- ADA, SOL and AVAX witnessed a massive decline in prices over the last few days.

- All these L1s showed similar performance in terms of TVL and DEX volumes.

Even though altcoins had an amazing run over the last few months, recent events have brought each token rally to a halt. Each of these tokens experienced a massive decline in price.

High correlation

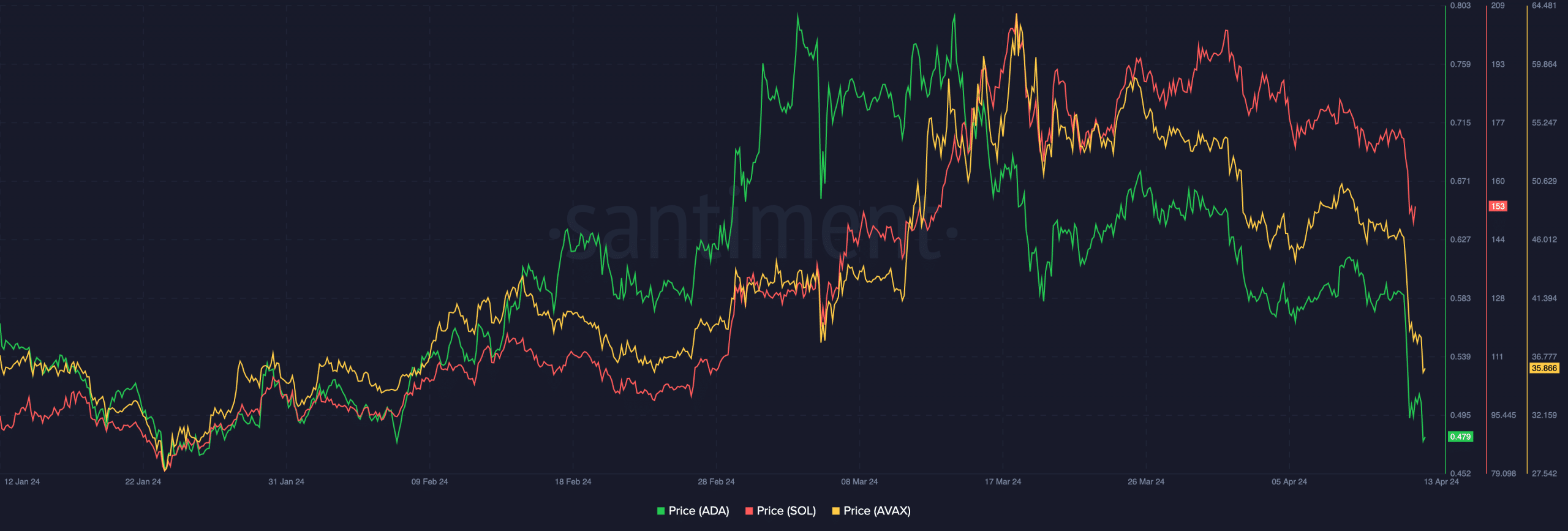

Over the past 24 hours, Cardano [ADA] saw a decline of 9.45%, Solana [SOL] dropped by 7.73%, and Avalanche [AVAX] fell by 6.03%.

Despite their unique protocol performances, the price movements of these tokens have displayed a strong correlation.

Analysis of Santiment’s data by AMBCrypto revealed that since the 26th of March, ADA, SOL, and AVAX have exhibited similar price movements.

Each of these movements were characterized by multiple lower lows and lower highs, establishing a bearish trend.

