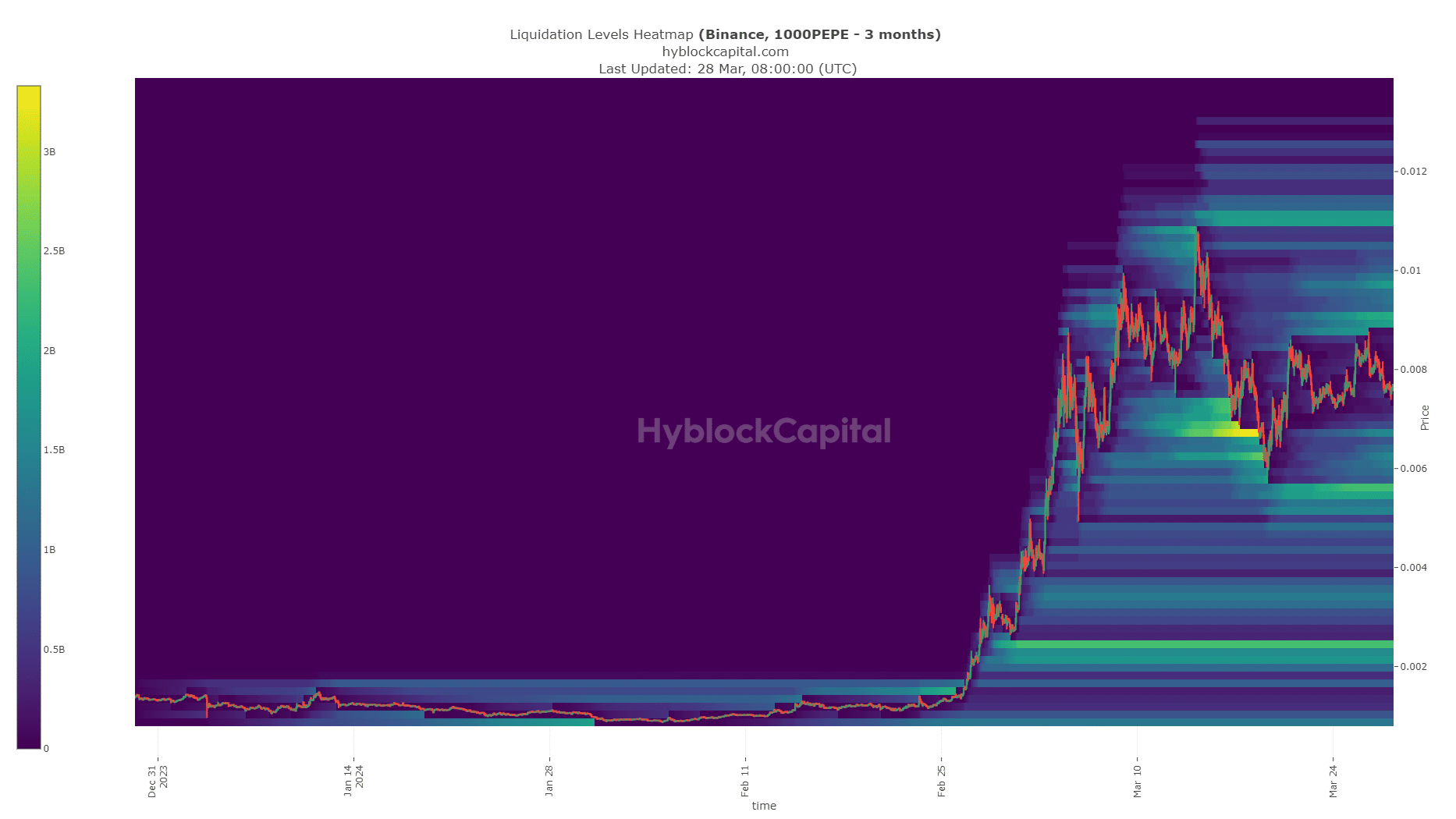

Source: Hyblock

Technical analysis showed that momentum was neutral and more sideways price action is to be expected. Once a move commences, there are two targets for traders to watch.

The $0.0000056 area to the south had a large concentration of liquidation levels. A price drop to this level or lower would break the bullish structure. Similarly, the area from $0.000009 to $0.00000986 is another region of interest.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

Above that, the $0.000011 was another level with a large number of liquidation levels. PEPE could be attracted to this level, and the liquidations caused would fuel further gains before the market has a chance to stabilize.

Therefore, holders could seek to book partial profits should prices climb to $0.000011.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Powered by WPeMatico