Source: Santiment

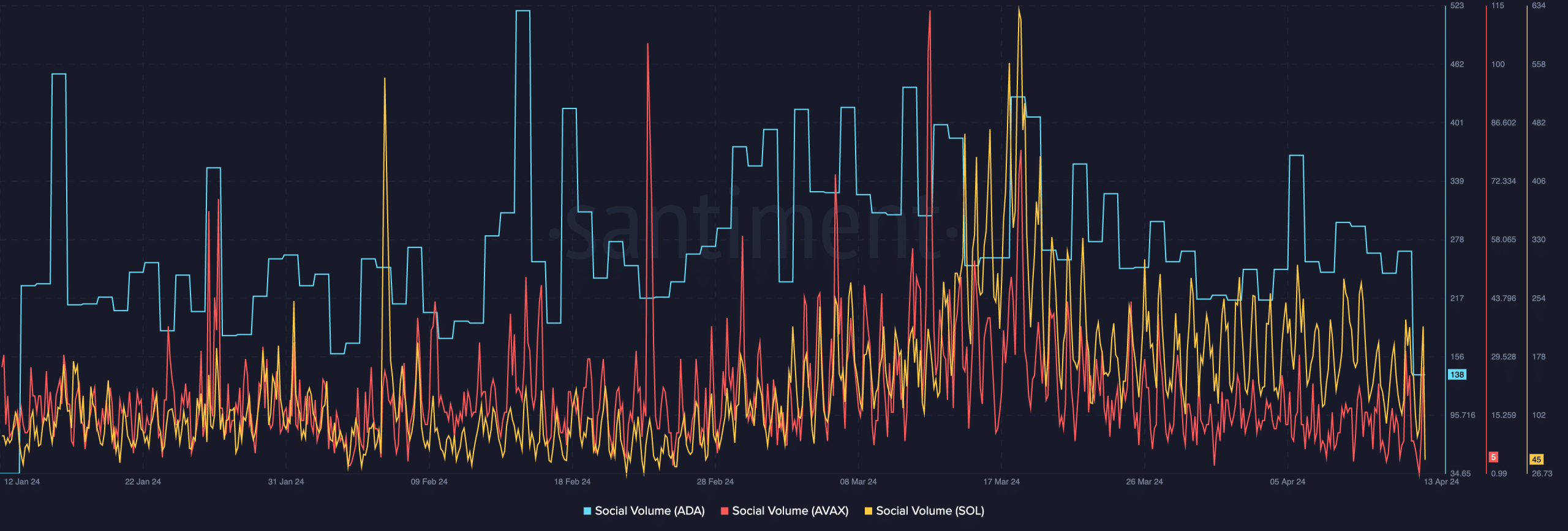

The decline in Social Volume further showcased the waning popularity of these tokens.

Santiment’s data indicated a significant decrease in social interactions surrounding ADA, SOL, and AVAX, suggesting a potential loss of interest among investors and enthusiasts on social platforms.

Source: Santiment

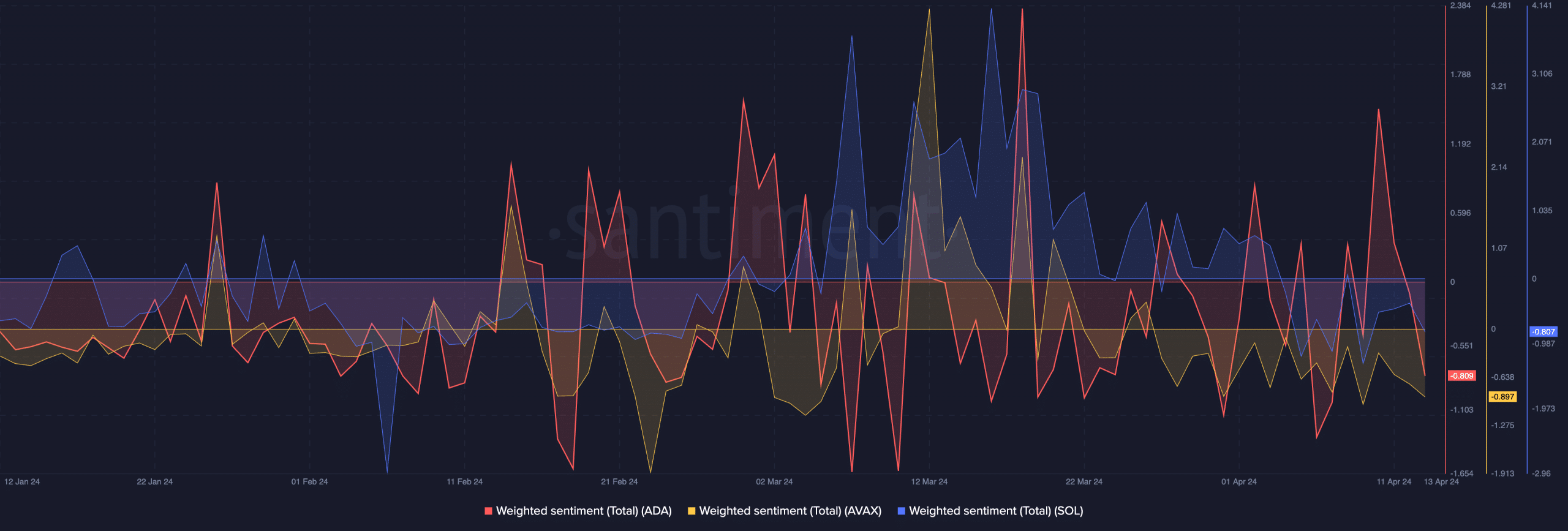

Weighted Sentiment around these tokens had also declined. This decline in sentiment indicated a higher prevalence of negative comments compared to positive ones.

This sentiment shift reflected a growing pessimism among market participants, which could contribute to downward pressure on prices.

Source: Santiment

How are the protocols doing?

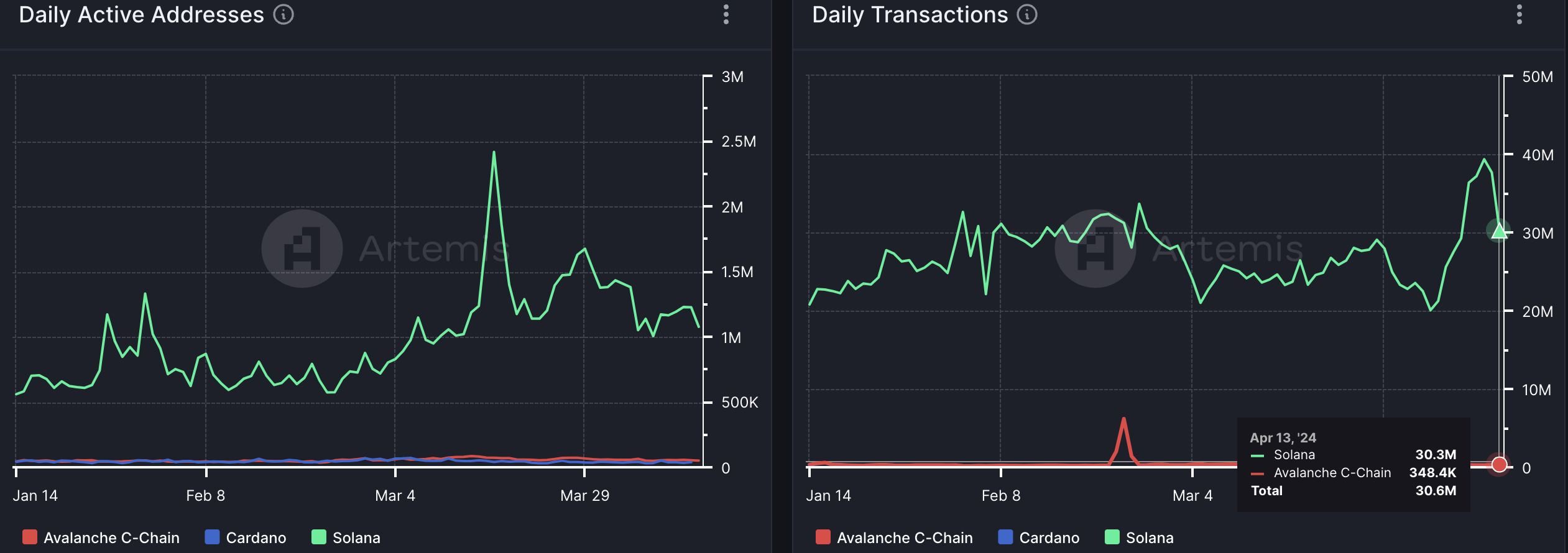

While Solana has maintained its network activity amid the price decline, Cardano and Avalanche have witnessed a dip in activity on their respective networks.

This divergence suggested that SOL may be better positioned for a potential reversal based on its protocol performance, while ADA and AVAX could face stagnation in the near term.

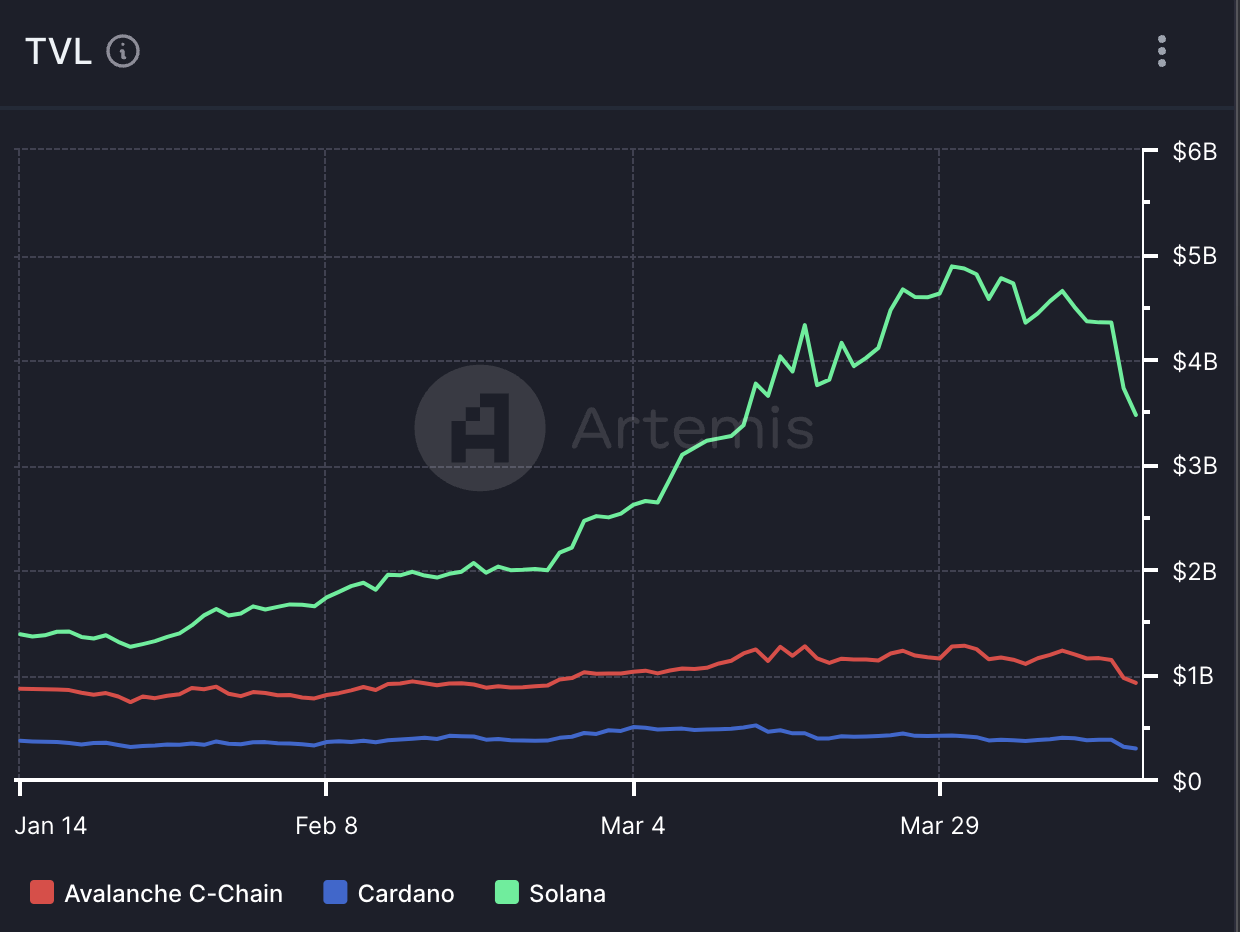

Source: Artemis

Despite the price correction, decentralized exchange (DEX) volumes have seen an uptick across all networks.

This increased trading activity on DEXes may indicate heightened market volatility and investor participation amid the price downturn.

However, Total Value Locked (TVL) has declined across Cardano, Solana, and Avalanche networks, signaling a reduction in the amount of assets locked in decentralized finance (DeFi) protocols.

This decrease in TVL could have broader implications for liquidity and investor confidence within these ecosystems.

Source: Artemis

Read Cardano’s [ADA] Price Prediction 2024-25

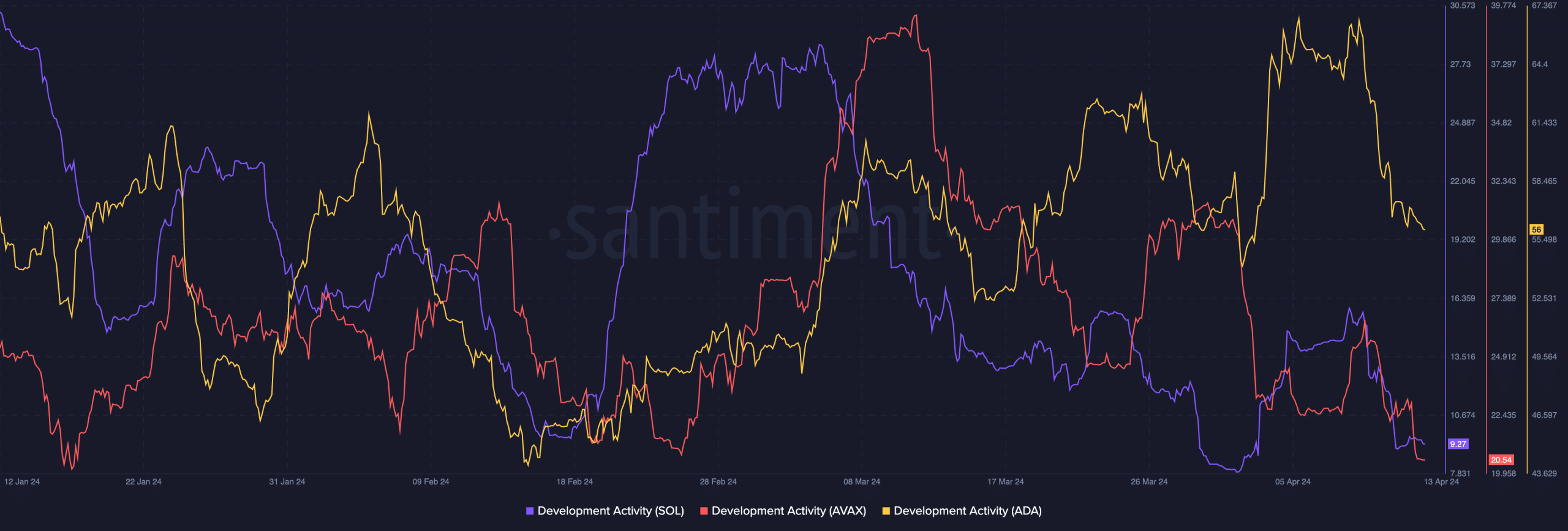

Coupled with that, there was a decline observed in the Development Activity across these networks as well.

New updates and upgrades seldom help improve sentiment around the token but can help in positive price action in the long run.

Source: Santiment

Powered by WPeMatico